Housing Inventory

Explore housing inventory in Canadian real estate — why it matters, how it's measured, and how it affects market conditions and strategy.

June 09, 2025

What is Housing Inventory?

Housing inventory refers to the total number of homes available for sale in a specific real estate market at a given time.

Why Housing Inventory Matters in Real Estate

In Canadian real estate, housing inventory is a critical factor in determining market conditions, such as whether it's a buyers’ or sellers’ market.

Low inventory typically leads to:

- Increased competition among buyers

- Higher sale prices and bidding wars

- Reduced time on market

High inventory, on the other hand, gives buyers more options and negotiating power. Inventory levels are tracked by real estate boards and influence pricing, development, and marketing strategies.

Understanding housing inventory trends helps buyers, sellers, and investors make informed decisions about timing and pricing.

Example of Housing Inventory in Action

With only a two-month supply of homes in the region, analysts flagged a record low in housing inventory, pushing average prices upward.

Key Takeaways

- Reflects number of homes actively for sale

- Helps determine market competitiveness

- Low inventory drives prices up

- Influences seller strategy and buyer urgency

- Used in industry reporting and analysis

Related Terms

- Buyers' Market

- Sellers' Market

- Sales-To-New-Listings Ratio (SNLR)

- Market Type

- Housing Supply

205 Queen Street, Brampton/Hazelview

205 Queen Street, Brampton/Hazelview

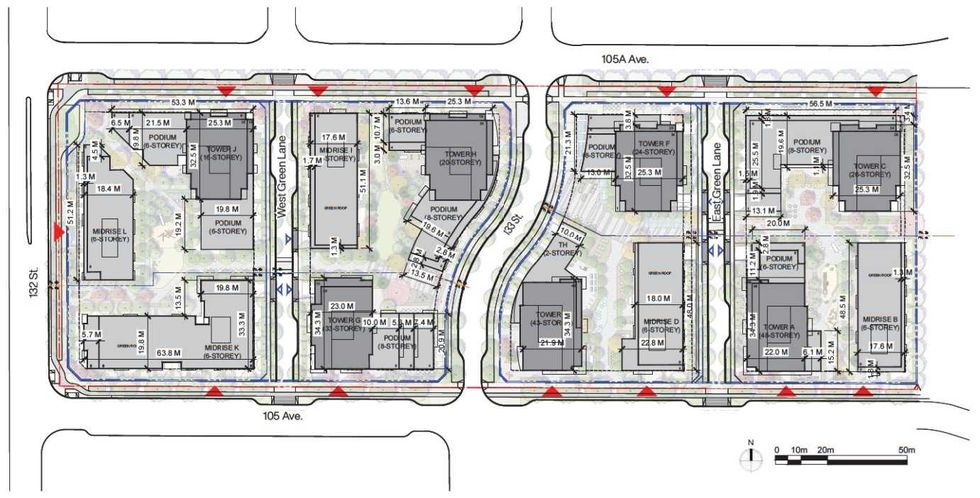

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group)

The layout of the Regency Garden redevelopment. (Arcadis, Onni Group) An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

An overview of the master plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group)

The phasing plan for the Regency Gardens redevelopment. (Arcadis, Onni Group) A rendering of the project at full build out. (Arcadis, Onni Group)

A rendering of the project at full build out. (Arcadis, Onni Group)