When a business like the Hudson's Bay Company (HBC) becomes insolvent the implications can be as far-reaching as the company is. And more and more of these implications are now coming into view as the insolvency proceedings progress.

The Hudson's Bay Company was operating a total of 96 stores — under the Hudson's Bay, Saks Fifth Avenue, and Saks OFF 5th brands — across the country, primarily within large regional shopping malls owned by REITs or institutional landlords such as pension funds.

After filing for and securing creditor protection under the Companies' Creditors Arrangement Act (CCAA) on March 7, HBC has been liquidating the inventory at all of its stores while the court-appointed Monitor has been leading a process to monetize its other assets, such as its leases, intellectual property, and historic artifacts. (Canadian Tire announced this month that it is acquiring HBC's IP for $30 million.)

Earlier this month, RioCan REIT (TSX: REI.UN) disclosed a $209 million loss on its investment in the joint venture it created with Hudson's Bay in 2015, which became HBC's primary real estate subsidiary and an integral part of HBC.

This week, it is Primaris REIT (TSX: PMZ.UN) who announced the fate of the nine Hudson's Bay stores in its portfolio.

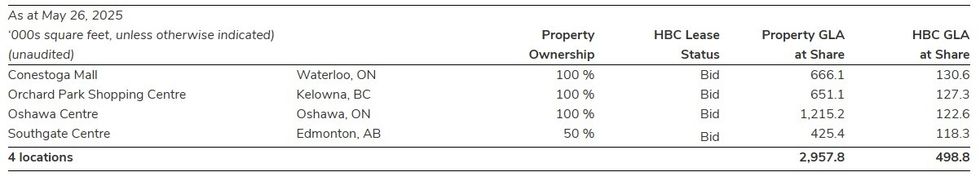

Four HBC Leases Subject To Bids

Primaris REIT says that four of the nine HBC leases are subject to bids that meet the minimum requirements defined under the lease monetization process. Court documents have not disclosed any details about these bids and even the REIT itself does not appear to know all of the details, saying in its press release today that "limited information is available about these bids, including any retailer plans or requested lease modifications" and that it is "not yet able to comment on the viability of the operating strategies or financial strength of the retailers bidding on these locations," but will do so once more details are known.

The four leases that are subject to bids are the locations within the Conestoga Mall and Oshawa Centre in Ontario, the Southgate Centre in Alberta, and the Orchard Park Shopping Centre in British Columbia. Two of the leases were acquired by Primaris REIT just before HBC filed for creditor protection, when Primaris paid $585 million in January for a 100% interest in the Oshawa Centre and a 50% interest in the Southgate Centre.

Altogether, the four Hudson's Bay stores total 498,770 sq. ft of leasable space, which Primaris said represents approximately 3.5% of its portfolio, one that is focused on enclosed shopping centres in growing Canadian markets. These four locations provided approximately $5.4 million in gross rental revenue ($10.84 per sq. ft) and $2.0 million in net rental revenue ($3.92 per sq. ft) for Primaris REIT.

Commenting on the bids, Primaris said that it believes that the REIT "will have significant influence over the outcomes of the bids" as a result of "significant deferred maintenance in the stores, and the time and cost required to restore the spaces to satisfactory operating condition for a retailer."

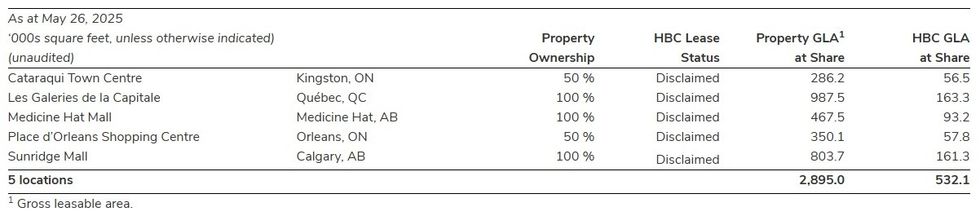

Five HBC Stores To Be Repurposed

No bids were submitted for any of the five remaining leases and the leases have now been disclaimed, said Primaris, adding that it is expecting to assume full control of the sites effective Monday, June 16.

