Last week, Statistics Canada published a new set of residential real estate investor data, including profiles of the types of owners in Nova Scotia, New Brunswick, Ontario, Manitoba, and British Columbia, as well as the kind of properties they owned.

The data, published as part of the Canadian Housing Statistics Program, focused on three distinct groups.

The first is the investor, which includes speculators, but also owners of secondary residences, short-term rental owners, landlords, developers, and for-profit businesses. These people own at least one residential property that is not being used as their primary residence.

The second type is the investor-occupant, who own a property with multiple residential units, including one that is used as their primary residence. This group includes homeowners with a laneway unit or basement suite, as well as owners of duplexes who live in one of the units.

The last group are the non-investors, who are neither an investor nor an investor-occupant, and are people who own a single housing unit that they use as their primary residence, with the exception of Canadian non-profits, which StatCan includes in this group.

It's important to note that this new batch of real estate investor data is from the 2021 Census, which means what it illustrates is dated back to 2020, but here are a few interesting tidbits, specific to British Columbia.

1. BC has more investor-occupants than any other province.

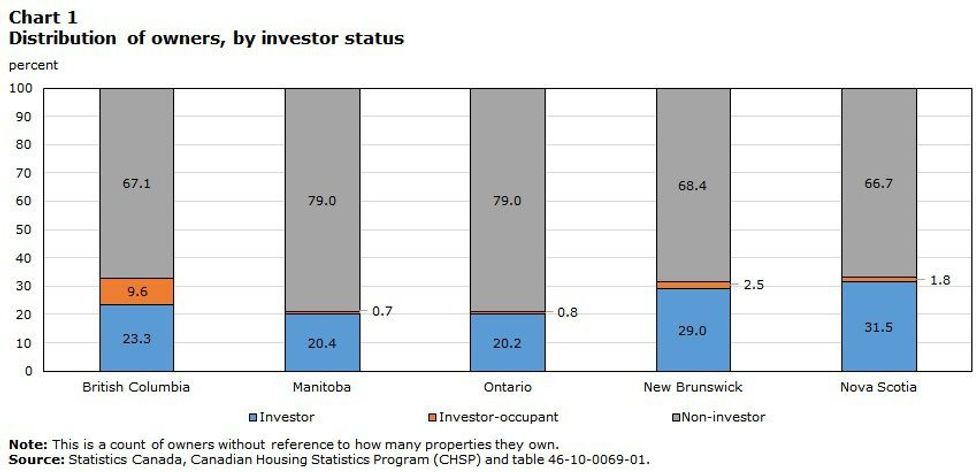

The StatCan report only examined the aforementioned provinces, and although you may expect BC or Ontario to have one of the higher amounts of real estate investors, what the data shows is closer to the opposite.

In 2020, approximately 23.3% of residential real estate owners in BC were investors, which is lower than Nova Scotia (31.5%) and New Brunswick (29.0%), but higher than Manitoba (20.4%) and Ontario (20.1%).

However, BC had -- by far -- the highest amount of investor-occupants, with 9.6% of owners in the province falling into the group that includes, among others, owners of laneway units and basement suites.

That proportion was not only the highest of the five provinces that were examined, but more than the other four provinces combined, with New Brunswick at 2.5%, Nova Scotia at 1.8%, Ontario at 0.8%, and Manitoba at 0.7%.

StatCan attributes this to the composition of BC's housing stock, where properties with multiple residential units represented a higher proportion (11.7%) of total stock than in the other provinces, such as Nova Scotia (5.7%) and Ontario (2.9%). Because a significant portion of those properties include residences with laneway units or basement suites, BC has a higher count of investor-occupants.

