A report released Wednesday finds that the GTA is on track to amass a roughly 235,000-unit deficit in purpose-built rental (PBR) housing supply over the next 10 years, made up of the current and projected shortfall in units. Using comparative pro forma analysis, the report also shows how far targeted policy changes can go towards making projects more viable moving forward.

The report was assembled by the Building Industry and Land Development Association (BILD) in conjunction with real estate consulting firm Urbanation and cost consulting company Finnegan Marshall, and it shares sobering insights into current PBR housing needs in the GTA, how project feasibility has changed since 2022, and policy changes they say need to be implemented by all three levels of government in order to meet housing needs over the next decade.

Titled The Pathway For Rental Housing Stock, the report builds upon a previous study released in February 2023 by providing updated information and outlooks following a number of policy and market changes that have impacted PBR development in the region.

Decoding The Current Market

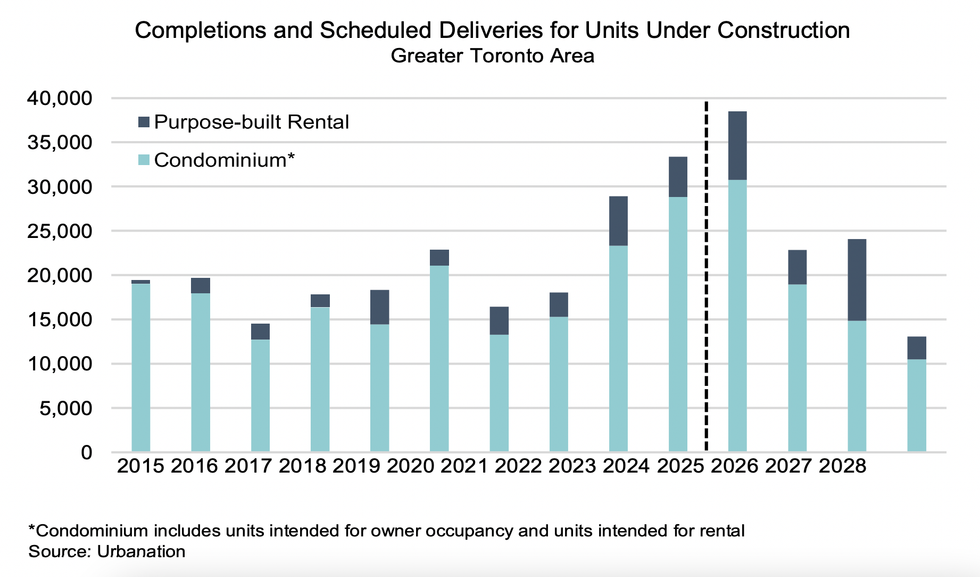

A whitepaper prepared by Urbanation provides an updated view of the GTA's PBR market as well as rental needs and the forces that are shaping those needs. The report highlights that the GTA saw a significant rise in rental demand over the past two years as the population surged by 550,000 people over 2023 and 2024. This historic demand was met by an historic wave of new purpose-built and condo rental completions that saw nearly 35,000 units added over the course of 2024 — more than double the 10-year average.