These five leases are for Hudson's Bay stores within the Cataraqui Town Centre and Place d’Orleans Shopping Centre in Ontario, Les Galeries de la Capitale in Quebec, and Medicine Hat Mall and Sunridge Mall in Alberta. These five stores amount to 532,100 sq. ft of leasable space and Primaris said its overall in-place portfolio occupancy rate will drop from 93.2% to 89.5% as a result of the vacancy. The REIT also said the vacancy will result in a reduction of $5.5 million in annualized revenue and $3.9 million in annualized net operating income.

In addition to those negative effects, Primaris REIT will also be spending a significant amount of money to repurpose and redevelop the stores, whether from subdividing existing spaces or demolishing some of the existing space to allow for new construction. The REIT says it will spend between $50 million and $60 million towards those efforts, which is expected to reduce the total leasable space from 532,100 sq. ft to 475,000 sq. ft. Primaris said it expects occupancy to occur in Q2 2026 and rent flow to commence in early-2027.

"With significant planning and preparation work already complete, management is now focused on rapidly executing on its longstanding re-tenanting, redevelopment, and repurposing plans in relation to each of the five disclaimed locations," the REIT said. "Discussions and negotiations are ongoing, and management expects to be able to announce definitive agreements, leases and plans for most of these locations over the remainder of 2025. Primaris' ultimate goal is to provide clarity for stakeholders and minimize disruption at the properties while delivering new rental income as soon as possible."

Primaris REIT And Hudson's Bay

Overall, Primaris REIT is framing the loss of Hudson's Bay as a positive and one that also carries financial benefits. The REIT says that as a result of the five leases being disclaimed, it is now free of obligations that required it to provide 1,866 parking spaces that effectively tied down 13 acres of land and said it is now also free from "no-build" restrictions on approximately 71 acres of land that barred it from building anything near HBC stores.

"All of these properties now offer significant intensification opportunities spanning retail outparcels, the potential sale of excess lands for multi-residential, hotel, or other high density uses, and the future expansion of the malls themselves," said Primaris.

"In addition to the above noted financial benefits and removed restrictions, regained control of these leases offers further indirect financial and qualitative benefits to the shopping centres, such as the halo effect on sales and rents from adjacent tenants following re-tenanting, or the positive impact on capitalization rates and valuations for properties that replace underperforming tenancies with new, stronger retailers," the REIT also said.

"Primaris REIT has been preparing for the departure of HBC, as its department store peers downsized and ceased operations over the past 15 years, including Zellers, Target and Sears," said President & COO Patrick Sullivan in a press release in April. "The departure of Canada's final conventional department store will enable future value creation for our stakeholders, paving the way for optimal use of space that better reflects the evolving needs and desires of the growing communities."

"Regaining control of five of our valuable anchor locations allows Primaris to commence repurposing a significant amount of low productivity space, and marks the beginning of our value surfacing exercise," said CEO Alex Avery in today's press release. "While HBC has been the focus of a lot of discussion and attention, the real story is just beginning, as the disclaiming of leases has finally removed obstructionist barriers enabling us to enhance our properties. We are confident that the quantitative and qualitative benefits of regaining control of these spaces will be materially positive for our properties and our unitholders."

- RioCan Recognizes $209M Investment Loss From Joint Venture With Hudson's Bay ›

- Inside Hudson's Bay's "Fully Intertwined" Relationship With RioCan ›

- Primaris REIT Pays $585M For Stakes In Southgate Centre, Oshawa Centre Malls ›

- Primaris REIT Buys CF Lime Ridge Mall In Hamilton For $416M ›

- Ruby Liu To Buy 3 Hudson's Bay Leases At Central Walk's Malls For $6M ›

- Cadillac Fairview "Resolutely Opposed" To Selling HBC Leases To Ruby Liu ›

- Ruby Liu's Bid For Hudson's Bay: The 25 Leases, Prices, And Business Plan ›