In February, shockwaves were sent through the Vancouver real estate industry after it was revealed that local developer Coromandel Properties had filed for creditor protection under the Companies' Creditors Arrangement Act (CCAA).

Coromandel Properties had found itself saddled with $700M of debt, citing increased interest rates and slow municipal development timelines, and was seeking protection from creditors in order to get its affairs in order, whether that be restructuring their financial commitments or selling off their assets.

Eight creditors on six different projects issued default notices to Coromandel, and the company's insolvency means all 16 of its active projects could be affected, in one way or another, if not completely jeopardized.

The case remains ongoing, and the CCAA proceedings will likely take numerous years to completely untangle and unfold. We know this, as well as what to expect with the case, from looking at legal precedents... and we don't have to look very far away or deep into the past either.

Port Capital Group and Terrace House

In May 2020, Vancouver-based Port Capital Group, who also owns real estate assets in Toronto, filed a Petition to the Supreme Court of British Columbia, seeking creditor protection under the CCAA. Like Coromandel, Port Capital Group was seeking authorization to "carry on business in a manner consistent with the preservation of their property and business," according to the Petition.

Port Capital's usual approach to development projects, according to the Petition, was to establish a project-specific limited partnership that would provide initial funding, with subsequent funding provided by Port Capital's development arm, Port Capital Development, on an as-needed basis.

Once projects were completed, Port Capital would sell off the residential component, with the company's "primary economic interest" being the fees it earned from managing the development process on behalf of the limited partners. Port Capital would then transfer ownership of the commercial component, if one existed, from its development division to its investment division, PortLiving Properties.

