While headlines have read of Canada’s red-hot, pandemic-induced housing boom for nearly a year, it turns out we’re not alone on the real estate frenzy front.

According to data from the Organization for Economic Co-operation and Development (OECD), nearly every major economy’s housing market is booming -- from South Korea to New Zealand.

Real house prices rose across the OECD by 7% on average from the fourth quarter of 2019 to the fourth quarter of 2020 -- the fastest year-to-year growth over the past two decades. And this has eyebrows raising, as the "are we or are we not in a bubble?" debate picks up steam in online banter.

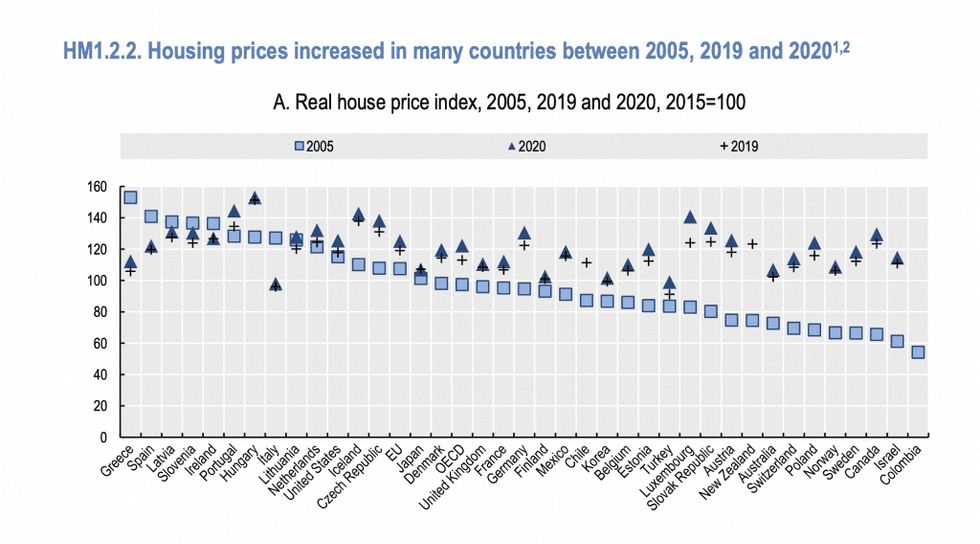

Looking at longer-term trends, real house prices increased in 32 countries between 2005 and 2019, with Colombia, Canada, and Israel recording the largest increases (over 80%) over this period. At the same time, six countries recorded a drop in real house prices over this period, most significantly in Greece and Italy (over 20%), according to OECD.

READ: GTA Home Sales Down Compared to Last Year, Still Well-Above Average

Focusing on the evolution of real house prices between 2019 and 2020 to assess the impact of the COVID-19 pandemic, real house prices rose in all but two countries. “In several countries, the growth in real house prices between 2019 and 2020 was significant: 13% in Luxembourg, 9% in Turkey, and 7% in Estonia, Germany, Poland, Portugal, and the Slovak Republic. Japan and Ireland experienced stable real house prices between 2019 and 2020,” reads the report.

According to a Financial Times analysis, the data shows that out of the 40 countries analyzed, only three saw real-terms house prices fall in the first three months of 2021. Furthermore, annual price growth across the OECD reached its fastest pace in 30 years in the first quarter of the year, hitting 9.4%.

The countries with the strongest growth included Canada (no surprise there), Turkey, South Korea, the UK, and New Zealand. Everywhere across the OECD, housing costs are rising higher than incomes and rents.

Speaking of the rental market, rent prices increased in all but two countries between 2005 and 2019. Turkey, Lithuania, Iceland, and Estonia recorded the largest increases (over 100%) over this period. Japan and Greece were the only two countries that saw a decrease in real rent prices since 2005; however, in Greece, the drop in rent prices was much smaller than real house prices (-10% vs. -31% decline), according to the report.

After experiencing a notable decline in many cities at the onset of the pandemic, rents are once again rising in Canada.

On the housing market front, the reasons for the rising temperatures and prices in major real estate markets worldwide are quite standard: low-interest rates, increased savings during the lockdown, and a need for more space to live. In addition to limited supply in major markets relative demand, the pandemic also put pressure on construction industries and supply chains, hiking up the cost of materials like lumber, steel, and copper, as Financial Times highlights.

Whatever the cause, the outcome is inevitable: compared to past generations, today's families pay a lot more for a half-decent roof above their heads -- in Canada and around the world.