Home buying demand is still trailing last year’s late summer pandemic market by double digit percentages, but there are signs conditions are perking back up; August numbers from the Toronto Regional Real Estate Board (TRREB) reveal the year-over-year decline in transactions is at its smallest difference in four months, with sales up 14% from July.

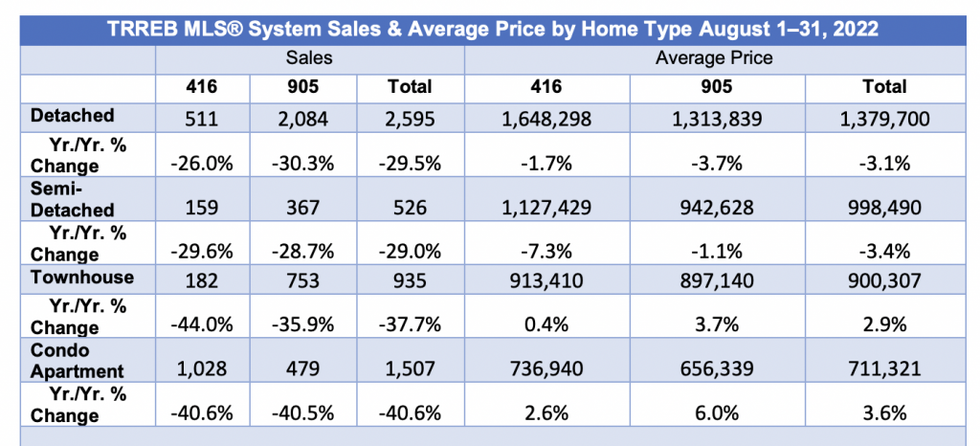

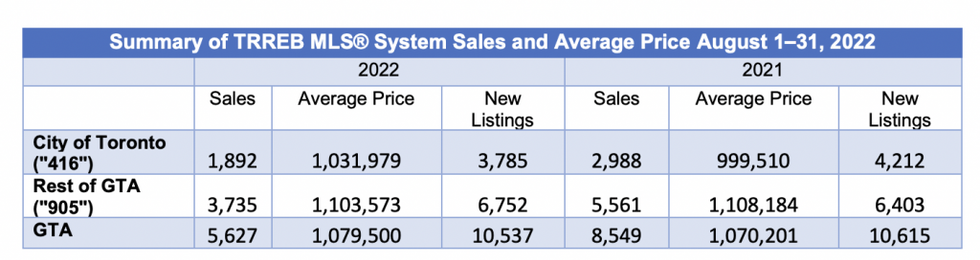

A total of 5,627 homes traded hands through the MLS, representing an annual decline of 34.2% -- an improvement from the 47% YoY drop recorded last month.

And, says the Board, sellers conditions are starting to tighten up, with sales marking a larger proportion of the 10,537 newly listed homes (roughly unchanged from last year at 0.73%).

Home price growth, however, continued to cool off with the GTA average remaining flat from last year at $1,079,500. That’s an increase of just 0.9%, the smallest gain since April 2020, and representing a dollar difference of $4,746 from July (+0.4%).

READ: Canadian Home Prices Could Fall 25% From Winter Peak: TD

The MLS Home Price Index rose 8.9%, compared to 12.9% last month.

Compared to the market peak recorded in February, sales have dropped by 38%, and more than $255,000 has come off the average home price, down 19%. According to TRREB, that the average price saw monthly growth compared to a decline in the HPI index suggests a greater share of more expensive home types sold in August.

In the City of Toronto, a total of 1,892 homes sold, marking a -36% YoY decline, with the average price coming in 3.2% higher than in 2021, at $1,031,979. In the 905-area markets, transactions were down by -32% with 3,735 sold, at an average price of $1,103,573 (-0.4%).

Softer market performance can be attributed to steadily rising mortgage rates, and, as a result, a tougher mortgage stress test threshold. The Bank of Canada has increased its benchmark interest rate four times since March, leading to spikes in both the variable and fixed-rate cost of borrowing. Another interest rate hike is to come in the Bank’s next policy announcement on September 7.

READ: Does the Mortgage Stress Test Still Make Sense… And Has It Ever?

This warrants a second look at the stress test from policymakers argues Kevin Crigger, TRREB’s President.

“While higher borrowing costs have impacted home purchase decisions, existing homeowners nearing mortgage renewal are also facing higher costs. There is room for the federal government to provide for greater housing affordability for existing homeowners by removing the stress test when existing mortgages are switched to a new lender, allowing for greater competition in the mortgage market,” he says. “Further, allowing for longer amortization periods on mortgage renewals would assist current homeowners in an inflationary environment where everyday costs have risen dramatically.”

TRREB CEO John DiMichele says, specifically, the existing criteria for stress testing has become redundant in the current interest rate environment. Present-day guidelines require borrowers to prove they could carry their mortgage at either a rate of 5.25%, or their contract rate plus 2%; however, given the rapid uptake in interest rates in recent months, all available market rates now exceed the 5.25% threshold. As a result, many borrowers are being stress tested in the 6 - 8% range.

“The Office of the Superintendent of Financial Institutions (OSFI) should weigh in on whether the current stress test remains applicable,” he says. Is it reasonable to test home buyers at two percentage points above the current elevated rates, or should a more flexible test be applied that follows the interest rate cycle? In addition, OSFI should consider removing the stress test for existing mortgage holders who want to shop for the best possible rate at renewal rather than forcing them to stay with their existing lender to avoid the stress test. This is especially the case when no additional funds are being requested.”