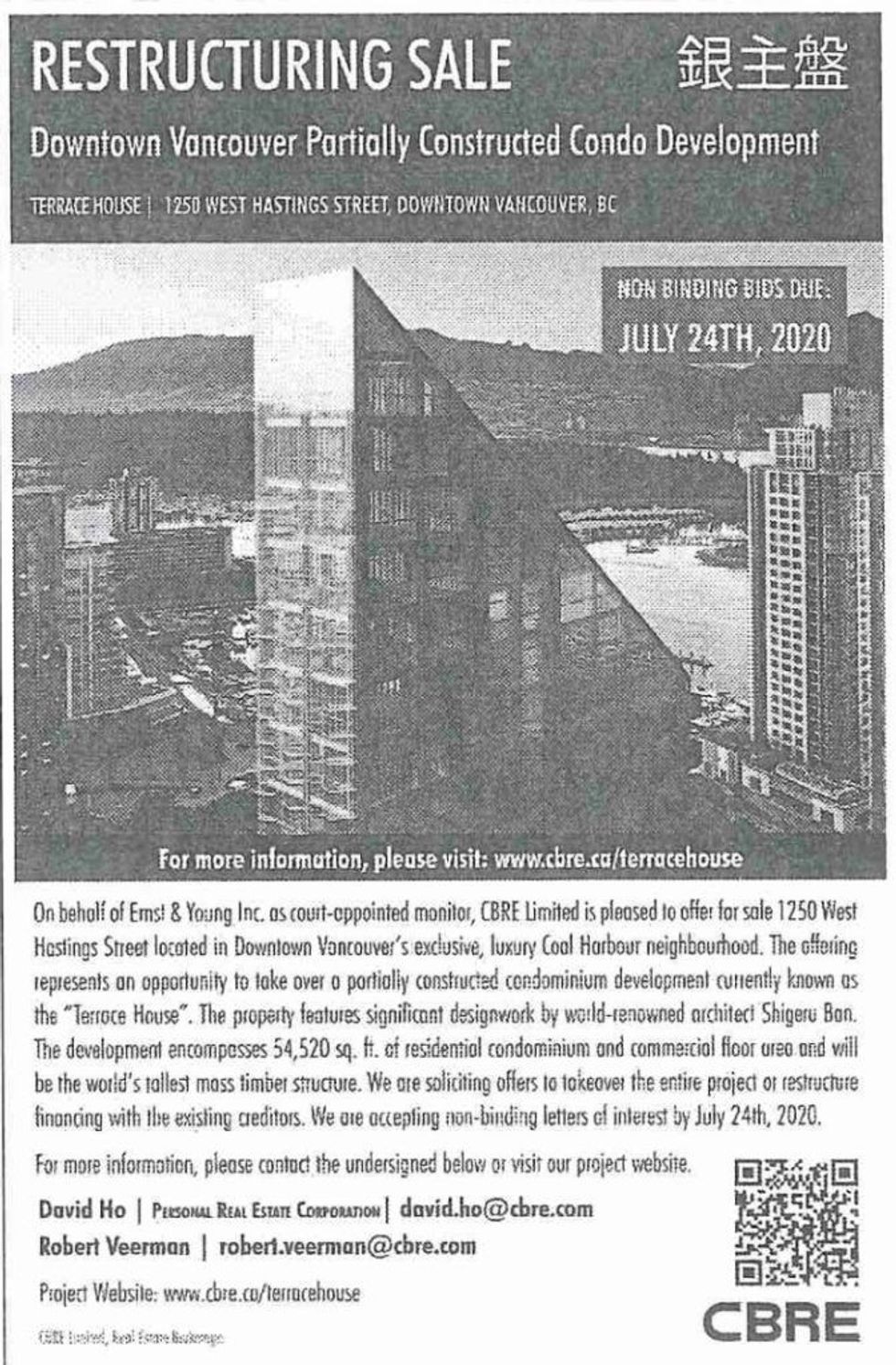

Port Capital Group's insolvency, unlike Coromandel Properties, was centered on just one single high-profile development project: Terrace House. Designed by Japan-based Shigeru Ban Architects, Terrace House was set to be a 19-storey high-rise strata condominium building on 1250 West Hastings Street, in the Coal Harbour neighbourhood of Vancouver, and the project received a lot of attention at the time because it was set to become the tallest hybrid timber building in the world.

Evergreen House Development Limited Partnership acted as the aforementioned limited partnership on the Terrace House project, with Port Capital Development acting as the General Partner, meaning it had complete operational control. The financial problems on Terrace House arose as a result of numerous factors, many of which were then exacerbated by the COVID-19 pandemic.

"The uncertain financial impact of the current COVID-19 pandemic has resulted in potential investors withdrawing their interest in investing in the Port Capital Group's ongoing projects, and has made it more difficult for the Port Capital Group to attract new investors," the 2020 Petition notes.

The Petition also reveals that Port Capital Development was "undercapitalized in terms of equity" and its parent company had to "make up [for] the equity shortfall by way of unsecured intercorporate advances and accrual of fees otherwise payable by [Evergreen LP] in order to continue the construction and development processes currently underway."

This created "friction" between Port Capital Group and some of its lenders, resulting in those lenders "showing less flexibility in the negotiation or re-negotiation of existing credit facilities," which ultimately placed Port Capital Group in what was described as a "liquidity crisis."

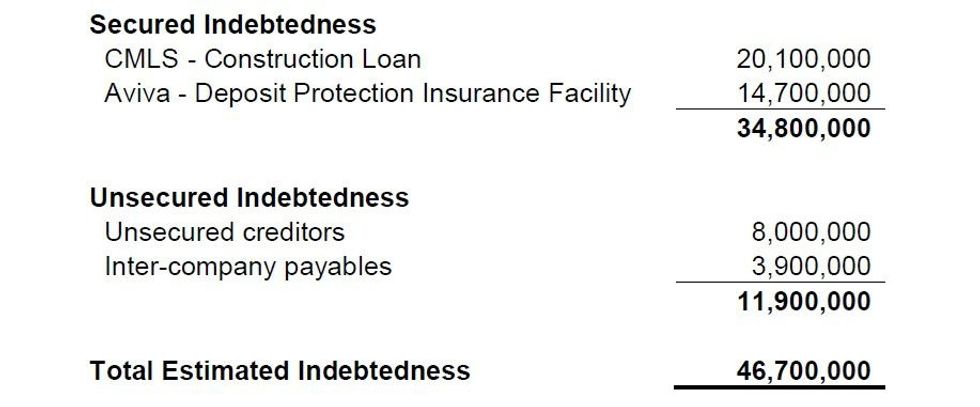

By the time Port Capital Group filed for creditor protection, it had found itself in $46.7M of debt.

