While Toronto and the wider Greater Toronto Area's (GTA) resale market began showing signs of life in October, data from the Building Industry and Land Development Association (BILD) shows new homes sales remained "notably low."

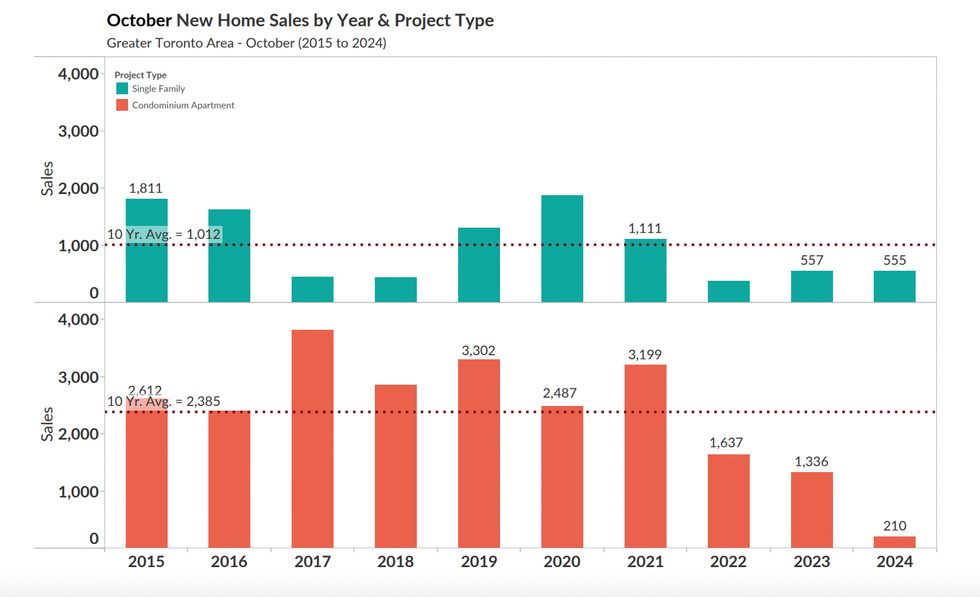

In total, there were 765 new home sales recorded in Toronto and the GTA, up from the meagre 591 homes sold in September, but 60% below October 2023 and 77% below the 10-year average.

In line with the condo resale glut, new condominium sales were hit "particularly hard" in October, accounting for only 210 of the units sold, down 84% from last year and 91% below the 10-year average. The 210 sales also come in slightly under last month's 247 condo transactions.

“The GTA new home market remained practically frozen with inaction in October 2024,” said Edward Jegg, Research Manager with Altus Group, BILD’s official source for new home market intelligence. “However, conditions are starting to align with inflation in check, resale activity surging, interest rates falling and upcoming changes to mortgage rules all pointing to buyers jumping back into the new home market in the coming months.”

New single-family homes fared slightly better on a month-over-month basis, increasing from 344 sales in September to 555 sales in October. However, these numbers remain unchanged from October 2023 and sit 45% below the 10-year average.

With sales low, remaining inventory increased slightly from 21,871 units in September to 22,299 units, comprising 17,682 condo units and 4,617 single-family dwellings, and representing a combined inventory level of 14.4 months.

With this release of new home sales data, BILD is taking the opportunity to, again, raise concerns over future implications of continued low sales. "Housing starts are the housing supply of tomorrow and the longer that sales remain low the more it is anticipated that available housing supply in the 2027-2029 time period will suffer. As buyers slowly return to the market this will invariable lead to price appreciation, less choice and mix in the future," says the release

Justin Sherwood, SVP of Communications and Research & Stakeholder Relations at BILD, points to high building costs as the source of the ongoing low sales trend.

“The Greater Toronto Area is grappling with a major ‘cost to build’ challenge. Rising construction costs, coupled with escalating government fees, taxes, and charges, have made it increasingly difficult to deliver new homes at a price point the market can absorb,” said Sherwood. “This cost imbalance has led to a sharp decline in both sales and housing starts, which poses a serious threat to the region’s future housing supply."

Sherwood also goes on to applaud the City of Vaughan's Tuesday decision to lower development charges on low-rise homes (single- or semi-detached) by 25%, from $94,466 per unit to $50,193 — a move that is meant to lower prices for homebuyers in the long-run.

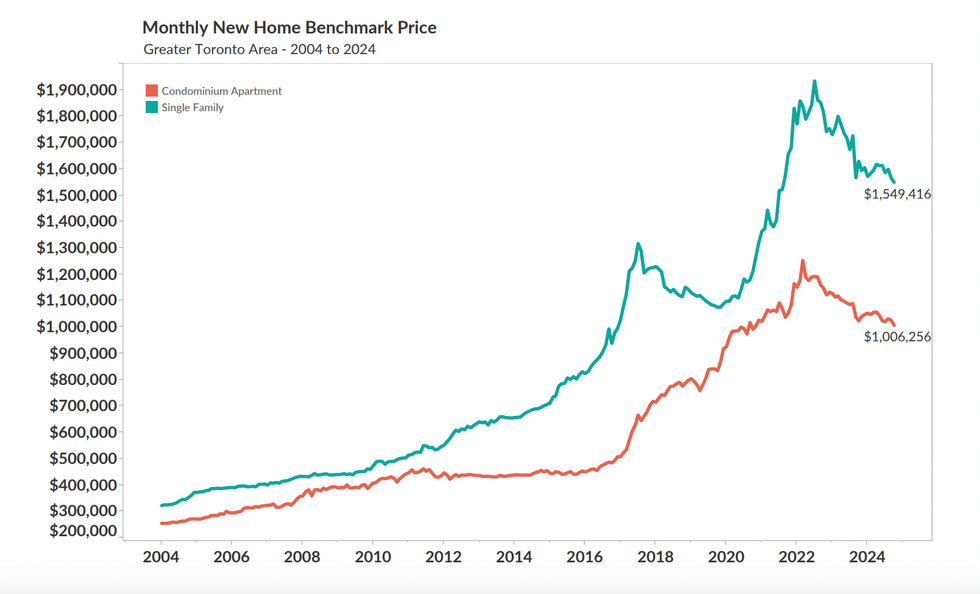

Finally, on the topic of home prices, BILD reports that Benchmark prices continued to trend downwards, with the average price for new condo units at $1,006,256, down from $1,025,111 in September and down 1.6% over the last 12 months. The benchmark price for new single-family homes was $1,549,416, down from $1,565,116 in September and down by 4.9% over the last 12 months.

- Vaughan "Dramatically" Drops Development Charge Rates ›

- "A 'Cost To Build' Crisis": GTA New Home Sales Down 70% Over Last September ›

- Canadian Home Sales Reach Highest Level Since April 2022 ›

- New Home Sector In Trouble, Prices See Biggest Drop Since 2009 ›

- "Historically Busy" November Still Not Enough For Housing Starts ›

- GTA New Home Market "Continued To Languish" In November ›