The boom times are over for the Canadian housing market, and there’s still further for home prices to fall, says recent commentary from a prominent economist.

In a note titled “Bottom still a ways away for Canada’s housing market,” RBC Assistant Chief Economist Robert Hogue writes that home resales have plunged 31% since the Bank of Canada started hiking interest rates in March, with prices down nearly 6% nationwide.

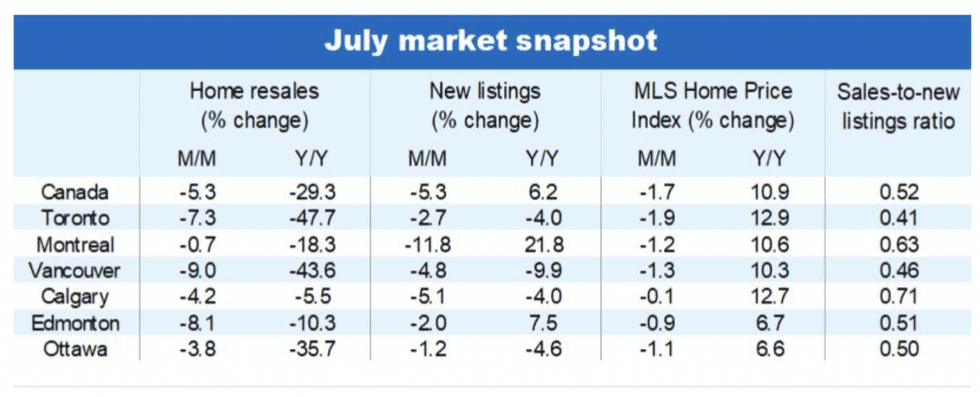

That includes a 5.3% monthly decline, and 1.7% annual drop in the Home Price Index in July, according to the Canadian Real Estate Association’s data. Ontario and British Columbia have absorbed the largest downturns and “the bottom is likely many months away still as our central bank has more work to do -- we expect a further 100 basis-point rate increase to 3.5% by the fall,” writes Hogue.

“We expect benchmark prices will be down approximately 12% from the recent peak nationwide [by next spring]. On a provincial basis, we think Ontario and British Columbia could record peak-to-trough declines exceeding 14%, and see Alberta and Saskatchewan at the other end of the scale with drops of less than 3%."

However, he adds, it’s an all-around better time to be in the market to purchase as “with the balance of power having dramatically shifted in their favour, buyers will be in a position to continue extracting price concessions from sellers for some time to come.”

A lot of the heat has come out of Canada’s largest urban centres. As previously mentioned, prices are dropping across Ontario, Hogue notes. Markets with the heftiest losses in their Home Price Index from the February peak include Cambridge (-17%.) Kitchener-Waterloo (-16%), Brantford (-14%), London (-14%) and Guelph (-10%). “In dollar terms,” writes Hogue, “the loss in value is striking, varying from $95,000 (Guelph) to $166,000 (Cambridge).”

In BC, the Fraser Valley is seeing the worst of it, with its HPI dipping by 5.6% -- or $65,000 -- since March, more than twice the decline in the Vancouver area.

As has been the trend, it’s the most expensive housing markets that will bear the brunt of the price correction; declines will be milder in overall more affordable markets, where buyers are less sensitive to interest rate changes. Hogue points to the Prairies and most of Atlantic Canada as “a case in point.”

“While likely to soften modestly, demand-supply conditions are well anchored in balanced territory in these regions,” he writes.

Overall, RBC expects the Bank of Canada to hike its trend-setting interest rate by another 100 basis points over its next two rate announcements in September and October, further knocking borrowers out of the market. As a result, RBC projects “home resales to fall 23% in Canada this year and a further 15% next year,” before the market adjusts to a new higher-rate reality by early 2023.

However, it’ll be a slow road to recovery; demand-supply conditions will take time to firm back up, says Hogue, placing his estimate for the price bottom in the spring of next year.