The Ontario Superior Court has greenlit the sales process for various assets of Stateview Homes, the Vaughan-based real estate developer who owes approximately $350M to various creditors, according to court documents obtained by STOREYS.

Five separate receivership applications regarding eight projects were previously filed by four creditors, with the receiverships being granted in May. In receivership proceedings, a third party is appointed as the receiver and is given control over the assets in question, with the objective being to recover as much of the amounts secured creditors are owed. This often involves selling the received assets and, on Monday, the sales process for seven of Stateview Homes' eight projects were approved to begin on Thursday.

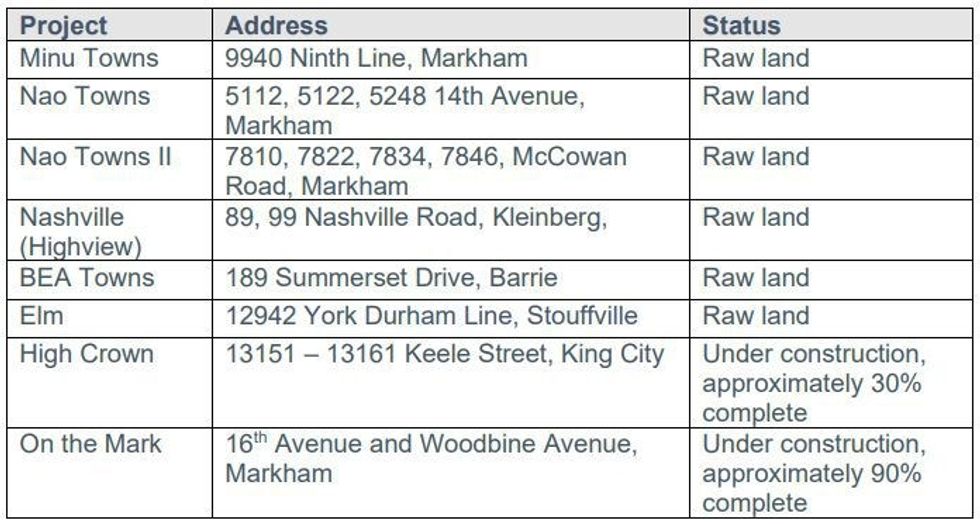

Toronto-based restructuring firm KSV Advisory was appointed as the receiver and will now work with the selected real estate brokerages to sell the assets, all of which are located in southern Ontario, and most of which have yet to commence construction. Because of the size and structures of Stateview's projects, multiple brokerages were selected to market and sell the various assets.

CBRE was selected to sell the Minu and Nao Phase I projects, Cushman & Wakefield was selected to sell the NAO Phase II and Elm projects, Colliers was selected to sell the BEA and Highview projects, and JLL was selected to sell the High Crown project and four industrial properties owned by Taurasi Holdings -- a corporation named after Stateview Group CEO Carlo Taurasi and Stateview Group President Dino Taurasi.

An eighth project, On The Mark, is not currently subject to a sales process, as construction is estimated to be 90% completed. According to KSV, construction was halted when the receivership began, and KSV has "engaged a former president of a major Toronto developer" to help KSV determine the feasibility of completing the project. A recommendation regarding On The Mark is expected later this month.

The four industrial properties owned by Taurasi Holdings are all located in Vaughan and managed by a third-party firm named Argo Property Management. The properties are located on 301 Bradwick Drive, 596 Oster Lane, 448 North Rivermede Road, and 6-8 Bradwick Drive. They total to over 115,000 sq. ft of leasable space, are 100% occupied, and generate around $130K in monthly rent, according to KSV.

Stateview Homes is a subsidiary of Stateview Group, which also owns Stateview Construction Ltd. and several other companies that are not subject to the receivership.

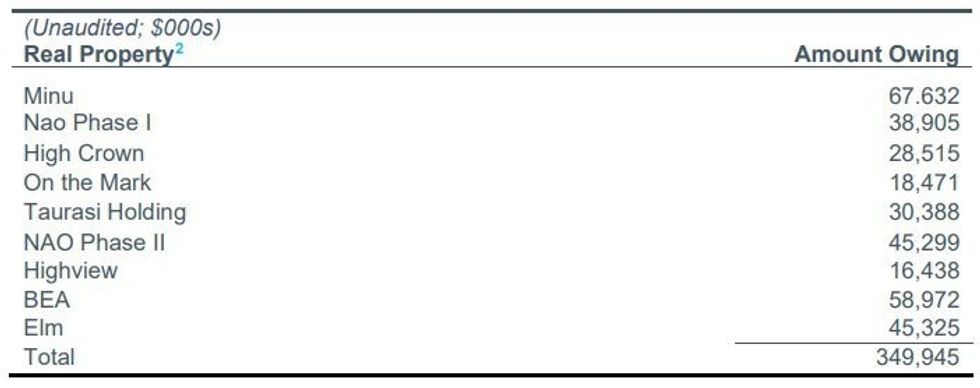

According to KSV's findings, Stateview Homes owes $349,945,000 in mortgages registered on the eight projects as of the receivership order dates. The five receivership applications were filed by four major lenders: Atrium Mortgage Corporation, Dorr Capital Corporation, KingSett Mortgage Corporation, and Meridian Credit Union, with Dorr being an applicant on four of the five filings.

According to records filed by each of the creditors, Kingsett and Dorr are owed $167,826,634.78 and $4,000,592.77, respectively, on the Minu, Nao Phase I, High Crown, and On The Mark projects. Atrium and Dorr are collectively owed $24,449,396.98 on the Nao Phase II project. Dorr is owed $9,192,852.58 on the Highview project and $38,121,787.67 on the BEA project. Meridian is owed $17,975,000.00 on the Elm project. All amounts are dated to April and total to about $261M of the $350M Stateview owes, the remaining portion of which is tied to other creditors not directly involved in the receivership.

