When the August inflation reading came in at 7% earlier this week, it was heralded as a sign that the sizzling pace of price growth -- and resulting interest rate hikes -- may finally have reached their peak.

But borrowers shouldn’t expect relief any time soon from soaring debt costs; new commentary from the Bank of Canada’s top brass has quashed any optimism that rate hikes will soon be in the rearview mirror.

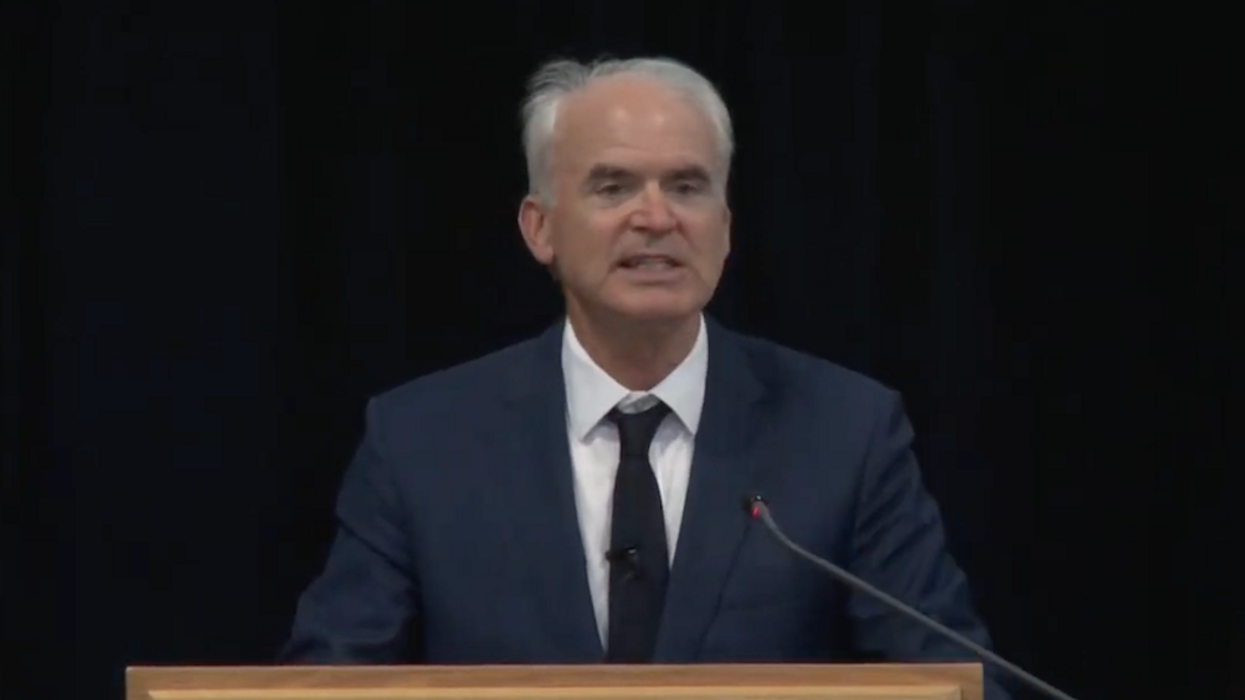

“While we’re headed in the right direction, that’s [7%] still too high,” said Paul Beaudry, BoC Deputy Governor, in a lecture given yesterday at the University of Waterloo.

“Consumers and businesses are rightfully wondering when we’ll stop feeling the pinch of high prices.”

READ: Bank of Canada Must Risk a Recession “Kamikaze Mission” to Control Inflation: Economists

The reality, says Beaudry, is that the central bank faces an “ongoing battle” to reign inflation back in to its 2% target, which has prompted the Bank to implement five rate hikes since March, bringing its trend-setting Overnight Lending Rate up 3% -- the steepest pace since the mid 1990s. Today’s benchmark cost of borrowing sits at 3.25%, a level not seen since December 2005.

The Bank has had the mandate of keeping inflation close to 2% since 1991, which has provided the stability for the private sector to make price- and wage-setting decisions with the confidence that growth will remain close to that target. After successfully implementing this approach for decades, the Bank has developed a “credible track record,” says Beaudry -- but that is now being “seriously tested.”

He also touched on the credibility challenges the Bank has faced this year, amid criticism it was too slow to act on inflation growth, which started to spike in January; the central bank didn’t implement its first rate hike until March, leading some economists to claim it was “behind the eight ball” on its monetary policy approach.

The pandemic brought about “unprecedented effects on the domestic and global economies,” Beaudry said, as the “entire world “effectively battened down the hatches so quickly and all at once,” and businesses endured a roller coaster of lockdown and re-opening mandates. Combined with the resulting supply change disruptions and war in Ukraine, that’s led to the highest inflation growth seen in decades.

“Looking back now, I believe we got a lot of things right when trying to manage the economic fallout from the pandemic,” he said. “But in other areas, we could have done better.”

“The more effective the Bank can be in its guiding role, the greater the chance of a soft landing—and the lower the risk of a hard landing,” he concluded.

The Bank has indeed taken a no-holds-barred approach at communication, all but confirming in their last interest rate announcement that another rate hike would be on the horizon, given inflation’s persistence. The next Bank of Canada interest rates announcement will be Wednesday, October 26.