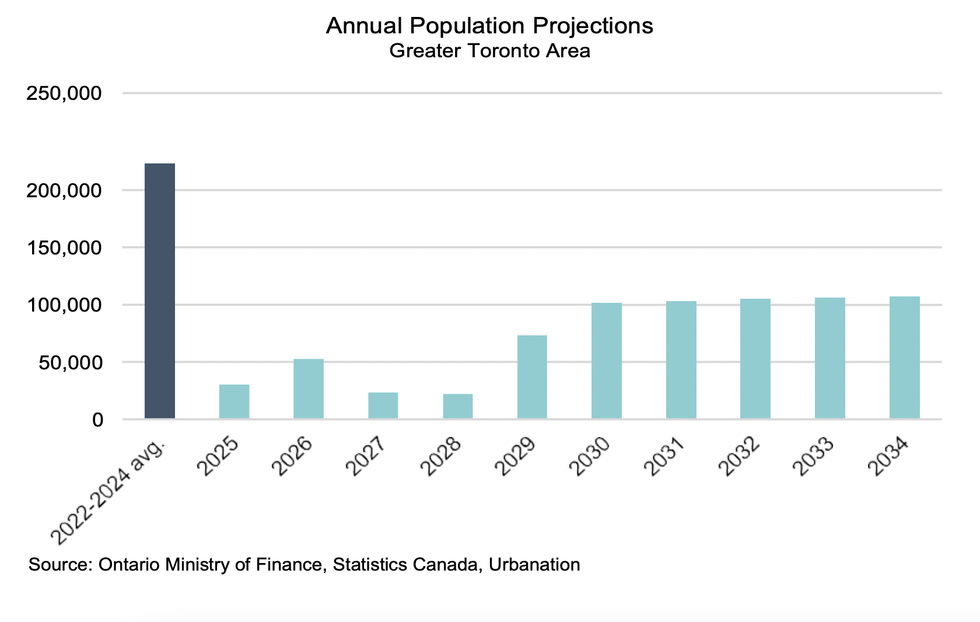

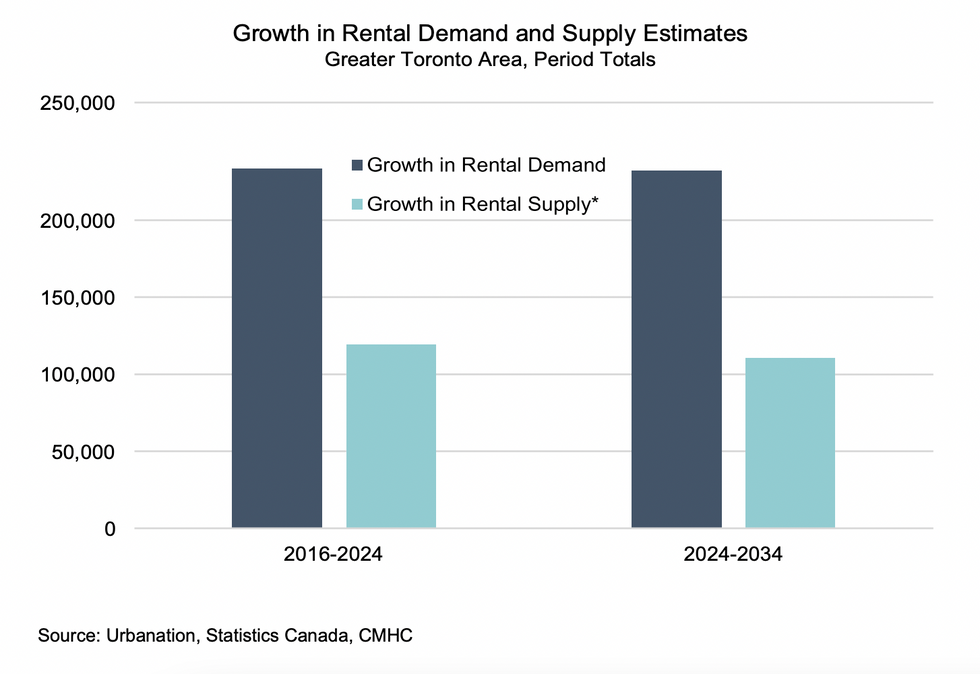

Since the Feds lowered immigration targets in October 2024, the region has started to see the flow of permanent and temporary residents dwindle, bringing down rents as completions continue to arrive in record numbers. But while the GTA population is expected to grow by 726,884 residents over the next 10 years — 38% less than the previous 10 years (1,177,497 residents) — plummeting condo completions and slowing PBR growth will also "substantially" pull down supply.

For context, the current downturn in condo presales has contributed to a 50% year-over-year drop in condo starts between 2023 and 2024, when it hit a 25-year low of 8,792 units. Meanwhile, despite rising 7% in 2024 to 6,637 units, PBR starts remain below the recent 2021 high of 7,061 units. Looking ahead, condo and PBR completions combined are expected to total 38,528 units in 2025, before moderating to 22,860 and 24,065 units in 2026 and 2027, respectively. Then by 2028, completions will fall to a 20-year low of 13,076 units.

But with investors fleeing the condo market, the report says PBRs will be expected to fill the rental gap by delivering 16,000 to 19,000 rental units per year for the next ten years — something it is not currently on track to do, due in part to red tape at various levels of government. More on that later.

"While the GTA could previously rely on condo investors to supply the market with the majority of new rental units, the downturn in new condo market activity underway suggests that won't be the case going forward and there will be a greater need for PBR construction. However, relative to the other large markets in Canada, the GTA ranks lowest in terms of per capita for rental construction," reads the report.

