November marked yet another gloomy month for real estate activity in the Greater Toronto Area, with both home sale and price declines growing more entrenched -- a trend the region’s real estate board attributes to the sharp sting of higher interest rates.

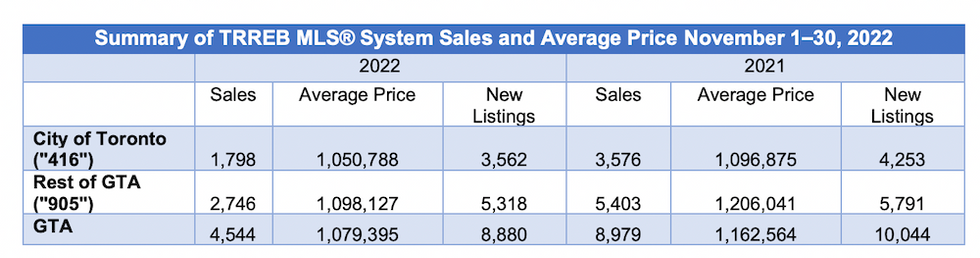

A total of 4,544 homes traded hands last month, down -49% on an annual basis and -8.4% from October, reports the Toronto Regional Real Estate Board (TRREB). Home prices dipped by -7.2% YoY to an average of $1,079,395, though remained roughly flat on a monthly basis, down just -0.9%.

However, the $1M-price floor remains supported by very scant supply -- new listings fell “substantially” from last year with just 8,880 homes brought to market (down -23.1% YoY and -14.5% MoM), marking a historical low.

While that’s keeping current market conditions from collapsing into buyers’ market territory, it spells trouble over the long term, once interest rates -- and market demand -- normalize, says TRREB President Kevin Crigger.

“Increased borrowing costs represent a short-term shock to the housing market. Over the medium- to long-term, the demand for ownership housing will pick up strongly,” he says. “This is because a huge share of record immigration will be pointed at the GTA and the Greater Golden Horseshoe (GGH) in the coming years, and all of these people will require a place to live, with the majority looking to buy. The long-term problem for policymakers will not be inflation and borrowing costs, but rather ensuring we have enough housing to accommodate population growth.”

READ: Average Home Price Needs to Fall Over $340K to Be “Affordable”: Report

In addition to the softening of average home prices, the MLS Home Price Index Composite Benchmark -- which represents the most typical type of home sold -- declined deeper, by -5.5%; compounded on the -1.3% decrease recorded for the measure in October, and price growth has chilled to a slower pace than even that of the early pandemic months.

The benchmark was pulled lower due to price declines that were concentrated in the most expensive market segments, such as detached and semi-detached houses, says Jason Mercer, TRREB’s Chief Market Analyst.

“Selling prices declined from the early year peak as market conditions became more balanced and homebuyers have sought to mitigate the impact of higher borrowing costs,” he says. “With that being said, the marked downward price trend experienced in the spring has come to an end. Selling prices have flatlined alongside average monthly mortgage payments since the summer.”

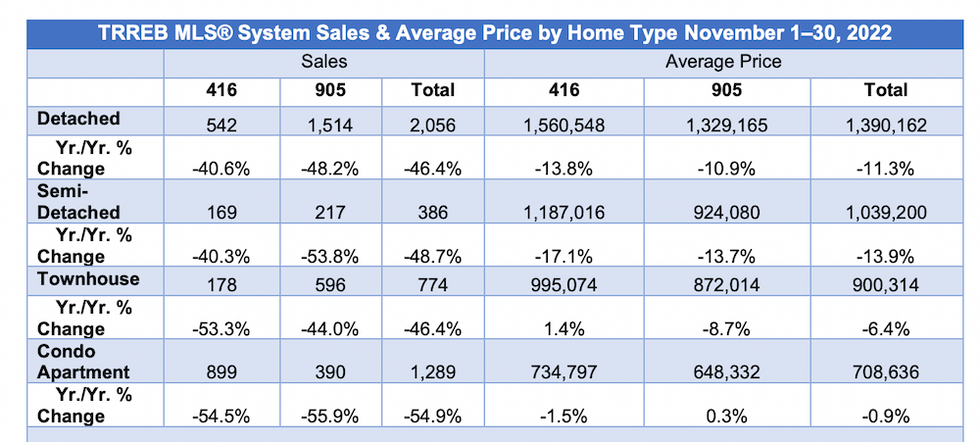

Semi-detached home prices absorbed the largest year-over-year decline, down -13.9% to an average of $1,039,200. That was followed closely by the detached segment, down -11.3%, but still prohibitively pricey at $1,390,162. As has been the long term trend, price declines were smallest for the most affordable market entry points, particularly under the $1M-mark. Townhouse prices dipped by -6.4% to an average of $900,314, while condo price declines remained flat, with a -0.9% decline and an average price of $708,636.

Lack of demand was virtually identical both in and outside of the City of Toronto; a total of 1,798 sales occurred within the “416” region, while 2,746 sold in the 905, both reflecting losses of 49.7% and 49.1%, respectively. Price declines were more apparent outside city limits, however, down -8.9% YoY at an average of $1,098,127, compared to an annual decrease of -4.2% in Toronto at $1,050,788.

While prices continue to decline throughout the GTA, TRREB CEO John DiMichele emphasizes the effect will be temporary -- and that levels of government need to do more now in order to avoid further affordability deterioration in the future.

“We have seen a lot of progress this year on the housing supply and related governance files such as the More Homes Built Faster Act. This is obviously good news. However, we need these new policies to turn into results over the next year,” he says. “Otherwise, the current market lull will soon be behind us, population growth will be accelerating, and we will have done nothing to account for our growing housing need. The result would be enhanced unaffordability and reduced economic competitiveness.”