Of that total, $34.8M was owed to two secured creditors -- CMLS Financial Ltd., a mortgage company; and Aviva Insurance Company of Canada, an insurance provider. On May 12, 2020, CMLS Financial issued Port Capital Group a Notice of Intention to Enforce Security regarding the amount Port Capital Group owed on its loan, which was secured by a first-ranking mortgage against the Terrace House project. Port Capital Group was unable to pay the debt, which ultimately prompted the company to seek creditor protection.

The remaining $11.9M of debt was to unsecured creditors, which included professional services, accountants, consultants, and others. About a third of that unsecured debt, $3.9M, was also inter-company debt, as a result of Port Capital Group's aforementioned funding structure for projects.

Although Terrace House was set to be 19 storeys, the building only consisted of 20 total units, with most units occupying an entire floor, in addition to two commercial retail units on the ground floor and three levels of parking underground.

The Supreme Court appointed Ernst & Young to serve as the Monitor for the case -- a third party that leads a company through CCAA proceedings -- and in a Monitor's Report dated May 28, 2020, Ernst & Young said 17 of the 20 residential units and both of the commercial retail units had been pre-sold.

The report also noted that demolition and abatement of the pre-existing structure on the site began in 2017, with excavation and shoring occurring in 2018. Construction began in late-2018, and by the time Port Capital Group filed for creditor protection in May 2020, the three-level parkade and first level of the building were substantially completed, with total project completion estimated at 20%.

CCAA Proceedings and Restructuring

Port Capital Group was granted creditor protection under the CCAA, and began working with Ernst & Young through what's called the Sale and Investment Solicitation Plan (SISP), a process in which the parties seek out firms to either invest in the project at hand or buy them outright, essentially taking over the project. The process can vary, but in this particular case consisted of three major stages, all of which Ernst & Young conducted in consultation with the secured creditors, CMLS Financial and Aviva.

The first is the "Pre-Marketing Stage." In this stage, the Monitor seeks out proposals from commercial real estate agents, who -- once selected -- will then prepare a "Teaser Letter" that lays out the opportunity for interested investors or buyers. Preparations for later steps will also be made in this stage, including establishing an electronic archive of all relevant case materials, drafting investment and sale agreement forms, and generating a list of known potential bidders.

In the Marketing Stage, those teaser letters are sent out to the known potential bidders, as well as any other potential parties with interest. Those interested can then sign a Non-Disclosure Agreement and receive a Confidential Information Memorandum to access the document archive, in order to do their due diligence on the project, before deciding whether they want to explore an investment or purchase.

Potential bidders then move on to the Offer Submission and Evaluation Stage, which itself is split into two phases. In the initial phase, interested bidders submit their bids and qualified agreements, all of which are non-binding. Those bids are then evaluated further, with the best then moving to the latter phase, where the offers are made formal and legally-binding. If multiple qualified bids reach this point, an auction can be held before the final selected auction is brought back to the Court for approval.

Critically, there is also no requirement that the parties have to come out of the process having chosen a bid, and all bids can be rejected by the Monitor, who can be given "enhanced" powers that give it more authority during the proceedings, as was the case here.

In the Port Capital Group case, the Terrace House project was solicited to approximately 670 potential bidders, including "local, national, and international strategic and financial parties and real estate developers," an Ernst & Young Monitor's Report said. CBRE Limited was also retained in order to market the Terrace House project to its investor network in Asia, via a newspaper advertisement in the South China Morning Post, a Hong Kong newspaper.

Ultimately, the decision came down to four offers. Two offers were made by Delta-based Solterra Development Corporation, one was made by Vancouver-based Landa Global, and one was made by 1296371 BC Ltd, a new company formed by Macario Tobi Reyes, Founder and CEO of Port Capital Group. In previous stages of the process, Bosa Properties also made a bid, which was ultimately rejected by Ernst & Young, in consultation with CMLS.

