With a vaccine on the horizon and plenty of lessons learned from the past year, things are looking up for 2021. And home prices are no exception -- in a very literal way.

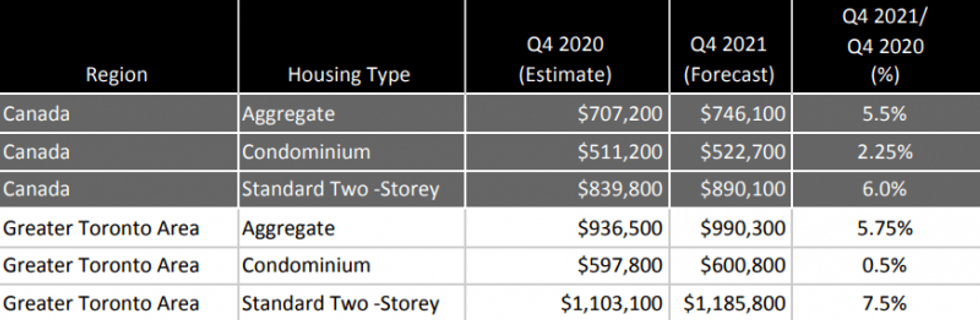

According to a new forecast from Royal LePage, the median price of a standard two-storey home in the GTA is expected to rise 7.5% next year, reaching an average price point of $1,185,800.

In a significantly less dramatic increase, the median price of a condominium is forecast to increase 0.5% to $600,800. This price projection, relatively flat as it is, reflects both a modest increase for condos in the 905-region, as well as a slight dip in median prices for the City of Toronto.

Meanwhile, the aggregate price of a GTA home (all home types) is expected to increase 5.75% year-over-year, ultimately reaching $990,300.

READ: Economists Expect Toronto Real Estate to See 5% Increase in Spring 2021: Survey

The entire country saw housing demand exceed expectations through the second half of this year, Royal LePage says.

"The supply of homes available for sale failed to keep pace, driving home prices higher and pushing unmet buyer demand into the new year," reads the report. As a result, the aggregate price of a home in Canada is set to increase 5.5% year-over-year to $746,100 in 2021, with the median prices of two-storey detached homes and condos expected to increase 6% to $890,100 and 2.25% to $522,700 respectively.

“The leading indicators we analyze are pointing to a market that favours property sellers in the all-important spring of 2021,” said Phil Soper, president and CEO, Royal LePage.

“Across the country, a large number of hopeful buyers intent on improving their housing situation were not able to find the home they were looking for this year, as the inventory of properties for sale came nowhere near to meeting surging demand. With policy makers all but promising record low, industry supportive interest rates to continue, we do not see this imbalance improving in the new year. The upward pressure on home prices will continue."

Nation-wide, the condo sphere is expected to see "healthy demand" in most of Canada’s largest cities, but the GTA is an exception. Those with their ear to the downtown core's ground know that November saw condo prices decline, year-over-year, for the first time since April, while October only managed a gain of less than 1%. Overall, Royal LePage says that where the GTA is concerned, "modest price gains for larger units outside of the city centre are expected to continue to offset softer demand in the downtown core."

It's also expected that, as international university students return and newly-arrived immigrants get settled in 2021's latter half, demand for centrally-located dwellings should rise. In October, the federal government announced plans to welcome more than 1.2 million immigrants over three years; previously-published Royal LePage research into this demographic reportedly shows that newcomers to Canada typically rent for three years before purchasing, after which they have a material impact on new household formation and overall housing demand.

READ: Is Guelph the Hottest Real Estate Market in Ontario Right Now?

For now, though, a spotlight is on ground-level properties.

According to the report, "the value of single-family houses and homes outside of major urban markets are forecast to continue to outpace city core condominiums" through 2021. This is a trend that will be driven by multiple factors, including Canadians seeking larger homes during the remote-work era, and "broad-based demographic trends," not least the retirement of baby boomers.

“Mega-trends that predate the pandemic are pushing home prices higher in secondary markets outside of our largest cities. Corporate Canada’s pandemic-driven move to work-from-home operations has simply accelerated relocation patterns already underway,” said Soper. “The huge baby-boomer demographic began post-children migration to suburban and recreational-style communities in the middle of the last decade, and material numbers of the equally populous millennial generation have been exiting city centre condos in search of space as they began families.”

Debra Harris, vice president at Royal LePage, says lighter activity is expected surrounding the winter holidays, but if inventory doesn't improve through 2021's early months, another year of strong price appreciation could follow.

“Low inventory is expected to put upward pressure on prices but we could see low unit sales if there isn’t product to sell,” Harris explains.

To that point, Soper said, while there was a clear shift toward larger properties over this year, the trend is expected to "moderate" as life returns to some semblance of normalcy. “Urban living remains attractive for many,” he says, and Harris agrees.

“Many young people returned home to save money during the pandemic and we expect them to want to get back into city life when the vaccine becomes available. The question is whether consumer confidence in the condo market will be healthy given the surge in listings. The reality is that current inventory is much healthier than where we were last year," Harris said.

"For the many young professionals who were discouraged by strong competition in the condo market in previous years, this window may be their opportunity to find a home they can get excited about living in.”

Looking ahead, the condo sphere is expected to maintain a varied performance, with higher demand for larger units in the 905 area. Soper says the trend of high demand outside of urban centres will slowly ease, with time, as listings in city centres become more competitive against growing prices in suburban and exurban markets.

According to Harris, while there has been a recent surge in condo listings, the "historically-starved Toronto condo market can withstand an increase in condo supply without significantly impacting price in the short term." Here, recall how new immigration targets and the return of university students should spark a jump in resale demand for condos through late 2021.

Of course, the numbers are influenced by provincial mandates and broad trends, but, Soper notes, they're also affected by individual choices. In fact, those decisions -- and the feelings of safety (or lack of it) that they stem from -- may have the most tangible impact of all.

“The first half of 2021 will be something of an economic and social tug-o-war between advancing medical science and surging housing demand,” Soper said. “The real estate brokerage industry has developed protocols that allow us to safely sell property during the pandemic, yet some would-be sellers will remain cautious and not list their properties while high levels of COVID-19 transmission remain the norm, restricting available housing supply.”