One of the larger ongoing development projects on the North Shore is the subject of foreclosure proceedings as a result of a substantial amount of debt and has now been listed for sale, according to filings in the Supreme Court of British Columbia and a sales brochure.

The development was set for 2050-2070 Marine Drive and 2000 Curling Road in the District of North Vancouver, a few minutes east from the Capilano River and the border with the District of West Vancouver.

The site is formerly home to the Travelodge Hotel by Wyndham Vancouver Lions Gate and a Denny's diner. The Pho Japolo restaurant on the site remains open.

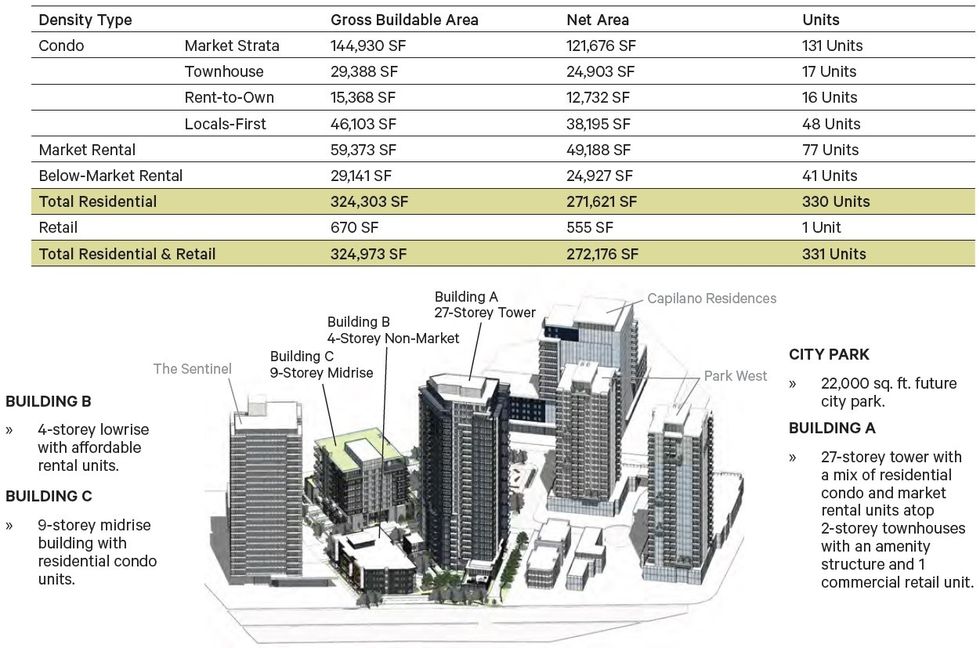

The project was being developed by Marvel Group, who was planning a 27-storey tower, nine-storey building, and four-storey building for the site with a total of 330 residential units. According to the District, the project has been in the pipeline since as far back as March 2017, with rezoning finally being approved by the District in September 2022, after revisions to the proposal.

Debt and Disposition

The foreclosure proceedings were initiated in August 2023 by Atrium Mortgage Investment Corporation — a lender on several development projects by Quarry Rock Developments that are also currently under foreclosure or receivership — against Marvel Developments (Lions Gate Village) Ltd. — the legal owner of the property — as well as Fereshteh Amin and Rahim Fakhari, the two guarantors of the loan.

The role Amin plays at Marvel Group is unclear, but Fakhari appears to be the CEO of the company, according to a LinkedIn profile.

Another member of the company, who was not listed in court documents but is listed on the District of North Vancouver's website as the applicant of the project, is Oguz Istif, a business associate of Vikram Vij, the chef and founder of Vij's.

After the two sides entered into a first-ranking mortgage agreement in June 2015, which was later amended in seven subsequent years, Marvel Group defaulted on the agreement and Atrium issued a demand for payment in August for the sum of $46,404,811.22.

On September 14, the Supreme Court granted an order nisi that confirmed the outstanding debt at $46,909,691.26, with interest accruing, while also setting the redemption date — the day by which the debtors can pay the outstanding amount to stop the foreclosure — at March 11.

That day came and passed and the Supreme Court then granted an order for conduct of sale to Atrium on March 14, allowing them to sell the property in order to recover the debt.

Atrium has since retained Jim Szabo, Tony Quattrin, Carter Kerzner, and Vincent Minichiello from CBRE Vancouver's National Investment Team to list and sell the property, according to a sales brochure sent out to industry professionals this week that was obtained by STOREYS. As of publishing, the listing, which does not include an asking price, is not public.

The Property

The property consists of four total parcels, with BC Assessment valuing 2050 Marine Drive (Denny's) at $13,999,200, 2060 Marine Drive (Travelodge) at $16,735,000, 2070 Marine Drive (Pho Japolo) at $5,199,800, and 2000 Curling Road (parking lot) at $19,209,400, for a total assessed value of $55,143,400.

According to the sales brochure, the amount of community amenity contributions that will need to be paid as a condition of the rezoning was negotiated in April 2022 at $3.4M and a development permit application was submitted to the District in February.

"As the process of rezoning in the North Vancouver district is lengthy, the purchaser will benefit from limited competition as well as cost and time savings with a fully zoned project," the brochure notes. "The site's attractive unit mix and location, as well as the increasing demand for multifamily projects in North Vancouver, will allow investors to capitalize on robust market growth and develop a complementary mixed-use offering in a rapidly growing hub of Metro Vancouver."

As the project has been in the works for numerous years and rezoning was also approved several years ago, the BC Assessment valuation is likely not far off from what the property is worth. However, with a price that would likely exceed $50M and a project of this size, the buyer pool for the property is smaller than it would be for a smaller property, which could result in the property staying on the market for an extended period of time.

The sale of the property will require final approval from the Supreme Court.

- Colliers' Hart Buck & Jennifer Darling On The Uptick In Court-Ordered Sales ›

- After Receivership, Planned 55-Storey Tower Site In Vancouver Put Up For Sale ›

- Vancouver Kilborn Building To Be Sold In Foreclosure Proceedings Over $93M Debt ›

- Sale Of Garibaldi At Squamish Approved Following Provincial Objection ›

- The Sophia Rental Project In Vancouver To Be Sold In Foreclosure Proceedings ›

- Denna Homes Proposing Two Towers In North Vancouver ›

- Foreclosed White Rock Project Listed For Sale Over $19M Debt ›