After a slow several months, Canada's housing market rebound appears imminent, and may even precede long-awaited interest rate cuts.

According to the latest Royal LePage House Price Survey, the aggregate price of a home in Canada rose 4.3% year over year to $789,500 in Q4 2023. However, it dipped 1.7% from Q3, as high borrowing costs continued to weigh on market activity.

Broken out by housing type, the national median price of a detached home increased 4.4% annually to $816,100 in Q4, while the median price of a condo jumped 4% to $583,900. On a quarterly basis, though, the median prices dropped 2.1% and 0.6%, respectively.

While prices have far surpassed pre-pandemic levels — the latest national aggregate is 18.7% above Q4 2020 levels and 22.2% above Q4 2019 levels — they’ve yet to fully recover from the recent correction, remaining 7.9% below the peak reached in Q1 2022.

That is, for now. Phil Soper, President and CEO of Royal LePage, expects the housing market to rebound in the first quarter of 2024, prior to any interest rate cuts from the Bank of Canada.

"I believe the narrative suggesting that the housing market will rebound only when the Bank of Canada lowers rates misses the mark," Soper said.

"The recovery will begin when consumers have confidence the home they buy today will not be worth less tomorrow. We see that tipping point occurring in the first quarter, before the highly anticipated easing of the Bank of Canada’s key lending rate."

Once the bank does cut rates, though, Canada’s "fundamental shortage" of supply will put upward pressure on prices, as sidelined buyers race back to the market in droves. Even a 25 basis-point cut could spur a flurry of activity, akin to the springtime rush seen in 2023, Karen Yolevski, Chief Operating Officer at Royal LePage Real Estate Services, told STOREYS.

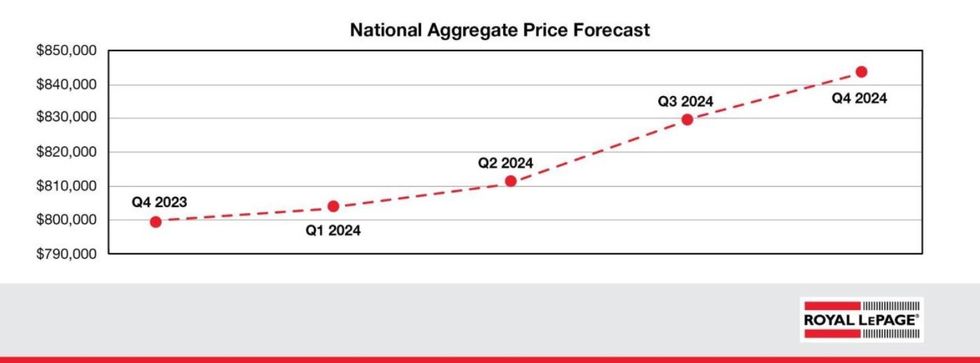

As such, Royal LePage expects the national aggregate home price to see "modest" quarterly gains throughout the first half of the year, followed by "more considerable" increases in the latter half once rate cuts begin.

All told, the national aggregate home price is forecast to rise 5.5% annually in Q4 2024. While the increase is in line with Royal LePage’s previous prediction, the quarterly dip in Q4 2023 means that the real estate company has revised the price down to $832,923 from $843,684.

The aggregate home price forecast in major markets has been revised downwards as well — from $1,198,012 to $1,190,698 in the Greater Toronto Area, and from $1,281,732 to $1,256,703 in Greater Vancouver.

But as it did throughout 2023, Calgary will buck the trend. The city continued to see quarterly price appreciation at year-end, leading Royal LePage to revise its Q4 2024 forecast to $716,580, up from $711,612.

"We believe that we're now at the bottom of pricing and that if you were to buy today you're not going to see a dramatic decrease in value. In fact, it’s likely the opposite. When interest rates do come down, it's very likely that you'll start to see prices accelerate further," Yolevski told STOREYS.

"This past spring, rates didn’t even have to come down to spur more activity and higher prices. All they had to do was stop rising. When rates do decrease, it could be a little more dramatic. People want to buy homes and there is not enough supply. That is what will drive up prices."