Investors have begun to play a "more prominent role" in the Canadian housing market, and account for roughly one-third of all homeowners in some provinces.

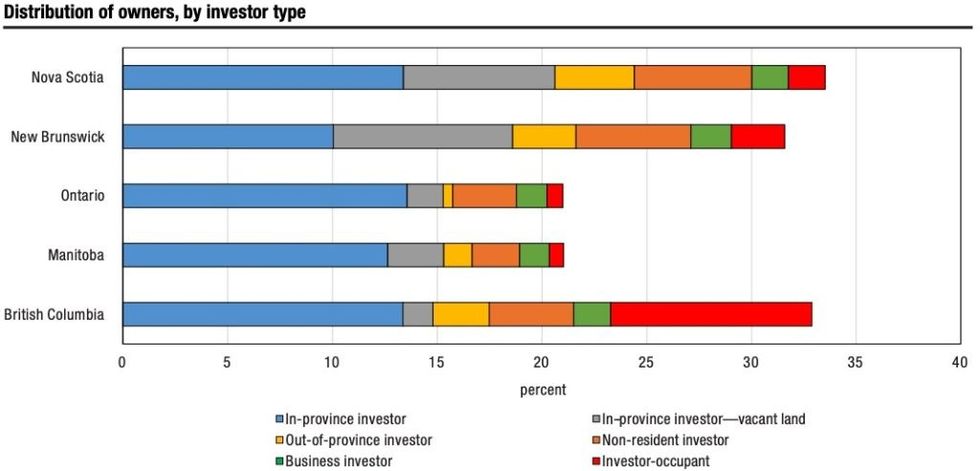

According to newly released data from Statistics Canada (StatCan), investors accounted for 33.5% of homeowners in Nova Scotia, 32.9% of homeowners in British Columbia, and 31.6% of homeowners in New Brunswick in 2020. In Ontario and Manitoba, investors made up 21% of all homeowners.

The data, part of the Canadian Housing Statistics Program, examines the demographic characteristics of real estate investors in the five aforementioned provinces.

"In recent years, there has been growing concern about the role of residential real estate investors in Canada," StatCan wrote. "While investors can provide needed rental stock, they have also been found to exacerbate house price volatility and can limit housing market access for first-time homebuyers."

READ: Over 40% of Ontario Condos Were Owned By Investors in 2020

The rate of investor-occupants -- those who own a property with multiple residential units, one of which is their primary residence -- was highest in BC, at 9.6%. In the City of Vancouver, the proportion grew to 15.9%.

The "significant presence" of investor-occupants in BC may be due to the promotion of incremental density, such as laneway homes, secondary suites, and duplexes, in urban areas. This form of density is gaining traction in Toronto as well.

While the majority of investors lived in the same province where their income property was located, Nova Scotia had the highest rate of out-of-province investors, at 3.8%, as well as the highest rate of non-resident investors, at over 5%.

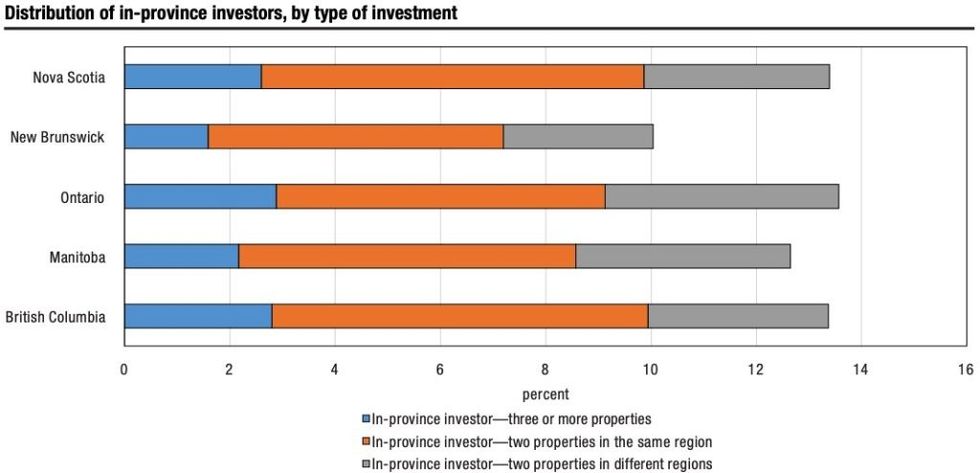

Ontario had the highest rate of investors who own three or more properties (2.9%), as well as the highest rate of those who own two properties in different regions (approximately 4.5%). StatCan noted that the latter figure may be mainly comprised of recreational property owners rather than landlords.

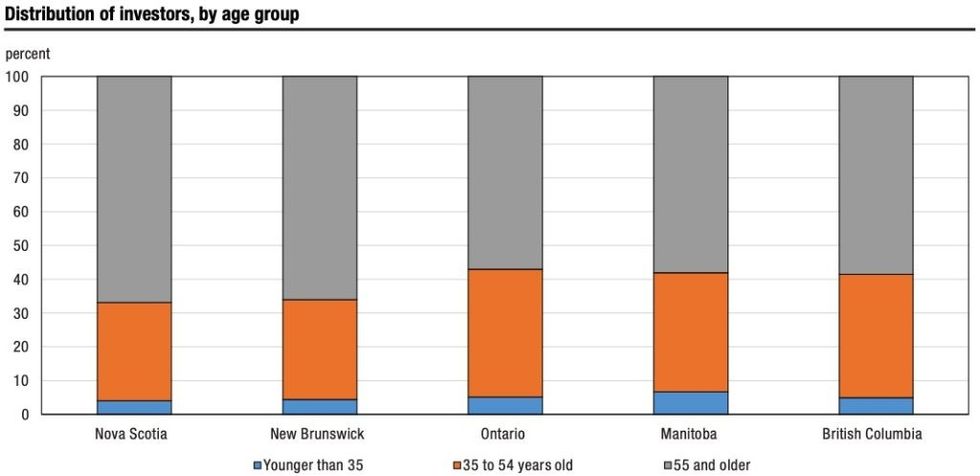

The data also found that established immigrants -- those who have been in Canada since at least 2010 -- and residents over the age of 55 were overrepresented among investors relative to their share of the population in all five provinces.

Despite being a minority in the adult population, the older age group represented the majority of residential investors in each province, ranging from a low of 57.1% in Ontario to a high of 66.9% in Nova Scotia.

Meanwhile, Canadians under the age of 35 were "significantly" underrepresented amongst investors, accounting for less than 9% in each province.

The discrepancy between the age groups is consistent with the notion that it takes a "lengthly period of saving" to purchase a home in the first place, let alone an investment property, StatCan said.

While men and women accounted for a similar proportion of investors across all five provinces, men were overrepresented among investors with three or more properties, which may suggest "a more significant difference between men and women in the propensity to become larger-scale investors."

As well, although the average assessed value of investors' real estate holdings was similar between men and women, the average income of female investors was markedly less than that of their male counterparts. In BC, female investors had an average income of $70K, while males earned an average of $125K. In Ontario, the figures were $75K and $115K, respectively.