Principal Residence

Learn what qualifies as a principal residence in Canadian real estate, how it affects taxes, and why proper designation is key to maximizing exemptions.

May 22, 2025

What is a Principal Residence?

A principal residence is the main home a person regularly inhabits and is eligible for certain tax exemptions under Canadian law.

Why Principal Residences Matter in Real Estate

In Canadian real estate, designating a property as your principal residence has significant tax implications. Most notably, it allows homeowners to claim the Principal Residence Exemption, which exempts capital gains from taxation when the home is sold.

To qualify as a principal residence:- The owner must live in the home regularly (even part of the year).

- It can be a house, condo, cottage, or mobile home.

- The property must be owned (not rented) and not primarily used to generate income.

Only one property per family unit (you, your spouse or common-law partner, and minor children) can be designated per year. Designations are reported to the Canada Revenue Agency (CRA) when the home is sold.

Understanding how principal residence rules work is crucial for tax planning, especially for owners of multiple properties. Incorrect or missed designations may result in unnecessary tax liabilities.

Professional advice can help homeowners optimize exemptions, especially when selling investment or vacation properties.

Example of a Principal Residence

A family sells their Toronto home for a $250,000 profit. Because it was their principal residence for the entire ownership period, they pay no capital gains tax.

Key Takeaways

- Your primary, regularly inhabited home.

- Eligible for capital gains tax exemption upon sale.

- Only one property per family can be designated each year.

- Must be reported to the CRA when sold.

- Important for tax and estate planning.

Related Terms

- Capital Gains Tax

- Primary Residence

- Investment Property

- CRA Designation

- Residential Property

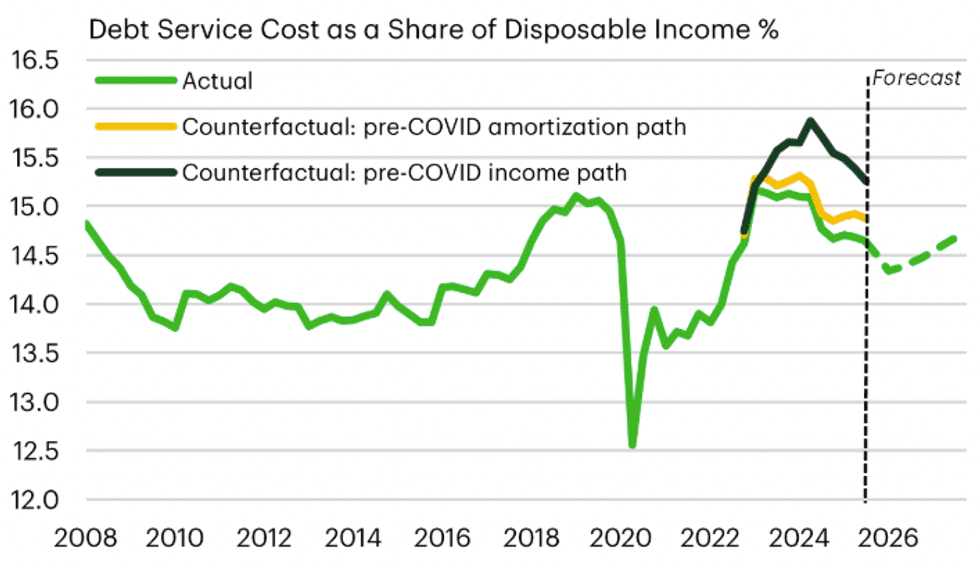

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics

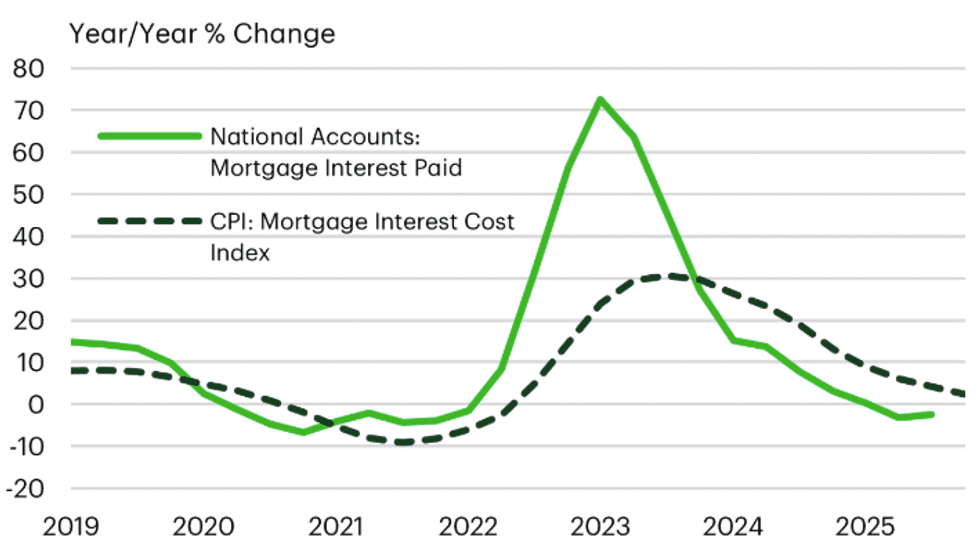

Income growth and longer amortizations are blunting mortgage shock/Statistics Canada, TD Economics Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics

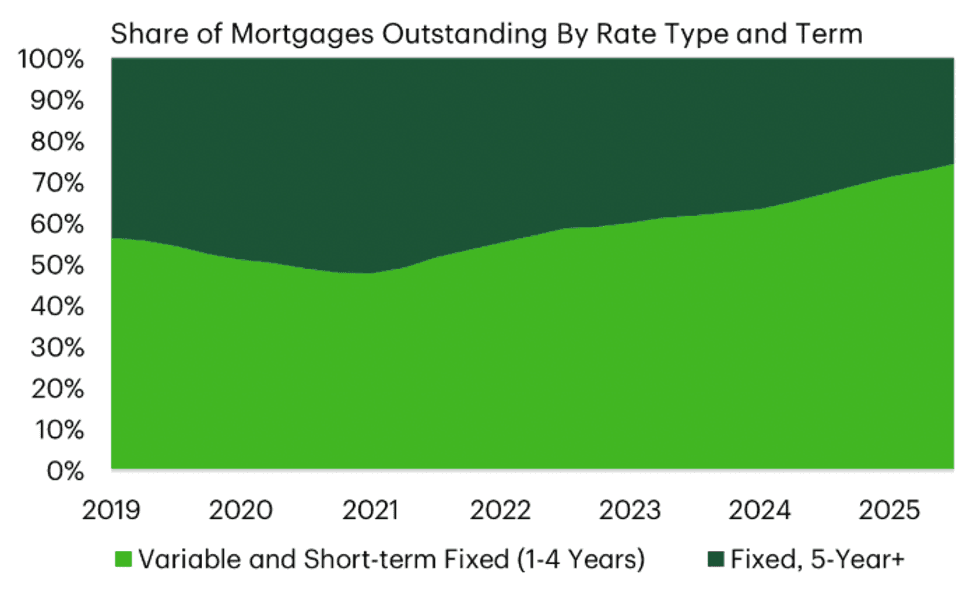

Canada's mortgage interest cost index is nearing deflation/Statistics Canada, TD Economics Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Canada's mortgage stock is more rate-sensitive today/Bank of Canada, TD Economics

Manuela Preis/Instagram

Manuela Preis/Instagram