Under the weight of interest rate hikes, Canadian housing softened remarkably this summer, and one economist cautions that markets will continue to “struggle” into 2024.

“Softer job market conditions could ease demand, and more listing availability should weigh on price growth. Most importantly, mortgage rates keep pushing higher,” writes BMO Economist Robert Kavcic in a recent note.

Kavcic points to the mortgage rates that characterized the spring, noting that, between January and March, both two and five-year GoC yields were down more than 60 bps, which caused some fixed mortgage rates to fall “comfortably” below 5%.

“Now, deepening bond-market selloffs have five-year GoC yields pushing 16-year highs. That leaves the lowest available mortgage rate today more than 100 bps higher than the lowest that was available in the spring,” he says.

“Meantime, households will continue to adjust to steady waves of mortgage resets through 2026. The 2024 vintage could see payment increases in the 25%-to-40% range if current interest rates hold, with the increases becoming even larger in 2025 and 2026.”

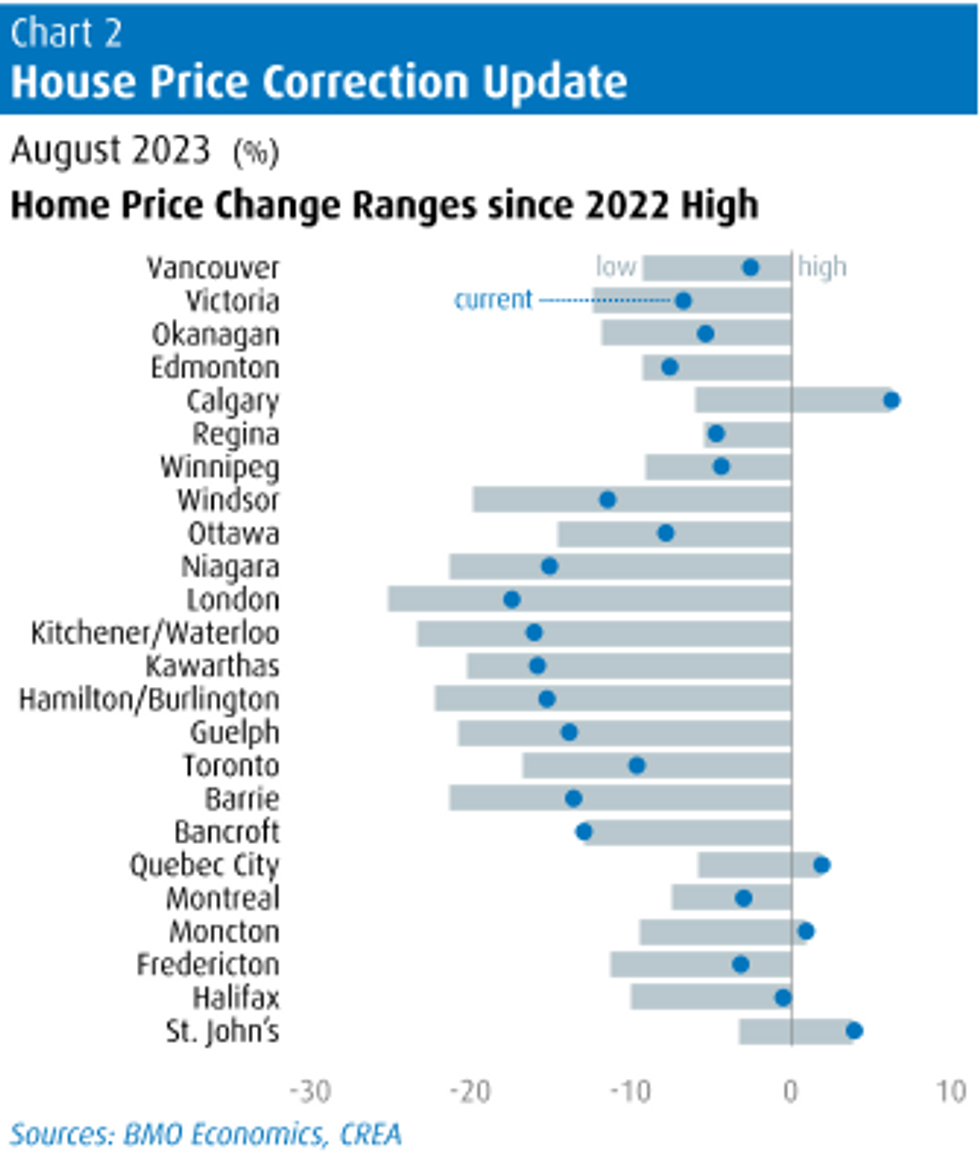

Markets in British Columbia and Ontario are expected to be “most exposed” to further real estate downturn and potential mortgage-market-driven economic weakness, notes Kavcic.

“Both provinces carry above-average household leverage and exposure to real estate, while Ontario was unquestionably the frothiest market during the boom. British Columbia’s household debt-to-disposable income ratio is the highest in Canada at just under 220%, while Ontario is second at 206% (compared to the 164% provincial median),” he writes.

“In both provinces, real estate and mortgage debt make a disproportionately large share of total household assets compared to other provinces.”

Markets in Quebec, Alberta, and Atlantic Canada are on track to weather the challenging economic conditions better.

“Quebec and Atlantic Canada carry relatively low exposure by these measures (some of it is just demographics as these populations are older). And, while Alberta carries above-median readings, market conditions in that province also suggest much less risk,” says Kavcic.