The National Bank of Canada released its 2021 Q1 Housing Affordability Monitor this week, and the outlook for would-be Toronto homebuyers is grim.

Of note, Toronto's median home price recently passed the $1 million mark -- a transition that pushed the median minimum downpayment from 10% up to 20% of a property's value.

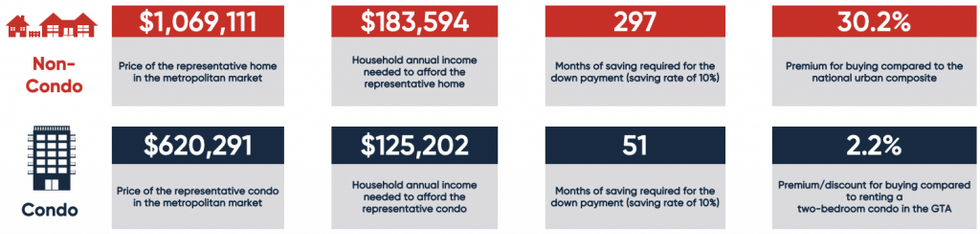

Looking back further than the start of Q1, the city's home prices rose 11.8% year-over-year, while the median household income rose only 1.2% in that time. With these fluctuations considered, according to the NBC, an annual household income of $183,594 -- and 297 months, or 24.75 years of saving at a rate of 10% -- is required to afford a representative "non-condo" style home, priced at $1,069,111.

That's nearly 25 years, with consistent earnings over $183K... in an imaginary world where home prices don't increase at all over the course of a quarter-century. The sentence is, quite literally, 25 to life.

READ: Average Price of GTA Homes Officially Eclipses $1M Mark

Let's consider the future by looking backwards.

According to TRREB, in 1996 (25 years ago), the median price for a single-family detached home hovered around $200,000 (5x less than current values). It's not completely bonkers, then, too suppose by 2046, the price for a similar property in the city could pass the $5,000,000 mark, relabeling the $214,000 downpayment required today as "spare change."

Where income is concerned, the theory of 25 years to a (present-day) downpayment at a savings rate of 10% applies to someone making more than $180,000 per year. Per the most recent available data from Statistics Canada, which is from 2019, the average Torontonian's income was $49,800. (The median income -- the same gauge housing prices are measured by -- was $35,000.)

So, if an individual graduates at the age of 20, and immediately scores a job that earns them that average annual income -- and that income remains unchanged, and they never combine it with another person's to create a greater household income -- it would take them approximately 56 years to be able to to place a downpayment on today's representative Toronto home.

Welcome to 2077: A year when the home price median will have, in all likelihood, left $1,069,111 in the dust, and our "recent graduate" just turned 76.

Hopefully for this hypothetical long-term savings mogul, their annual income did increase, they did combine their earnings to build a larger household income, and they made some return-heavy investments along the way.

If that's all the case, then maybe (just maybe), this Torontonian's child will be able to enjoy an inherited home -- and the mortgage that comes with it -- when it's left in their name a few years down the line.