Sale and Investment Solicitation Process (SISP)

Learn what a SISP is in Canadian real estate and finance — how court-monitored sales processes help resolve distressed asset situations.

June 09, 2025

What is a Sale and Investment Solicitation Process (SISP)?

A Sale and Investment Solicitation Process (SISP) is a formal court-supervised method of marketing, selling, or refinancing distressed assets during insolvency or restructuring proceedings.

Why a Sale and Investment Solicitation Process Matters in Real Estate

In Canadian commercial real estate and corporate finance, a SISP ensures transparency and fairness when creditors seek recovery through asset disposition.

A SISP typically includes:

- Marketing the asset to potential buyers/investors

- Establishing bid deadlines and terms

- Evaluating offers with court oversight

- Facilitating asset sale, investment, or restructuring

It may be initiated under the Companies’ Creditors Arrangement Act (CCAA) or Bankruptcy and Insolvency Act (BIA).

Understanding SISP is essential for investors, lenders, and professionals navigating distressed asset acquisitions.

Example of a SISP in Action

Following a retailer’s insolvency, the court approves a SISP to evaluate bids for its owned distribution centre and leasehold interests.

Key Takeaways

- Court-approved process to market and sell assets

- Ensures fairness in insolvency situations

- Used in real estate and corporate restructuring

- Attracts buyers and investors to distressed assets

- Common in CCAA and BIA proceedings

Related Terms

- Insolvency

- Receivership

- CCAA

- Commercial Property

- Bankruptcy and Insolvency Act

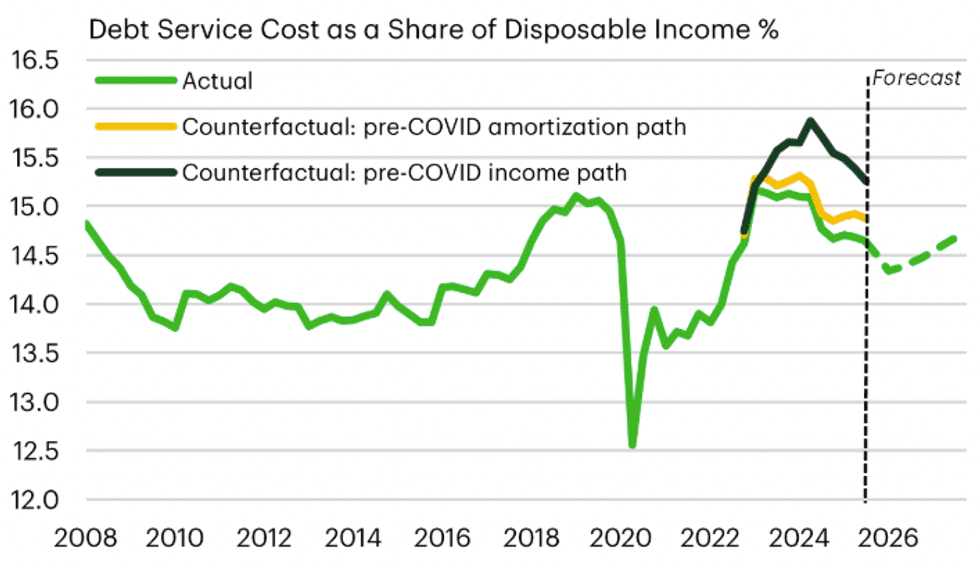

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics

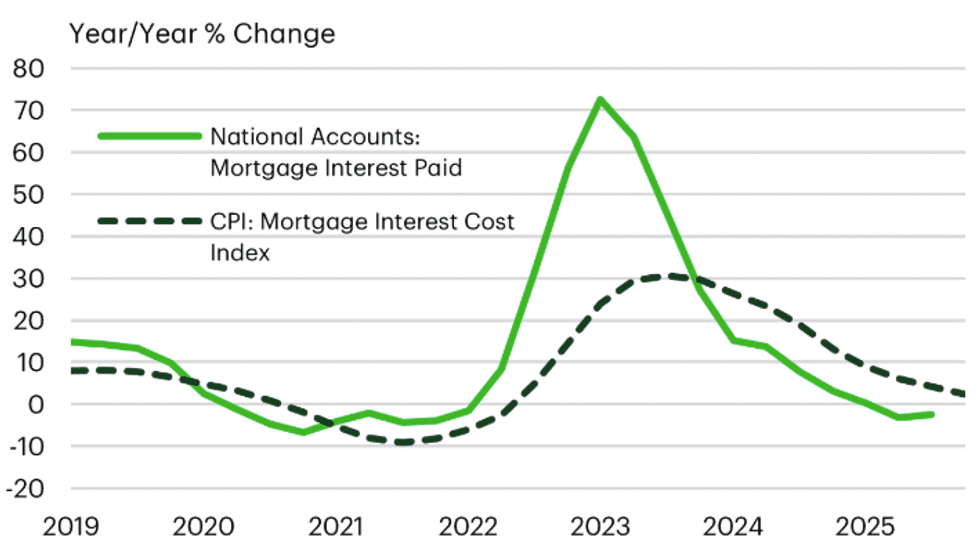

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics

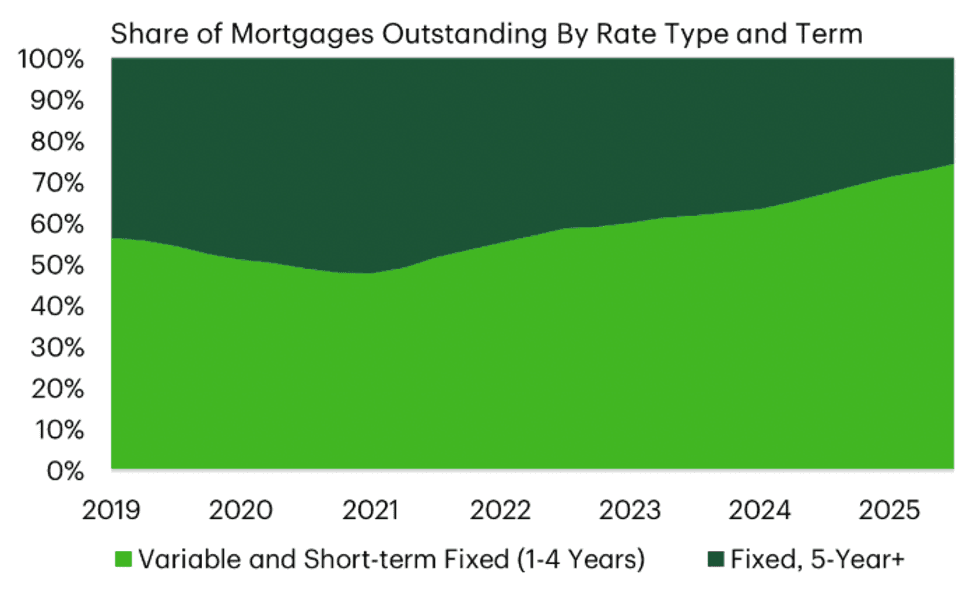

Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Manuela Preis/Instagram

Manuela Preis/Instagram