Court of Appeal documents summarize the Solterra and Landa Global offers as "asset purchase agreements," meaning either developer would buy the Terrace House project, take over the development, and carry it to the finish line. Other case files show that Landa Global's offer to purchase the project was originally $19M, before it was raised to $21.5M, then to $22M. Solterra's two offers were $21M and $23,666,666 plus "additional purchase price addition in certain scenarios."

The Court, however, noted that "under the Solterra and Landa cash offers [...] CMLS would suffer a shortfall of varying degrees," ranging from over $500,000 to $3.2M depending on the offer. Additionally, under these cash offers, a number of pre-sale buyers for Terrace House could potentially lose their pre-sale agreements that give them the right to purchase the homes once completed.

"Under any of the cash offers," the Court said, "the Petitioners would disclaim the $16M of pre-sale agreements. [...] CMLS/Aviva would then potentially advance arguments that these pre-sale purchasers had forfeited the right to a return of those cash deposits such that CMLS/Aviva would claim those amounts toward satisfaction of their loans."

On the other hand, with the offer brought forth by Reyes' new company, the Interim Lending Facility -- a $1.8M loan from Desjardins Financial Security that served as financing during the solicitation process -- and CMLS Financial would be paid in full. Additionally, Aviva could see full or material recovery as well, and litigation over the $8M in pre-sale cash deposits would be avoided because the agreements could be carried over to Reyes' new company, whose plan involved "complex refinancing" and borrowing money from Domain, a commercial lender.

In June 2021, somewhat surprisingly, the Supreme Court ruled in favor of Solterra's offer and dismissed the offer made by Reyes' new company. However, in October 2021, the Court of Appeal reversed the ruling, ordering Solterra's offer to be put aside in favour of the one made by Reyes' company, which completed later in the month. Additionally, the Court also ordered the $8M in pre-sale cash deposits be released from trust, held by Dentons Canada, and returned to seven pre-sale purchasers. Deposits ranged from just under $600,000 to $2.8M, and included deposits for the two commercial retail units.

After Reyes' company took over the project, they continued trying to identify further financing and development partners, in order to resume construction on Terrace House. In April 2022, the developers reached an agreement with Enso Holdings Ltd. that would see Enso not only co-develop the project, but also become the majority General Partner. According to public register information, Enso Holdings is based in Dubai.

That deal ultimately would not work out, however, as the project's financials worsened, prompting the issuing of a Material Adverse Change, a contractual condition that allows a buyer to cancel a transaction if circumstances change and the value of what's being acquired is significantly reduced. In July 2022, both Domain and Aviva filed motions that would result in Terrace House undergoing a sale process once again, with Ernst & Young saying in a subsequent report that "the Petitioners appear to have no prospect of implementing a plan for the reorganization of the Terrace House Project."

"The Petitioners have had over two years to formulate and implement a plan to exit CCAA," Ernst & Young added. "The Petitioners cannot meet their post-filing obligations in the short term; and in the longer term, they do not have construction financing to resume construction of the Terrace House project; and while they have made good faith and diligent efforts, they do not appear to have any equity so they need to rely on support from others."