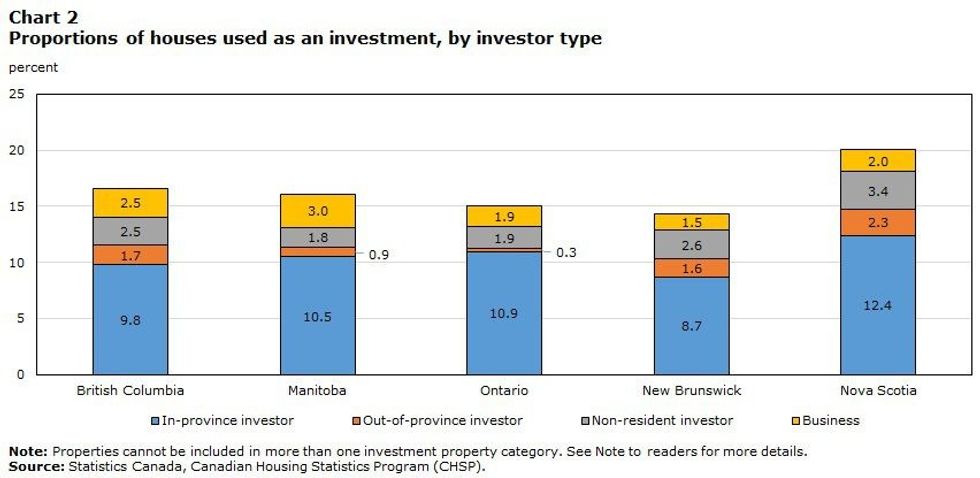

2. BC has the most non-resident condo investors.

Within the "investor" group, StatCan also distinguishes between in-province investors that live in the same province as their investment property, out-of-province investors that like in a different province, and non-resident investors that live outside of Canada.

By those definitions, the StatCan real estate investor data shows that BC had the highest amount of non-resident investors in condominiums in the country, with 7% of investors in condos living outside of Canada. Ontario had the second-most, at 5.6%, followed by Nova Scotia at 5.4%.

In BC, in-province investors accounted for the highest proportion (18.1%) of condo investors, followed by businesses (8.6%), non-residential investors (7.0%), and out-of-province investors (2.6%).

All in all, 36.3% of condos in BC are owned by real estate investors, a number that was lower than Ontario and Nova Scotia, but higher than Manitoba and New Brunswick.

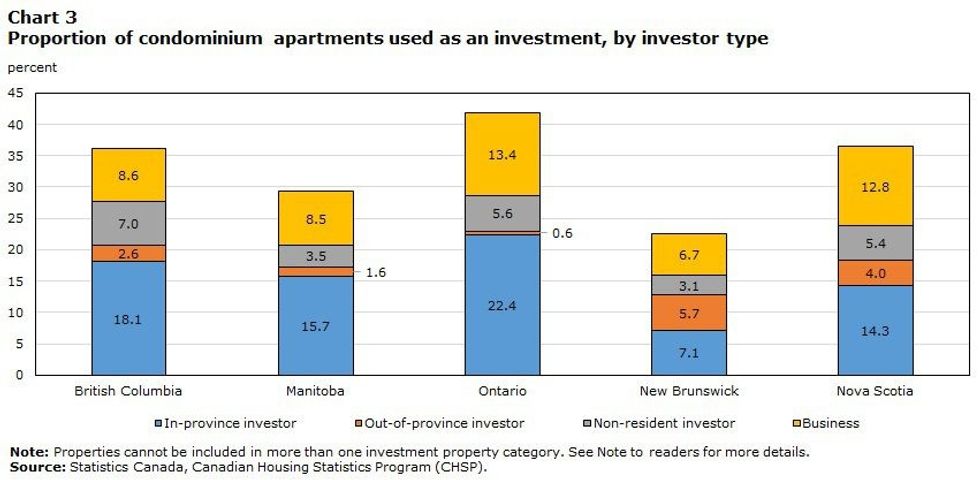

3. Among investors, houses are less popular than condos.

While 36.3% of condos in BC are owned by investors, just 16.5% of houses are owned by investors, meaning condos are more than twice as popular among investors than houses. This likely surprises few in Metro Vancouver, thanks to the ever-growing supply of condos.

BC's overall 16.5%, however, was still the second-highest among the five provinces, coming behind Nova Scotia where 20.1% of houses were owned by real estate investors.

By the various kinds of investors, BC was in the middle of the pack by proportion of in-province investors in houses, proportion of out-of-province investors, and proportion of non-resident investors.

More notable, however, is the proportion of business investors in houses in BC -- 2.5% -- which was the second-highest after Manitoba's 3%.

