[Editor's Note: On August 1, after industry feedback, the Province announced that it would be partially walking back the changes, as detailed at the end of this article.]

In an open letter dated July 25 and addressed to Minister of Housing Ravi Kahlon, the BC Real Estate Association (BCREA) voiced a series of concerns regarding changes to the Residential Tenancy Act that came into effect earlier this month.

On July 3, the Province announced that it was increasing the amount of notice landlords must give to tenants when evicting on the basis of personal or caretaker use, from two months to four months. Eviction notices under those circumstances would also have to be generated through a new Landlord Use Web Portal the Province was creating. Additionally, the amount of time tenants have to dispute eviction notices was increased from 15 days to 30 days.

Several of the changes, which came into effect on July 18, were previously announced in April, but the Province only said that it would be increasing the amount of notice from landlords, without specifying how much of an increase.

In their open letter, the BCREA said that the change is not precise enough and could become a "major hurdle" for first-time homebuyers in a way that was likely not intended.

"The new legislation makes no distinction between a buyer of a tenanted unit who just wants to move into their new home and a landlord who might be using a bad-faith eviction as a tool to raise rents beyond the allowable limit," said the BCREA. "This lack of clarity alone has been the subject of consternation among buyers who aren't evicting tenants for some nefarious purpose. The conflating of these two very distinct purposes is unfair to buyers who just want to occupy the homes they have purchased within a reasonable timeframe."

"While this is a problem for all buyers, this is a particular problem for high-ratio-insured buyers, including first-time buyers, who generally need mortgage default insurance to secure their financing," the BCREA added. "Mortgage insurers do not insure rental properties, and the extended notice period makes it especially difficult for buyers to get vacant possession of their properties within the time allowed by financial institutions. Without the mortgage insurance in place, buyers, and especially first-time buyers, will not be able to secure the financing they need to complete their purchase."

The BCREA's concerns were echoed by the Canadian Mortgage Brokers Association of British Columbia (CMBA-BC), who published their own open letter to the Ministry of Housing earlier this month.

"In practical terms, most lenders allow for a 90-120-day rate hold period when approving mortgages for real estate purchasers," said the CMHA-BC. "Adding a four-month notice period to terminate tenancies complicates the mortgage approval process, potentially leading to funding denials or increased costs for purchasers. These changes will impact first-time homebuyers the most as these are the most typical buyers of previous rental properties."

The BCREA went on the explain that without mortgage default insurance, lenders typically require a minimum down payment of 20% for rental properties, which many first-time buyers may not be able to provide. Additionally, a requirement of default-insured mortgages is often vacant possession. That now takes longer because of the increase to four months, the BCREA says, and in effect, becomes a five-month period when including the eviction dispute period increase to 30 days.

"Combining a four-month eviction notice with a 30-day dispute notice produces an effective five-month period in which a buyer can't take possession of their new home," said the BCREA. "This is impractical for buyers moving from one home to another and is too long a period to wait between completions."

Additionally, the BCREA also voiced concerns regarding the new Landlord Use Web Portal, saying that "older-generation landlords may not know how to use these sophisticated 'portals' and that the additional hassle may push landlords to sell their rental properties."

They also voiced privacy concerns as it relates to buyers.

"The portal will require landlords to provide details about the persons moving into the home. The details of the new occupant of the home will be shared with the tenant. Apparently, this includes sharing a copy of the Contract of Purchase and Sale, which includes personal and confidential information about the buyer which was never intended to be accessed outside of the transaction. Inappropriate use of this and any other private information by a former tenant could compromise the future safety of the buyer, especially if the former tenant blames the buyer for evicting them. The buyer's financial security could also be compromised."

Industry Recommendations

In light of these concerns, the BCREA recommended five changes: adjusting the rules for conventional mortgage buyers to allow for vacant possession within three months, allowing high-ratio insured buyers who will be occupying the property to continue to have a two-month notice period, adding privacy protections, allowing a paper-based alternative to the Landlord Use Web Portal, and eliminating the reporting requirement for buyers who intended to occupy their own unit.

"We are being told by REALTORS®, mortgage brokers, and clients that the increasing regulatory burden and cost is making rental property owners question whether they will be staying in the business," said the BCREA. "Increasingly, they are choosing to sell either to institutional owners who increase rents to better meet costs of operation. Or they are selling to those who would redevelop older properties, and likely eliminate the more affordable units."

"Our research indicates that owners of tenanted properties are finding it harder to sell these units, because of the regulatory load and costs imposed on landlords," they added. "There are many units that are being left vacant rather than having a tenant living there. This is even true for new condo units that are reaching completion. They are much easier to sell as vacant units so tenants are not getting the benefit of these coming onto the market. It is only recently that this kind of calculation has come into play in terms of owners' decisions to sell. This is hardly conducive to increasing the stock of rental units in the marketplace."

"We firmly believe that the amendments to the RTA will exacerbate the housing shortage in our province by discouraging investment and hindering entry into the market for first-time homebuyers," added the CMBA-BC. "Specifically, extending the notice period required to terminate tenancies will reduce incentives for property owners to make their units available for long-term occupancy. This restriction not only limits housing options but also poses challenges for financial institutions that play a crucial role in facilitating homeownership for British Columbians."

[Editor's Note: On August 1, the Province announced that it would be shortening the eviction notice period from four months to three months and the dispute period from 30 days to 21 days, effective August 21, but only in cases where the eviction notice is issued on behalf of a purchaser. The four-month notice period and 30-day dispute period that came into effect on July 18 will still apply to evictions for personal or caretaker use.]

- Op-Ed: The Capital Gains Hike Hurts Private Landlords, Rental Market ›

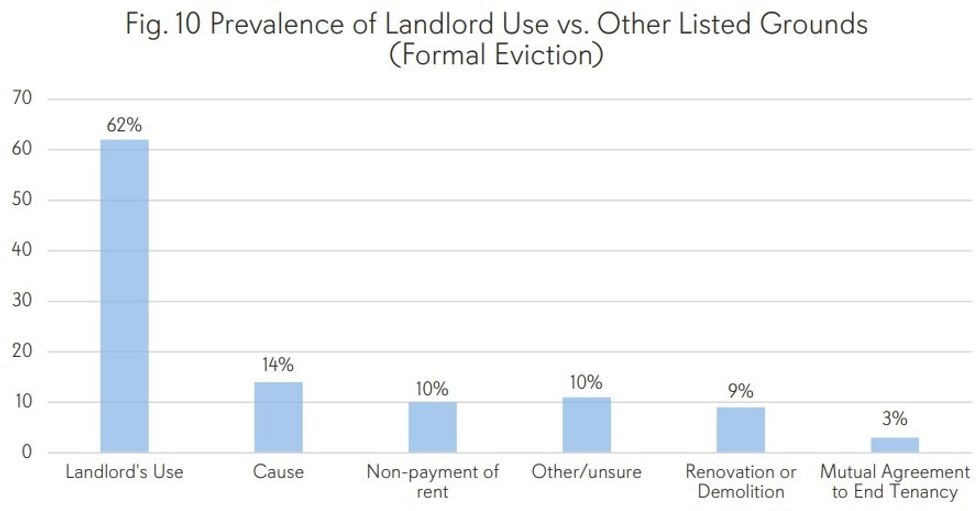

- How British Columbia Can Combat No-Fault "Landlord Use" Evictions ›

- How The Ontario Developer Coalition Pledging To Reduce Prices Came Together ›

- Greater Vancouver Real Estate 'Surprisingly' Weak After Rate Cuts ›

- Fraser Valley Real Estate Market "Sluggish" Despite Rate Cuts ›