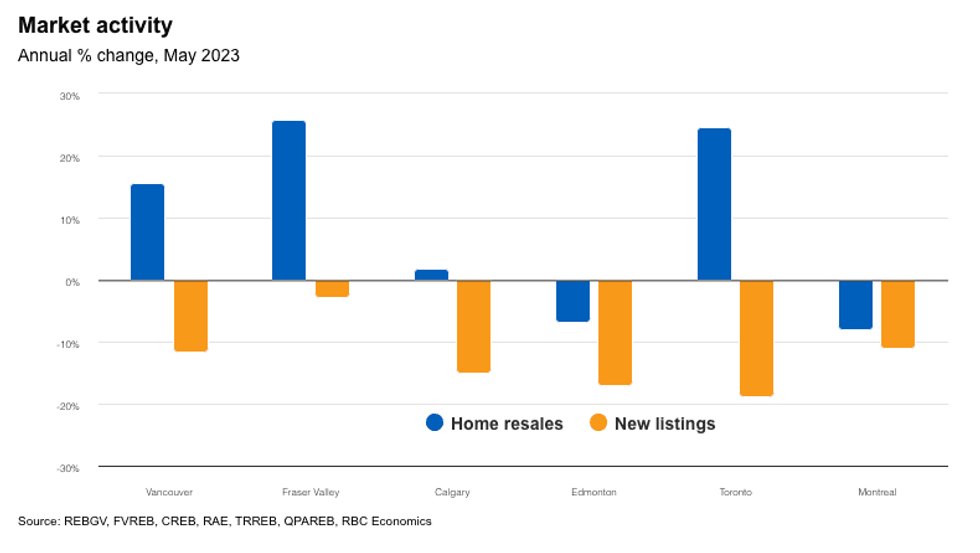

More sellers returned to Canadian housing markets in May, according to the latest numbers from local real estate boards, but a new report from RBC Economics cautions that it’s not enough to bring those markets into balance.

“Sellers are beginning to warm up to recovering housing markets,” writes Assistant Chief Economist Robert Hogue in Tuesday’s report. “Early reports from local real estate boards unanimously show a material rise in new listings in May. This is good news for buyers who have been frustrated by historically low inventories. But in most cases, the rise in supply made only a small dent in tight demand-supply conditions.”

Hogue goes on to say that in order to quell demand, a “further large influx” of sellers is needed. In the meantime, prices are being pushed upwards across the board.

“We think higher prices will play their role as a stabilizer for the market: cooling demand and pulling in more supply. Our view is that mechanism as well as affordability issues will restrain further price appreciation. However, the current market strength clearly poses upside risks.”

Toronto: “Pressure Has Built Up Fast”

Toronto’s housing market observed a 5.2% uptick in activity between April and May. Although that increase was well below the gains recorded between March and April -- which came in at a “spectacular” 25%, resembling gains recorded during the pandemic boom -- it certainly speaks to the fact that home-buying desire is alive and well in Toronto’s market.

RELATED: GTA Home Prices Continue To Rebound Amidst High Demand, Lack Of Inventory

As well, May brought a “sharp increase” in sellers, and as such, a rally in new listings, which were up 17% month over month on a seasonally adjusted basis, according to RBC’s calculation.

Still, new listings did little to satisfy the pent-up demand, and as such, Toronto’s market remained tight. As well, with respect to prices, “pressure has built fast,” says Hogue. To illustrate, the Greater Toronto Area’s MLS HPI grew for a second consecutive month, this time by 3.2% -- “a pace that rivals what was seen during the boom time earlier in the pandemic.”

Adds Hogue, “Even more sellers will be needed to boost inventories and rebalance the market. Otherwise, this price trajectory will persist in the coming months.”

Vancouver: “New Buying Opportunities”

“More sellers stepped into the market in May, taking advantage of increasingly favourable conditions over the past few months,” writes Hogue of Vancouver’s market. On a seasonally adjusted basis, RBC estimates that the Vancouver area saw a 15% spike in new listings between April and May, marking the largest increase since January. “These new buying opportunities generated further increases in resale transactions, extending the current upswing to four months.”

RELATED: Metro Vancouver Housing Market Showing “Signs Of Heating Up”: REBGV

Nonetheless, demand-supply conditions remained tight, and prices continued to trend upwards. For the fourth month in a row, Vancouver’s MLS HPI lifted, growing by 1.3% between April and May.

Says Hogue, “Our view is that extremely poor affordability will significantly limit the speed at which they will rise in the period ahead.”

Montreal: “Resurgent Demand”

Montreal’s market “turned a corner” in May, says Hogue. By RBC’s estimation, home sales jumped 22% from April on a seasonally adjusted basis, “representing the biggest jump in more than two years and an end to a sharp year-long slide.”

Although more listings came online in May, it was “not quite enough to satisfy resurgent demand.” As such, prices increased for the fourth straight month in May, with the most significant price appreciation observed in the condo market, where median prices climbed 3.3% from April. Single-detached homes also rose “solidly” by 1.9%.

“We expect those trends to continue in the near term,” adds Hogue.

Calgary: “A Supply-Side Story”

“It was largely a supply-side story too in Calgary last month,” writes Hogue. According to RBC’s calculation, new listings “soared” 27% (seasonally adjusted) between April and May, and this helped prop up home resale activity, which grew more than 6%.

“But the new listings increase came from decades-low levels (excluding the pandemic lockdown period) following sharp declines earlier this year,” continues Hogue. “In the end, it provided only modest relief to still extremely-tight demand-supply conditions.”

Meanwhile, property values “continued to appreciate at a sustained pace.” To that end, Calgary’s MLS HPI rose 1% between April and May, which is a trend that is expected to persist in the near term.