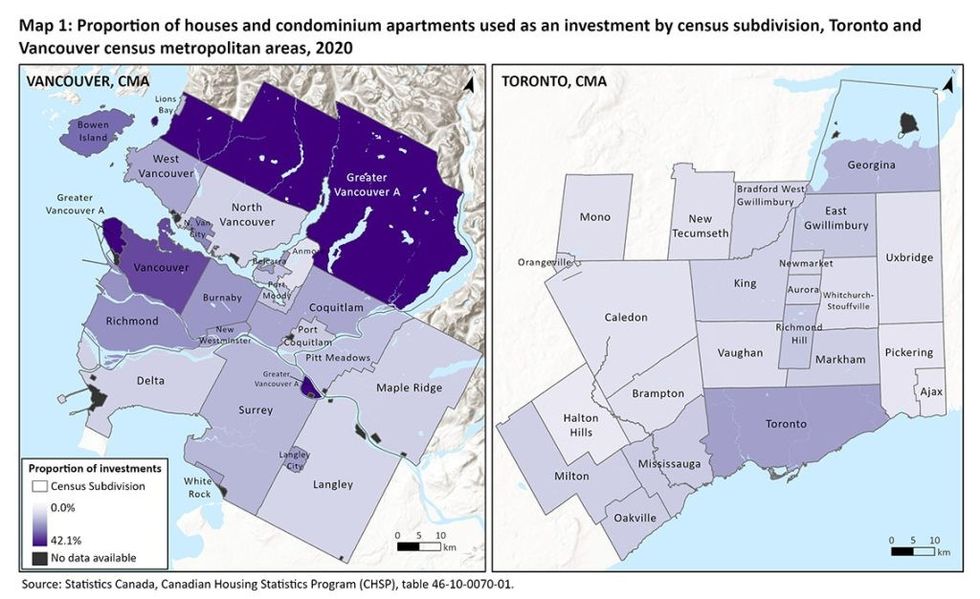

4. Real estate investment is more concentrated around Vancouver.

Also perhaps not surprising is the fact that real estate investment is more concentrated in Vancouver and its surrounding cities than it is in suburban cities farther away.

Disregarding the "Greater Vancouver A" region that's mostly mountainous and therefore has a smaller sample size, The City of Vancouver had the highest concentration of real estate investment, which was upwards of 40% -- more concentrated than it is in the City of Toronto.

Surrounding municipalities such as Richmond and Burnaby have a medium-level concentration of real estate investment, while cities like Langley and Maple Ridge have the lowest concentration of investors.

The one exception is North Vancouver, which is surrounded by high concentrations of investors, but has very little of it itself. However, that is likely attributed to its low quantity of condos when compared to cities like Vancouver, Richmond, and Burnaby.

5. BC has the most real estate investors outside CMAs and CAs.

Statistics Canada defines Census Metropolitan Areas (CMAs) as cities with a population of over 100,000, while anything less than that, but above 10,000, is considered a Census Agglomeration (CA). For example, Burnaby and Surrey are included in the Vancouver CMA, while Squamish, Prince George, and Cranbrook are considered CAs.

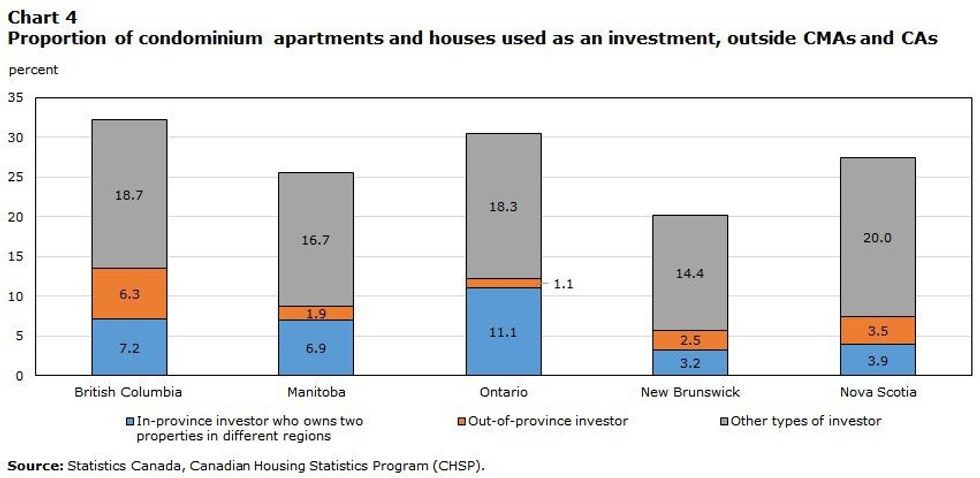

By those definitions, 32.2% of condos and houses in BC outside of CMAs and CAs are owned by investors, the highest amount of all the provinces included in the real estate investor data, with Ontario second at 30.5%, and Nova Scotia third at 27.4%.

Additionally, of those properties outside CMAs and CAs that were owned by investors, 6.3% of those owners were out-of-province investors, again the highest proportion among all included provinces, with Nova Scotia second at 3.5%.

Population centres in BC with less than 10,000 people include places like Hope, Tofino, Harrison Hot Springs, Cultus Lake, and Pemberton, several of which could be considered resort towns or seasonal destinations where there are higher proportions of secondary residences or residences used for short-term rentals, explaining the sizeable number.