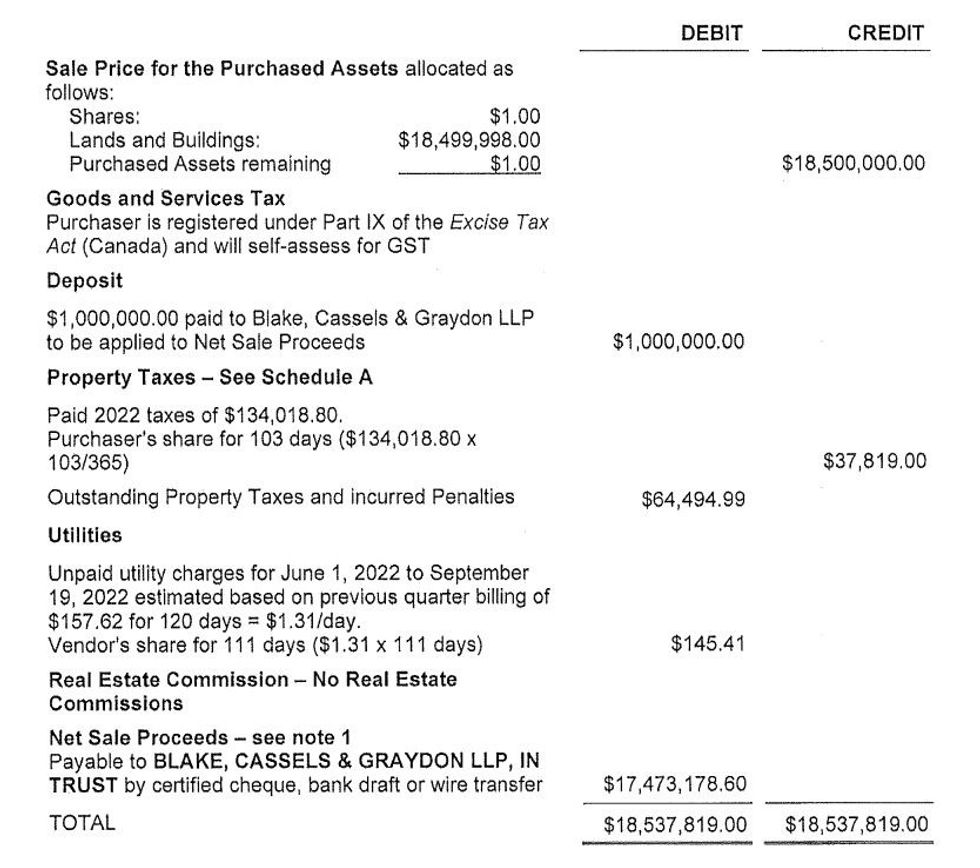

Many of the previously-interested parties were then contacted again, and in September 2022, the Supreme Court approved the sale of Terrace House to -- in a full-circle turn of events -- Solterra. According to the sales agreement, the transaction involved all of the rights, titles, and assets, including but not limited to the approved contracts, warranties, plans, permits, and approvals associated with the project, for a base purchase price of $18.5M.

Since the sale to Solterra, the Supreme Court has authorized and directed Ernst & Young to distribute some of the proceeds from the sale to various parties that are owed money, such as Domain and Aviva, according to a October 2022 court order. In December, the same court authorized Dentons to release and return $2,703,434 in deposits to five presale purchasers, pursuant to British Columbia's Real Estate Development Marketing Act (REMDA).

RELATED: Red Tape and Rising Rates Push Coromandel Properties to Seek Creditor Protection

STOREYS reached out to Solterra and multiple people at Ernst & Young involved in the case to inquire about the current status of the case, as well as the future of the Terrace House project, but none of the parties have responded as of publishing.

In CCAA proceedings, companies that are granted creditor protection can exit the CCAA process once a final plan is created and approved, called the Plan of Agreement or Compromise. Subsequently, a court can then issue an order dismissing the Monitor and terminating the CCAA proceedings.

According to the Government of Canada's CCAA records, no court order dismissing the Monitor and terminating the CCAA proceedings has been issued.

Coromandel Properties

As for Coromandel Properties, what the Port Capital Group precedent shows, if anything, is that we can expect an extensive process that will take several years to conclude.

While Port Capital Group's CCAA proceedings essentially wasted a year as a result of the initial sale and then second sale to Solterra, the case involved only a single project, and began with Port Capital having less than $50M in debt.

With Coromandel Properties, as many as 16 projects are in jeopardy, with three projects each saddled with over $40M of debt. Coromandel has indicated intentions to complete projects that are currently under construction, but several of the 16 projects are not.

As Ernst & Young did in the Port Capital Group case, Deloitte has been appointed as the Monitor in Coromandel's CCCA proceedings, and the firm will now work with Coromandel to explore refinancing or sale options for its various projects.

Although the Sale and Investment Solicitation Plan process can sometimes be quick or condensed, the sheer amount of projects likely makes a quick sale or refinancing that much more complex. A complete resolution where all those who are owed -- lenders, investors, pre-sale purchasers -- are made whole again could take many, many years.