Another announcement, another rate hike. Right when sales and supply start to move, we are left to rally again.

This is becoming an all-too uncomfortable and sticky narrative. In the battle to tame inflation, interest rate increases continue to beat up the housing market, but not in the way the BoC might hope. In a roundabout way, with the intention that interest rates might subdue home prices, we just keep suppressing supply, and are creating the opposite effect.

Today, we thought it would be useful to share the very real impact these rate hikes have on the new home market, and how – combined with other factors like immigration and high demand – this impacts Canada’s overall housing dynamics.

We are going to keep things simple, by highlighting some basic correlations.

- Immigration is at record highs so more housing is needed.

- Inflation is high, so rates have increased, which makes mortgage and construction debt expensive.

- Material costs have inflated, as has the cost of labor, so housing is extremely expensive to build. This means more money/debt, and higher prices, are required to start a project.

- Debt is expensive, so more buyers struggle to afford what they used to, so prices fall. But, more housing is needed, so prices only fall to the point supply and demand meet.

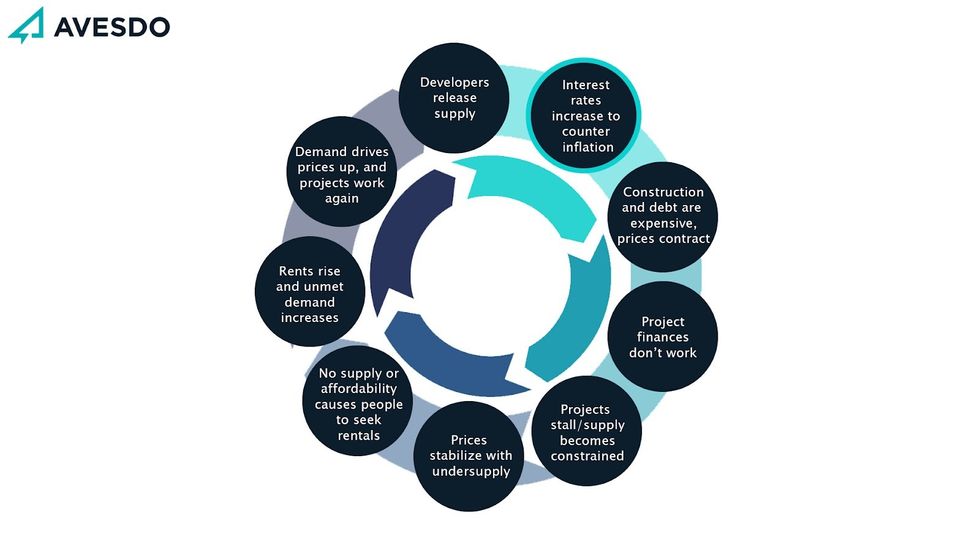

The circle looks like this:

As the graphic shows, the challenge is that every counter measure leads to, with equal or greater momentum, the opposite result.

It would be different if there were no demand or immigration, or if developers had to bring inventory to market – which they don’t.

It would also be different if there was a glut of supply in the market – which there isn’t.

The Data On Demand

The week of the rate announcement, we saw new deal starts drop 34% vs. the week prior, only to rally right back up the following week and hit a 2023 high point the next week.

The Data On Supply

Despite having more than 50 projects contracted and ready to launch this quarter, we saw less than half actually go forward, totaling only 65% of what was launched the same quarter last year. The data shows that as buyers get momentarily fearful and pull back, developers pull supply back even further, and don’t come back to the table as quickly as buyers do.

All About Prices

The week’s sputter in absorption had virtually no effect on prices. In fact, in 2023, the average sale price of a new home launched through our system in Canada is over $1,100psf, up from just over $1,000psf in 2022. And that’s without significant, high-priced downtown tower launches to pull up the averages – these numbers stem largely from suburban projects and towers in the outer rings of the greater Vancouver and Toronto areas.

More On Supply

For 20 years, the government has tried to tackle housing from the speculative demand side. They’ve added taxes, increased mortgage qualifications, and dissuaded foreign ownership, among other tactics. But this only addressed demand for ownership (and just slightly), not housing. As our population has grown – passing 40 million this month – CMHC reports housing supply has not kept up. Now, after many years of increasing housing demand, the supply gap is so large that ownership demand tactics simply don’t work – not even temporarily.

Assuming there is no longer debate over the fact this is a supply issue, let’s look honestly at where housing supply comes from. (Trigger warning, this may feel scary):

- Developers build it

- People leave their homes — owners have to sell and rent, renters have to vacate and become homeless, or people leave the country

- People die, no longer needing housing, so properties go back to the market

Let’s tackle these one at a time.

