The loss of housing affordability across the nation continues, with soaring home prices stripping away any earlier affordability gains, and Canada's most costly cities taking the biggest hit.

This comes after the "housing fever" that swept the nation last summer resulted in uneven affordability across the country in the fourth quarter, according to a new housing trends and affordability report from RBC economist Robert Hogue.

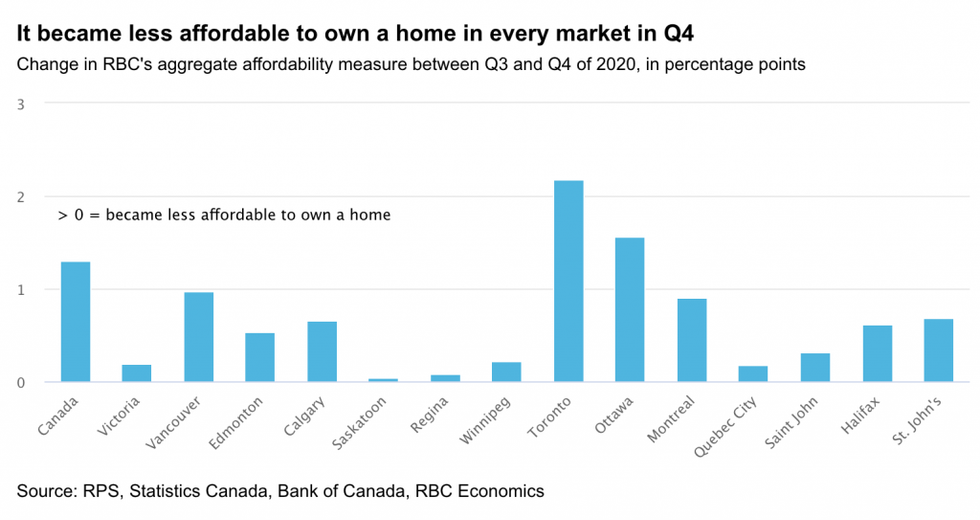

As a result, RBC’s affordability measure rose in all markets the bank tracks (an increase represents a loss of affordability), with Toronto, Ottawa, Vancouver, and Montreal recording the most significant price deterioration, as super-tight demand-supply conditions propelled property values at the fastest rates in years.

However, price deterioration was less apparent in parts of the Prairies and Atlantic Canada, as upward price pressures were less intense in these regions despite sellers firmly in the driver’s seat.

READ: Value of Monthly Canadian Home Resales Up 350% From Pandemic Lows

While it's no secret the pandemic caused a surge of interest for properties with larger living spaces, this growing trend has ultimately increased prices for single-detached homes -- which were already in short supply in many parts of Canada prior to the pandemic -- making it less affordable to buy them.

As a result, the typically calmer markets recorded some of the larger price increases -- narrowing their affordability advantage over big cities.

What's more, Hogue says since the pandemic, mortgage carrying costs have also increased more as a share of household income in Windsor, Hamilton, Halifax, and London than in Vancouver, Toronto or Montreal. Toronto’s ratio, in fact, is still below pre-pandemic levels, despite rising in the fourth quarter.

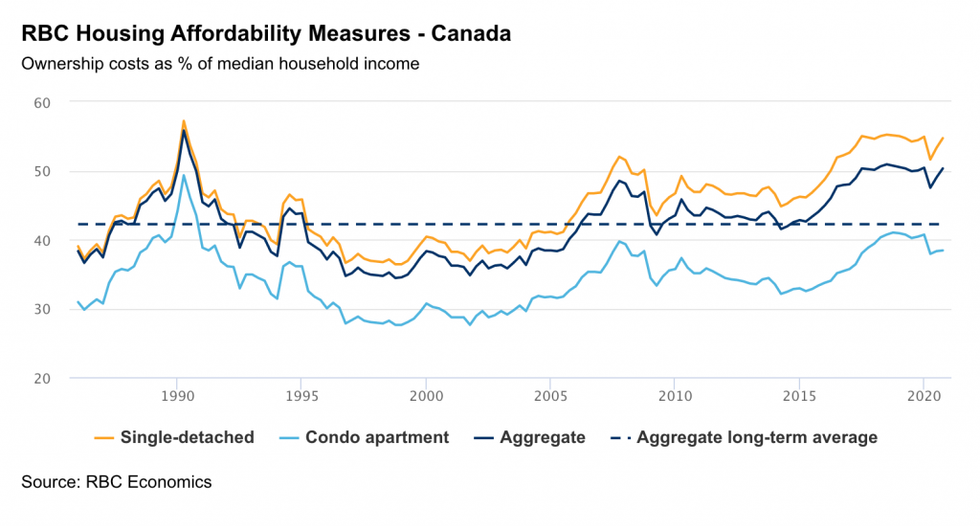

Hogue said RBC’s measure for single-detached homes surged 1.4 percentage points to 54.7% in the fourth quarter, while condo apartment affordability, on the other hand, remained little changed for the most part with some markets seeing a small improvement.

Condo prices slipped in Toronto, Vancouver, Edmonton, and a few other markets in the face of "plentiful inventories," and RBC’s national condo measure inched 0.1 percentage points higher to 38.4%.

With ownership costs rising in all markets last quarter, the most affordable markets in the country are found in Atlantic Canada and the Prairie Provinces.

Saint John (with an RBC aggregate measure of 23.1%), St. John’s (24.2%), and Regina (26.1%) continue to get top grades, while Vancouver (78.8%), Toronto (67.6%), and Victoria (55.3%), on the other hand, get the poorest scores.

What's more, following years’ long erosion, Montreal (43.5%) and Ottawa (40.0%) now pose a higher degree of strain for buyers — though, Hogue said it's not as extreme.

As for what's to come, Hogue saysthe near-term outlook is "grim" for home buyers, as further price escalations from earlier this year have made prospects even more challenging. At the same time, smaller markets are now starting to lose some of their affordability advantage, further adding stress to buyers who might be willing to move to a different town to find a home they can afford.

Though what might come as a surprise, Hogue says condo apartments remain the more viable option for many potential homeowners in 2021, however, the economist says he sees upward price pressure building for this segment later this year.