Property Value

Explore how property value is determined in Canadian real estate, what influences it, and how it’s used in buying, selling, and financing decisions.

May 30, 2025

What is Property Value?

Property value refers to the estimated monetary worth of a real estate asset based on market conditions, location, features, and comparable sales.

Why Property Value Matters in Real Estate

In Canadian real estate, property value influences buying and selling prices, mortgage lending, taxation, and investment analysis.

Factors affecting property value include:

- Recent comparable sales (comps)

- Condition, upgrades, and lot size

- Local market trends and interest rates

- School zones, transit access, and amenities

Property value may differ depending on context: assessed value (for taxes), appraised value (for financing), and market value (what a buyer will pay).

Understanding property value helps buyers negotiate, sellers price competitively, and investors evaluate returns.

Example of Property Value

A seller lists their home at $850,000 based on an appraisal and recent comparable sales, reflecting the property’s current market value.

Key Takeaways

- Reflects what a property is worth.

- Varies by market, condition, and purpose.

- Used in lending, pricing, and taxation.

- Can differ from assessed or appraised values.

- Key to all real estate decisions.

Related Terms

- Appraisal

- Market Value

- Assessed Value

- Depreciation

- Comparable Market Analysis (CMA)

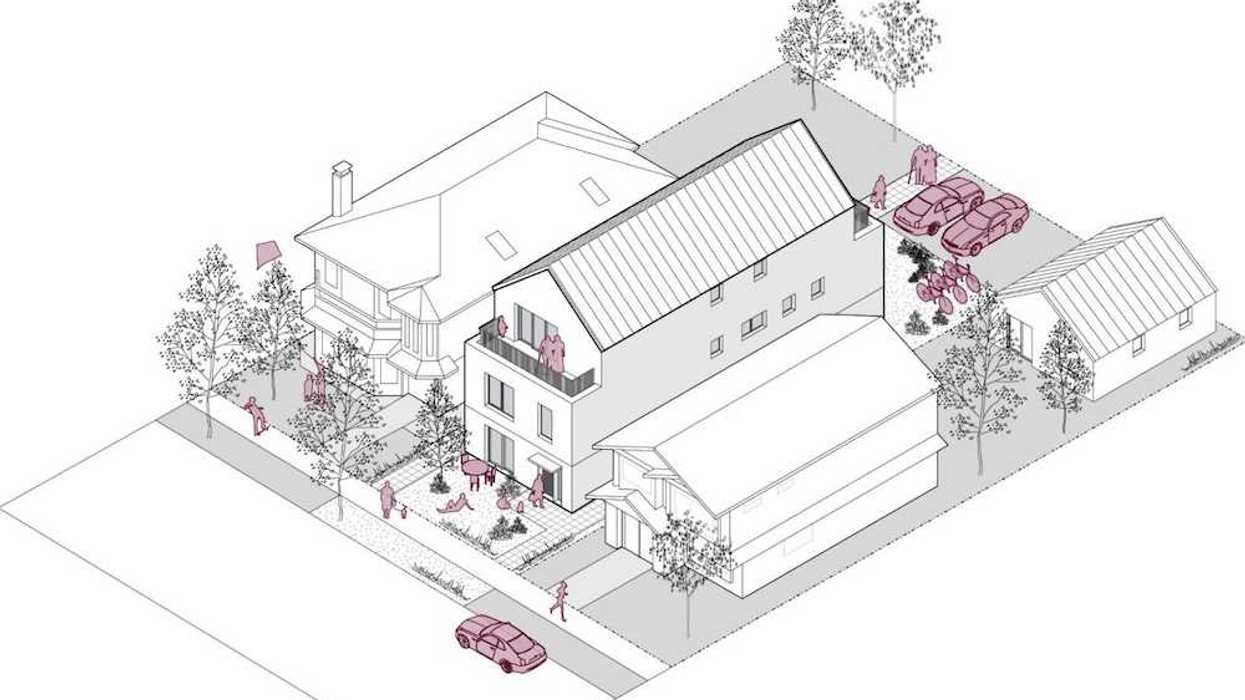

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect

Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

The Yonge Corporate Centre at 4100-4150 Yonge Street. (Europro)

The Yonge Corporate Centre at 4100-4150 Yonge Street. (Europro)

Jon Sailer

Jon Sailer