On top of falling construction, declining homeownership rates are exacerbating the looming supply deficit as more would-be-homeowners turn instead to renting. According to Urbanation, the GTA's homeownership rate fell from 68% in 2011 to 65% in 2021 and rates are expected to continue falling due to "ongoing, long-term ownership affordability challenges."

Considering projected population growth, falling homeownership rates, and dwindling supply, Urbanation estimates the GTA will have a rental deficit of 235,000 units in ten years, made up of 121,000 units needed in the future and the 114,000-unit deficit that grew between 2016 and 2024.

Feasibility Stronger Where DCs Are Lower

Pro formas, pro formas, pro formas. While PBR demand may be headed fora major increase and while developers may be eager to build these rental types, Urbanation highlights that current conditions just aren't conducive for development.

"The deterioration in economic feasibility for new development and often lengthly application timelines has left a large supply of units waiting in the pipeline," reads the report. "As of Q1 2025, the GTA had a total of 200,586 PBR units in the proposed stage that had not started construction. [...] This is in addition to hundreds of thousands of units in the planning stages proposed as condominium or have an undetermined tenure."

To help explain how these conditions hold development back, the second portion of the report consists of two April 2025 pro forma analyses from Finnegan Marshall for condo and PBR projects proposed in both downtown Toronto and Mississauga. According to the analysis, both municipalities saw feasibility for PBRs improve over the last two years thanks to federal, provincial, and municipal changes, such as the feds waiving HST on new PBRs in fall 2023, the matching of that incentive by the province, and the two cities implementing various incentives to spur development.

However, in Mississauga, where municipal incentives for development were more impactful, the analysis found that pro formas for both building types had improved by a greater amount than in Toronto. In January of this year, Mississauga voted to lower development charges (DCs) for residential projects by 50%, to eliminate the fees for three-bedroom PBR units, and to defer the collection of DCs until occupancy permits are issued for all residential developments.

For Toronto's part, the City has done things like freeze DCs at current rates and waive DCs for certain housing types like sixplexes, but the report says more needs to be done.

"The lack of support from the City of Toronto remains a key impediment. While the city has adopted some measures, they are time-bound and have very restricted eligibility," it reads. "The lack of broad-based relief in Toronto, where the need for more housing is notably the greatest, as evidenced by the pro formas in this document, means new PBR and condo remain non-viable."

According to the analysis, for a hypothetical 400-unit condo development in Mississauga, including year-one operating costs, the net revenue would now be $28,333,469. In Toronto, that same condo project would deliver just $11,478,175 in profits, making it unviable. For comparison, the profit on a 400-unit Toronto condo proposed in late-2022 would have been $39,772,225.

If the same development was proposed as a PBR in Toronto, the project would now cost $251,850,000 and the net annual cash flow would be $974,246. In Mississauga, where average rent is around $383 lower than Toronto, the cost would be a more affordable $226,715, while annual income would be $820,460.

Recommendations From BILD

In the final portion of the report, BILD lays out a to-do list of policy changes for the municipal, provincial, and federal governments aimed at spurring rental development.

At the municipal level, BILD recommends things like eliminating or lowering DCs for rental and mixed-use projects and lowering property tax rates for PBRs via Tax Increment Financing and the New Multi-Residential Subclass discount of 35% on property taxes. At the provincial level, they recommend unlocking existing DC reserves for ready-to-go projects, and federally, recommendations include expanding CMHC programs, lifting the foreign buyer ban, and establishing a housing task force that includes all three levels of government, among other suggestions.

BILD's SVP of Communications, Research & Stakeholder Relations, Justin Sherwood, emphasizes just how important it is that these recommendations be adopted in order to avoid a "tremendous economic hit," ensure housing is delivered, and keep the industry on two feet.

"The industry is facing massive amounts of layoffs. You're looking at starts dropping tremendously — somewhere in the order of magnitude of 60% in the GTA — and you're actually seeing the drying up of investment going into residential construction, whether it be for sale or for rent," Sherwood tells STOREYS, adding that the number one goal is to ensure people are housed. "[...] We need to be able to put roofs over heads. Population is going to continue to grow. Whether it's going to grow by 400,000 people a year in Canada or 500,000 people, it's still growing, right? That need is not going away."

But spurring housing, Sherwood points out, not only benefits developers but all three levels of government as well. "There's an economic benefit that the housing sector brings to the domestic economy," he says. "It's one of the largest sectors in the Canadian economy, it's one of the largest employers in the Canadian economy, and it sources about 90% of its raw materials domestically. If all of a sudden that starts declining, there's a tremendous negative impact to governments."