As residents continue to take advantage of the current low interest rates and increased household savings, they purchased many of the limited number of single-family homes available last month. This pushed inventory levels to near-historic lows, while also driving prices up to a new record high in the process.

The GTA's new home market had strong sales in October, typical for this time of year, with 4,280 deals closed. This marked a 7% increase over the Toronto area's 10-year average, according to the Building Industry and Land Development Association (BILD), which represents homebuilders.

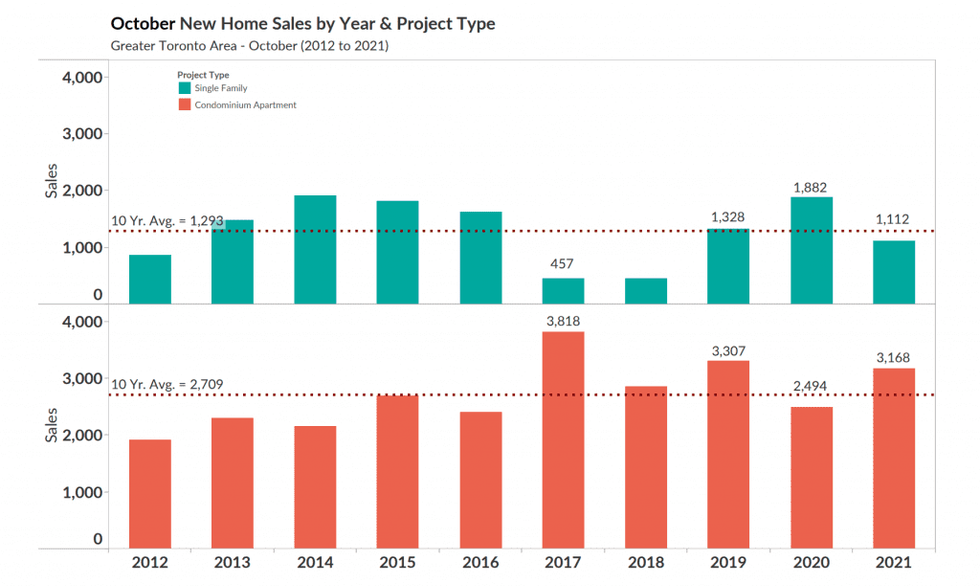

Sales of new single-family homes, including detached, linked, and semi-detached houses, and townhouses accounted for 1,112 of the units sold in October, though, this was 14% below the 10-year average, and down 41% from the previous year, said Altus Group, BILD’s official source for new home market intelligence.

But, as single-family home inventory continued to deplete, new construction single-family home prices hit a new record in the Toronto region, setting a $1.66-million benchmark that was 36.7% above October 2020s $1.21 million.

READ: Supply Chain Issues, Volatile Material Costs Continue to Impact Construction Industry

Last month was also the second month in a row that the price for newly built detached, semi-detached, and townhouses rose more than 30%, as supply dwindled to the second-lowest level on record.

With single-family home options significantly lagging sales, remaining inventory slipped once again in October compared to the previous month, to just 1,138 units, marking the second-lowest level of remaining inventory for single-family homes ever, with the lowest being March 2017.

“Several factors are contributing to the shortage of new single-family home supply in the GTA, including a lack of serviced land, supply chain issues, and labour shortages,” said Justin Sherwood, BILD’s SVP Communications & Stakeholder Relations.

“As municipal and regional governments go through their municipal comprehensive reviews and Official Plan processes, they need to ensure they are planning for appropriate housing supply and choice for future residents.”

However, despite October's declines for single-family homes, the condo side of the market, which includes units in low, medium and high-rise buildings, stacked townhouses, and loft units, accounted for 3,168 units sold.

According to BILD, last month's condo sales were 17% above the 10-year average, marking the fourth-highest level of condo apartment sales for the month of October since Altus Group started tracking the home building industry in 2000.

With available condominium apartment inventory outpacing sales in October, remaining inventory increased compared to the previous month, to 11,973 units, though this was still well below the 10-year average of 16,000 units. The remaining inventory includes units in preconstruction and projects currently under construction and in completed buildings.

With demand for condos increasing, the benchmark price for this segment increased to $1,052,208 in October compared to the previous month and up 6.2% over the last 12 months.

Edward Jegg, Analytics Team Leader at Altus Analytics, Altus Group says, "the new condominium apartment sector remains reasonably well supplied to meet current demand levels."

As inventory for single-family homes continues to fall to historic lows and prices climb to new records, the Toronto area condo market continues to serve as a more affordable alternative for those who are still looking to enter into the housing market.