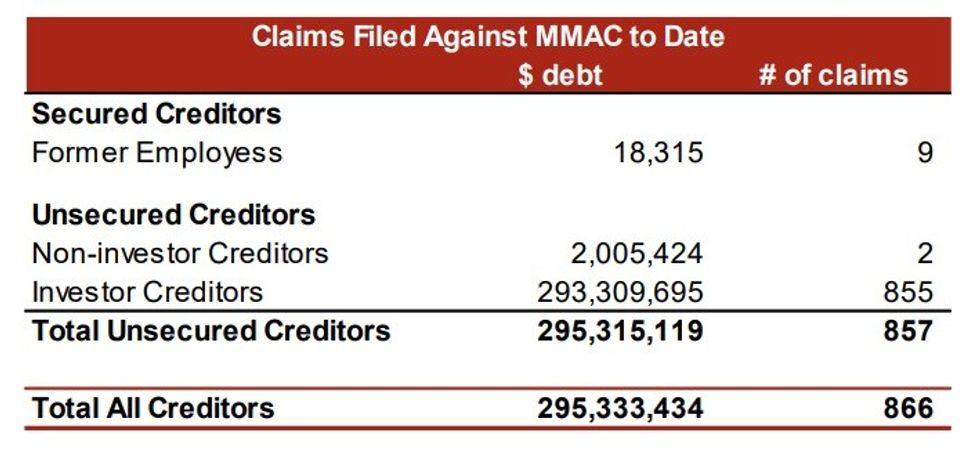

The amount of money Greg Martel took from investors is likely much more than previously estimated, according to PricewaterhouseCoopers (PwC), the trustee in the ongoing bankruptcy case.

Previously, it was estimated that Martel — through My Mortgage Auction Corp (MMAC), which operated as Shop Your Own Mortgage (SYOM) — owed $226M to up to 1,100 investors. However, a report given to the court last week by PwC estimated the total to be over $293M, and to only 855 investors.

The updated estimate comes from claims that investors began filing after MMAC was assigned into bankruptcy on June 6.

On August 31, Greg Martel was personally placed under bankruptcy by the BC Supreme Court, at the request of an investor named Corey Edgar, and his personal bankruptcy proceedings have now been consolidated with that of MMAC.

Martel sold high-interest bridge loans to individuals as investment opportunities, but after he was unable to provide payment as requested by several investors, he was accused of running a Ponzi scheme — a form of fraud where money received from investors is used to pay back earlier investors while presenting the payment as a return on their investment, while the schemer diverts some of the funds for personal gain.

PwC says it has conducted interviews with former employees of MMAC and concluded that Martel "was responsible for underwriting all bridge loans and authorizing funds transfers and payments for MMAC and the related corporations." Martel also "directed a significant amount of funds to the related corporations, and himself" and "personal expenses were often paid from the MMAC bank account including rent for residences in Victoria and Vancouver."

He has provided little to no cooperation with the various investigations into his businesses, has lied about the location of the money he took from investors, and was declared to be in contempt of court this week, at the request of PwC. The court also granted PwC's application for a warrant to have Martel apprehended and brought to court.

To date, PwC has only been able to recover $292,586. Of that total, $100,297 was recovered from MMAC's account with the Royal Bank of Canada. The remaining $192,289 was recovered via a garnishing order obtained via a separate legal proceeding, prior to PwC being appointed as the receiver.

"The books and records indicate that bridge loans may have been made, however the borrower list located by the Receiver does not provide borrower details and no bridge loan agreements or other supporting documents have been located," said PwC. "Further information on the borrowers was requested from Mr. Martel, but he has not furnished any information."

PwC says it is currently conducting an extensive analysis of the flow of funds that made its way through MMAC all the way back to its inception. They say the analysis involves analyzing thousands of financial transactions from several financial institutions, and the hope is that the analysis will help complete the picture of MMAC's operations and the assets that can be realized.

On top of the $293M that is owed to investors, MMAC also owes over $2M to non-investor creditors, including $1.825M to the Canada Revenue Agency, which was only discovered recently.

PwC says all the claims still have to be fully vetted, but that the significant difference between the prior estimate and the current estimate indicates the general inaccuracy of MMAC's financial records. PwC says it is still receiving claims on a regular basis, so the amount owed could likely continue to rise.

Aside from being nearly unreachable — with little communication provided only through his counsel — Martel has also provided little information about his assets.