Stateview also owes $250,271.75 to the Canada Revenue Agency in municipal taxes as of May 16. Additionally, in March, TD Bank accused Stateview of "cheque-kiting" -- a form of fraud that takes advantage of the time it takes a cheque to clear -- in a lawsuit seeking to recover $37M in losses.

RELATED: TD Bank Goes After GTA Developer for "Cheque-Kiting" in $37M Lawsuit

According to KSV, TD Bank and Stateview reached a settlement agreement in April that would require Stateview to pay back the $37M in installments across a three-month period, including $3.15M upfront, which was paid on May 15. In its receivership application, Kingsett voiced concerns regarding how it would be affected by the settlement agreement with TD Bank.

"The TD settlement agreement, among other things, contemplates significant immediate payments to TD Bank, who ought to be an unsecured creditor, in priority to the [receivership] applicants and the debtors' other creditors," KingSett said. "The applicants were not privy to, nor were they include in any discussions in connection with, the TD settlement agreement."

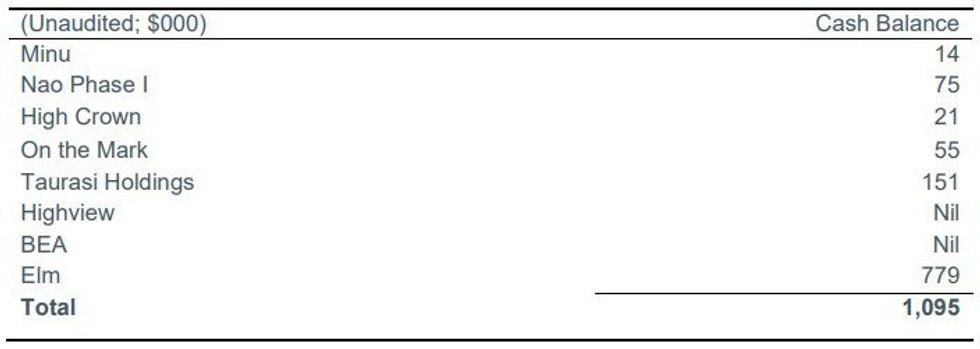

According to KSV, Stateview held just $1,095,000 across all of the accounts held by the companies under receivership as of May 1.

KSV also says that it advised Stateview Group -- after it was appointed as the receiver but before KSV took control of the received companies -- that money in its Elm account, which held a majority of Stateview's remaining funds ($779,000), should only be used for purposes related to the Elm project.

However, KSV found that Stateview had used funds in the Elm account to pay costs unrelated to the Elm project and that by May 18, the Elm account balance was down to $303,000.

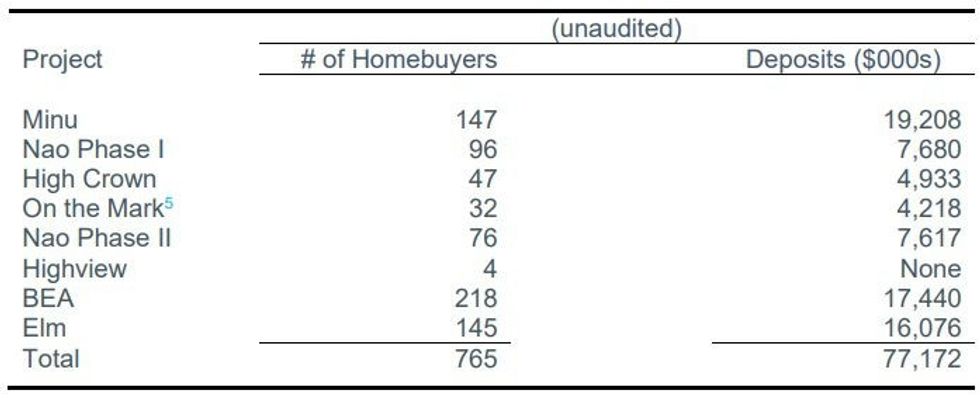

Across the eight projects, Stateview Homes also accumulated $77,172,000 from deposits paid by 765 homebuyers, but had used up all of it on direct and indirect project costs before the receivership began.

"As freehold homes, the receivership companies were not required to keep the deposits in trust," said KSV. "The receiver has been advised by the Stateview Group's representatives that all deposits have been spent; however, the use of those funds has not yet been determined and the receiver has not, as of the date of this report, commenced a tracing exercise."

Homebuyers who paid deposits, however, will be eligible for deposit protection from Tarion Warranty Corporation, which provides deposit insurance and administers Ontario's new home warranty program.

According to Tarion, the few homebuyers who have already occupied a completed home can submit a warranty claim, adding that they will "backstop Stateview's warranties if the builder is unable to fulfill their warranty commitments."

Those who have paid deposits on homes for projects that have yet to complete will have to wait, however, as Tarion says it has to hold off until the received assets are sold to see what happens with the existing purchase agreements. In receivership proceedings, as in CCAA creditor protection proceedings, existing purchase agreements can either be sold along with the assets or terminated.

"Until the court approves sale transactions under the sale process, it is uncertain what will happen with Stateview's existing purchase agreements," Tarion says. "This uncertainty may continue into the Fall of 2023 or later depending on the final timelines under the court-ordered sale process."

READ: Inside The Impending Sale Of Etobicoke's Woodbine Mall

Receivership proceedings sometimes also include a claims procedure for purchasers who paid deposits.

Beginning Thursday, the selected brokerages will begin marketing the properties before opening them up to bids. The bid deadline is set for mid-to-late July, after which bids will be short-listed, chosen, and finalized, with all sales requiring final approval from the court.