Developers Need To Build More

Based on our data, which we’ve been sharing for months, developers are not building enough. They continue to stall projects by the dozens, shorting the market thousands of units annually. This will not change until the math works. Period. The small number of units being built by not-for-profits or government development companies is a small fraction of what the development community is withholding, and capable of delivering. Whether for or not-for-profit, the supply is not being built to the level needed in all asset classes.

People Lose Their Homes

Sadly, this will increase. As ownership has moved out of reach, more will either elect or be forced to rent. As rental demand increases, rents sky-rocket – as we’ve seen. This means more residents pushed out, adding to the number of adults living with elderly parents, in vans/RVs, shelters, or on streets. BC reports almost 20% of its homeless population is actually employed. More people are coming to Canada than leaving, and those moving from cities and provinces are relocating further afield, driving prices up in all regions, further displacing more people.

People Die, Freeing Up Housing

Without leaning into the sensational and grim reality of this statement, it’s real. We must consider the aging Baby Boomer, who will make up most of this group in the coming years. Currently, the oldest Baby Boomers are 77. As the average age of death in Canada is currently 82, we expect to see the mortality rates for Baby Boomers begin rising dramatically within the next five years. When you consider that birth rates have been on the decline in Canada for decades – currently well below replacement rates – today’s immigration efforts are more easily understood (but unlikely to fully compensate for the impending losses). I would point to our current labor market as a leading indicator: immigration struggles to offset the increasing number of Boomers leaving the labor market, majorly impacting wage inflation the last few years. In summary, more supply is coming – but will take between five and 10+ years to onboard as our aging population dies.

Combining all these factors with their current solutions, this story ends with home ownership and rent costs at an all-time high, more homes owned by the rich and institutions, and increasing counts of people living with their parents, in their car, or on the streets.

READ: Strong Early Indicators Point to Market Rebound in 2023

As I’ve likely been branded “pro-developer” – and some may have already stopped reading – I’ll spare you my opinions, and instead point to this problem’s glaringly simple answer.

We need to ensure the housing development industry delivers the much-needed supply that it can, and the only way to ensure that happens is to help them make the numbers work. That’s it.

It means you will have to become okay with them making a profit. It means you may even need to subsidize that profit with government incentives. It means that you may need to become okay with density in your neighbourhood, or with the fact that unproductive agricultural land, growing weeds, may need to be repurposed. It means that some housing will get more expensive, in order to subsidize affordable housing. It seems to me the alternative is for more people to lose their wealth, and their housing, or for us to wait until they lose their lives.

You don’t have to like it, but the data is clear: if the pro forma doesn’t work, housing doesn’t come to market, which undersupplies the market, which – in the current high demand environment – makes prices (and pain) go up.

The government can’t build enough social housing. It’s too expensive, and one of the main mechanisms to do so is to attach it to market condo development as a requirement. None of which will get built if the numbers don’t work.

It’s slow, and requires now-non-existent cheap debt, for average Joes to build laneway homes or basement suites. Office owners would require zoning, plus massive and expensive infrastructure changes, to become residential builders and reno empty offices into condos at any scale. Foreign buyers left the movie, and it appears they weren’t the problem.

Having followed the data daily, and with my 20 years of development experience, I would suggest that new home builders are the only ones who can quickly and effectively solve this supply problem. And looking at our backlog, they are ready to do it – quickly, with thousands of units – if the numbers work.

What You Can Do

Contribute politically. Vote for housing. Support municipal, provincial, and federal politicians who plan to empower the industry to deliver it. Support projects at public hearings, developer open houses, and the like. Put down your NIMBY (not in my back yard) placards and support density in your community. Support all housing types -- social and market, rental and ownership – we need it all.

Stop sitting on the sidelines hoping for a crash -- the data suggests it’s likely that the cost (price and debt) will just keep rising. The only scenario where it doesn’t is a crash so dramatic and devastating that only the rich and the institutions will be able to buy (so you’ll miss out then too, and may actually be contributing to that eventuality).

Baby Boomers, continue to help your kids — they desperately need it. Start moving your wealth out of your homes now to offset their debt costs. Sell your second home to get your kids into their first; buy a presale for your kids, or to downsize into in a few years – you can help finance when it closes, when rates are likely to be lower.

Whatever you do, support the new home building industry to do what they do, and bring any and all housing to market.

This article is authored by Ben Smith, President of AVESDO: a Canadian software company harnessing the power of data to help real estate professionals make better, faster, and more informed sales decisions.

Cover image: Mirvish Village Urban Renewal Project/Shutterstock

This article was produced in partnership with STOREYS Custom Studio.