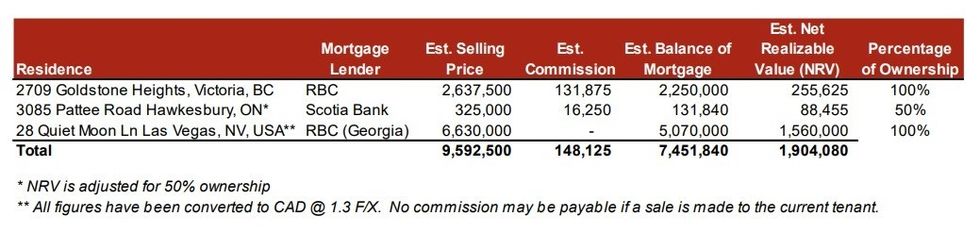

Currently, PwC has identified three residences that Martel either owns solely or partially. One is located in Victoria, one is located in Ontario, and one is located in Las Vegas. All three remain encumbered with mortgages and the total equity that can be recovered is estimated at just over $1.9M.

Factoring in the remaining balances of the mortgages on the three properties, the amount Martel owes surpasses $300M.

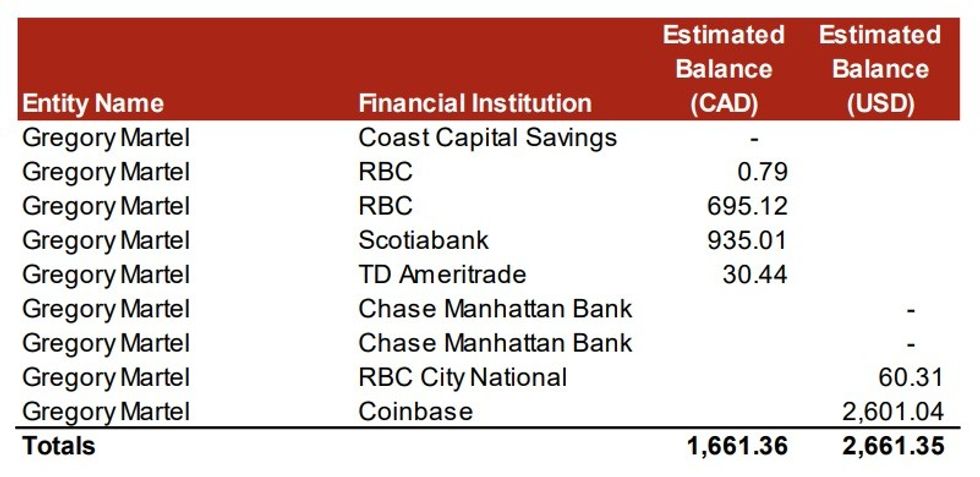

PwC has also identified nine bank accounts under Greg Martel's name. PwC says it is in the process of notifying the banks about the bankruptcy proceedings and requesting that each account be frozen and their balances transferred to the trustee account.

The balances of the nine accounts total approximately $4,300, split between Canadian and American dollars, a majority of which is held in an account with Coinbase, a cryptocurrency trading platform. Martel previously tried to have the existence of this account hidden via a sealing order, but failed.

PwC also noted that Martel had leased 16 high-end cars through Victoria-based Silver Arrow Cars Ltd., but all of the vehicles were seized by the leasing company prior to the bankruptcy proceedings and therefore cannot be realized.

Moving forward, PwC will now continue to consolidate and simplify the proceedings, seeking out an order to merge the bankruptcy estate of MMAC with the Greg Martel bankruptcy estate.

It will also work towards identifiying common creditors between MMAC and Greg Martel, which is expected to be significant.

"The Trustee expects that all investor claims filed against MMAC will also be provable claims against Mr. Martel," said PwC. "Investor claims are expected to comprise over 99% of the claims against the MMAC estate and over 99% of the claims against the estate of Greg Martel."

Another big reason PwC is seeking to consolidate the proceedings is because it is unclear "whether there will be sufficient recoverings to cover the costs of administration."

"There is a larger than usual amount of work to do to ascertain the existence or non-existence of any assets by conducting the funds flow analysis," said PwC. "While there are cases where receiverships and bankruptcy estates have limited assets to fund the costs of administration, the cost of these administrations are exceptional given the number of creditors/investors and the difficulty in pursuing asset recoveries given a non-compliant debtor."