After many months of rapidly increasing home prices, a "slightly more balanced market" is expected to hit the GTA this summer, a new report from online brokerage Zoocasa predicts.

Record low inventory and incredibly high levels of competition have continued to plague the GTA housing market throughout the typically slow winter months, with the average price of a Toronto home having risen 27.7% year-over-year. But the issue of supply is starting to take a turn for the better, the report notes, with listings in February up 77% compared to the previous month.

READ: The Average Detached House in Toronto Has Officially Crossed the $2M Mark

"As the supply trend in February suggests, we look to be headed in the direction of a slightly more balanced market," the report reads. "The data for last month leads to a sales to new listings ratio (SNLR) of 64%, down 9% month over month, pointing towards the market looking a little more favourable for buyers in the coming spring."

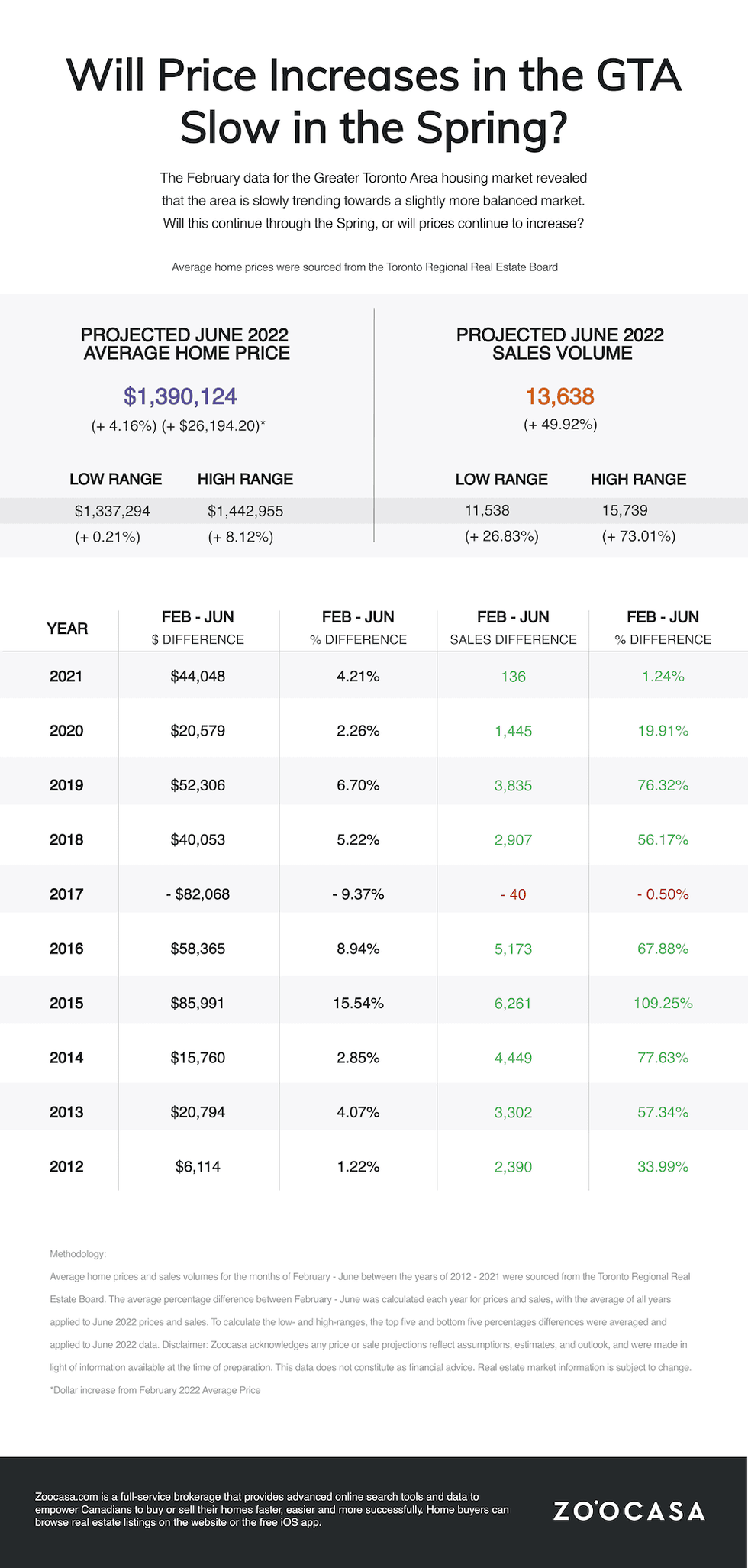

This trend is likely to slow price growth but won't stop it altogether, meaning there isn't much relief in sight for aspiring buyers who are already priced out of the market. Zoocasa is projecting the average price of a home in the GTA will hit $1,390,124 in June -- a 4.16% increase. More conservative price estimates would see just a 0.21% increase to $1,337,294, while on the higher end of possibilities, there could be an 8.12% increase to $1,443,955.

Sales are also expected to continue trending upward with 13,638 transactions predicted for June -- a 22.8% increased from the same month last year. On the low end of possible June sale outcomes would be 11,538 sales, while more aggressive estimates would see 15,739 transactions take place.

"As mentioned in our earlier predictions for this year, supply is definitely a key to the real estate market story for 2022," said Zoocasa CEO Lauren Haw. "As supply has started to open up in February, we are starting to see a little relief for buyers in terms of opportunity and availability leading to more balanced conditions versus the intense sellers advantage we've been facing. Price relief however is unlikely, and we are expecting to see continued increases in the single digits into the Spring market across property types."