Property Protection

Explore property protection in Canadian real estate — what it includes, why it’s required by lenders, and how it helps homeowners recover from damage.

May 22, 2025

What is Property Protection?

Property protection refers to the coverage provided by home insurance that safeguards the physical structure of a property and its contents against damage or loss.

Why does Property Protection Matter in Real Estate?

In Canadian real estate, property protection is a critical part of home insurance policies. It ensures that homeowners can repair or replace their home and belongings if they’re damaged by covered perils.Typically covers:- Fire, water, or storm damage

- Theft or vandalism

- Accidental damage to fixtures or appliances

- Detached structures (e.g., garages or sheds)

Understanding property protection helps homeowners evaluate their risks, select appropriate insurance, and avoid major out-of-pocket costs after a loss.

Example of Property Protection in Action

A windstorm damages a roof and garage door. The homeowner’s insurance policy covers repairs under property protection.

Key Takeaways

- Safeguards home and belongings.

- Covers damage from specific risks.

- Required by mortgage lenders.

- Limits and exclusions apply.

- Crucial for financial security.

Related Terms

- Home Insurance

- Liability Coverage

- Replacement Cost

- Risk Management

- Coverage Limit

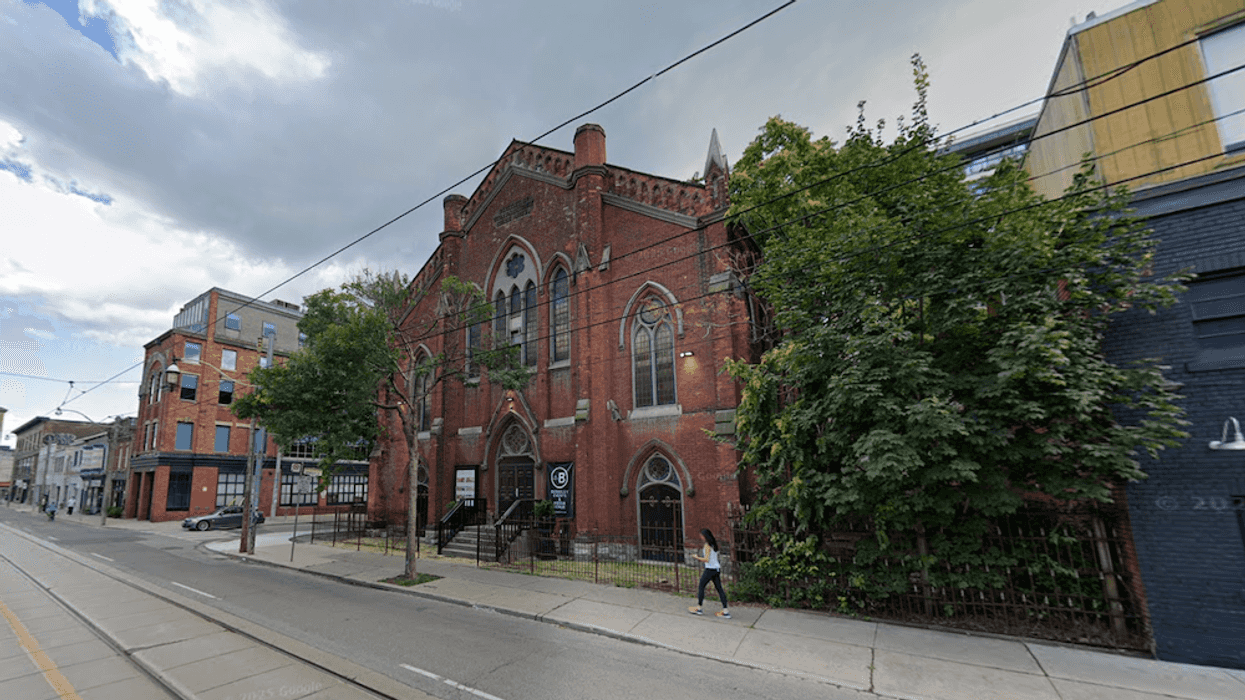

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

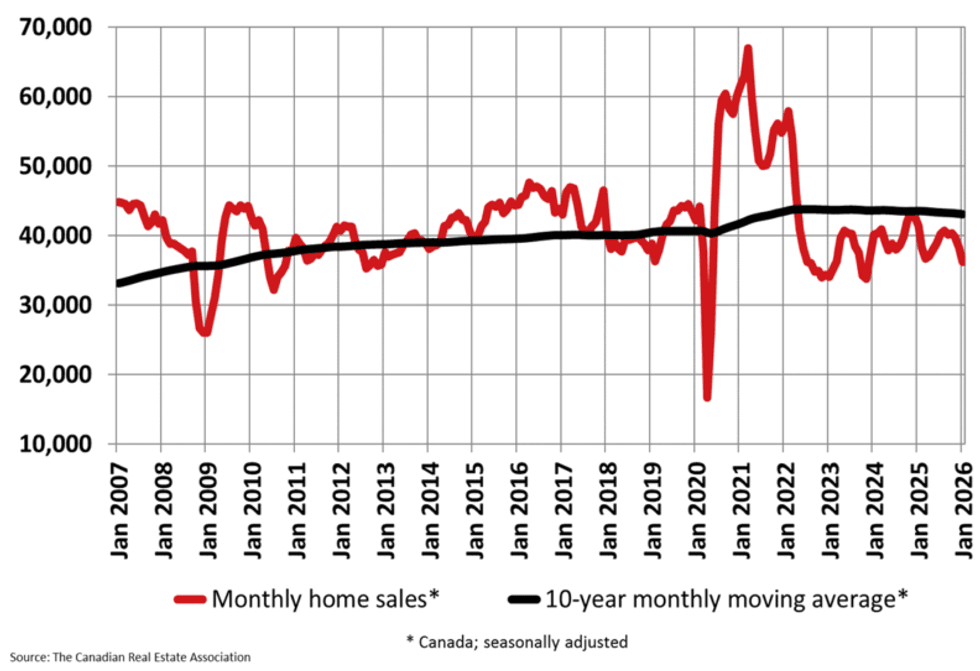

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

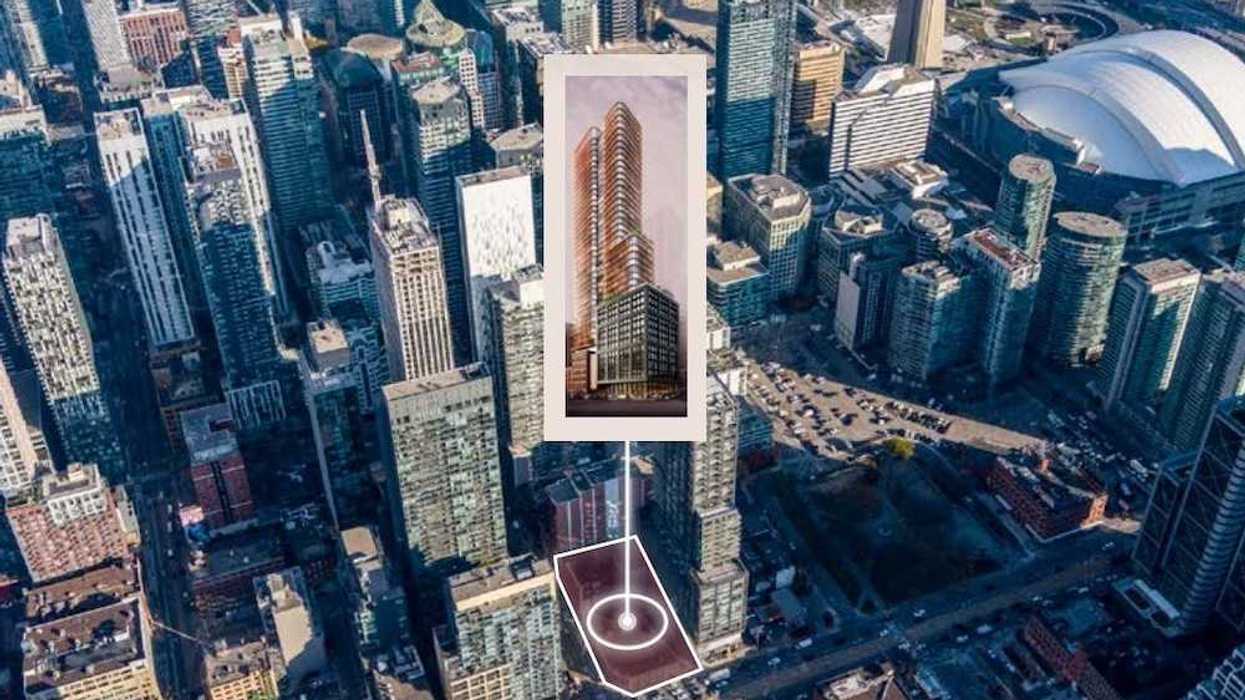

401-415 King Street West. (JLL)

401-415 King Street West. (JLL)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.