Over the past few months, as various regulators and investigators have continued to uncover the full extent of Greg Martel's businesses, assets, and debts, they have done so with practically no cooperation from Martel himself.

They appear to have had enough.

PricewaterhouseCoopers (PwC), the appointed Receiver in the case, will be seeking a declaration that Martel is guilty of contempt of court and will also be seeking a Form 115 warrant to have Martel apprehended and brought to court, according to a notice of application filed in the Supreme Court of British Columbia obtained by STOREYS.

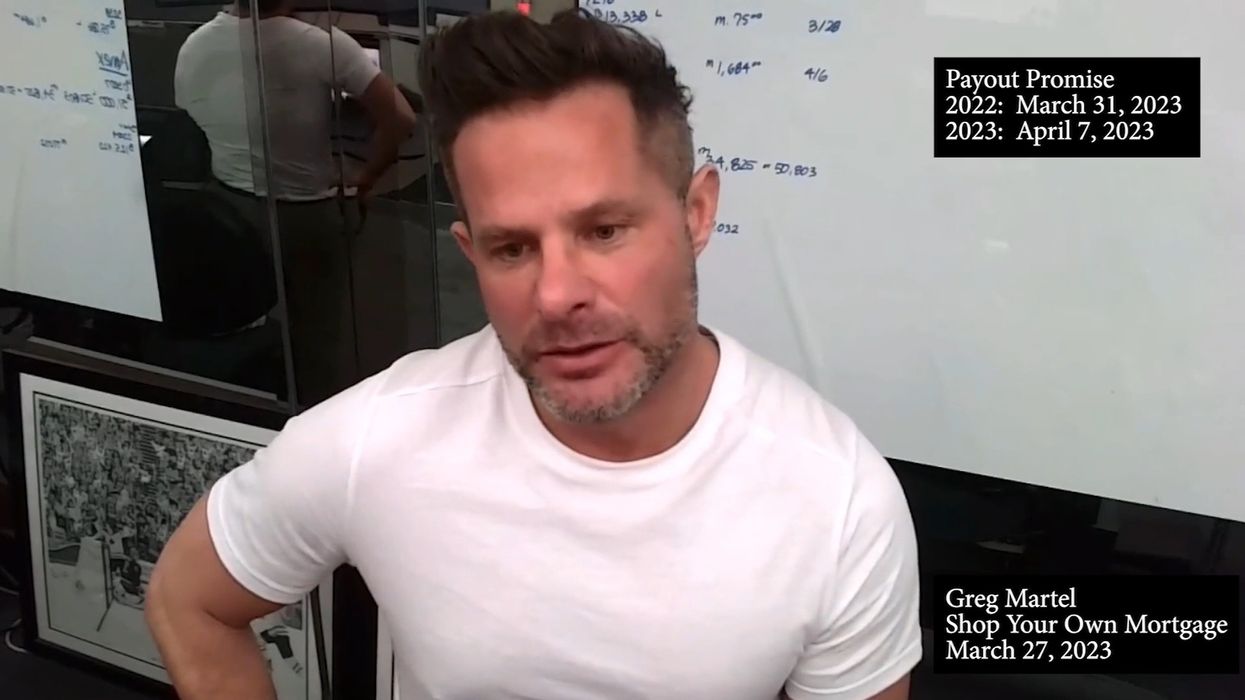

Greg Martel is the sole director of My Mortgage Auction Corp (MMAC) which does business as Shop Your Own Mortgage (SYOM) and sold high interest bridge loans as investment opportunities. After failing to provide payment as requested by several investors, Martel and his company were the subject of several lawsuits, alleging a total amount owed of at least $25M and that SYOM was a Ponzi scheme — a form of fraud where money received from investors is used to pay back earlier investors while presenting the payment as a return on their investment, while the schemer diverts some of the funds for personal gain.

It's now estimated that he owes nearly 1,200 investors a grand total of $226M.

My Mortgage Auction Corp is registered in Victoria, British Columbia, but also operated in California, Colorado, Florida, and Texas. Martel is also the subject of a lawsuit in Nevada.

Martel's whereabouts have been unknown since the allegations first became public, and although he has communicated with PwC, he has been almost unreachable, has provided little factual information, and has even lied to PwC about where the money he received from investors currently is, as was previously reported by STOREYS.

PwC was appointed as the Receiver on May 4, and according to PwC Senior Vice President Neil Bunker, in an affidavit dated August 30, Martel was required to provide an affidavit outlining the company's operations and assets by May 12. Bunker swears that Martel instead provided, on May 12, a letter with a preliminary list of assets that noted Martel was "not in a position, as of yet, to provide a complete listing of his assets, nor to swear an affidavit verifying the list."

Martel then provided an affidavit on May 17, but the list of assets was "largely unchanged," Bunker says, and PwC believed that the list "remained inadequate."

Bunker says Martel was also non-compliant with the receivership order that was amended on May 17 to authorize PwC to assign MMAC into bankruptcy, and to direct Google to turn over all emails and data it had regarding MMAC. As part of that receivership order, Martel was also required to provide information regarding the bridge loans recorded in MMAC's financial statements.

Martel did not do so.

Since early June, Bunker says that PwC has had no direct contact with Martel, and Martel has only communicated through his lawyer.

"On June 27, 2023, the Receiver attended a call with, and provided various contact details to, Mr. Martel's counsel in an attempt to assist counsel in its pursuits to obtain information requested by the Receiver and required to be provided by the court order," says PwC in its notice of application. "Since that date the Receiver has not received any further information or documents from Mr. Martel or his counsel."

In July, Martel's counsel later communicated with PwC that they were concerned the request for Martel to provide the required information "could result in Mr. Martel placing himself in jeopardy," PwC said. "At that time, counsel for Mr. Martel indicated that, until the protection of Mr. Martel's right against self-incrimination was addressed, they were unable to provide more documents."

PwC says that the bridge loans "likely represent the single largest group of assets of MMAC."

Because Martel has lied about the whereabouts of the those bridge loans — he said they were in an account at Scotia Capital, but the Receiver found no accounts at all — and has not provided any further information, among many other reasons, PwC believes that Martel is guilty of contempt of court.

"Mr. Martel's contempt of court is particularly egregious given that he is in breach of three separate orders of this Court and had had several months to comply," PwC said. "Mr. Martel's offence is not only contemptuous but also has the effect of prejudicing PwC in its mandate, as Court-appointed Receiver, to recover funds for MMAC's creditors. Respectfully, it is appropriate for this Court to rebuke Mr. Martel's conduct and fund him guilty of contempt of court."

Martel is also currently under investigation by the BC Securities Commission, and has had his license revoked by the Financial Services Regulatory Authority of Ontario.

On Thursday, the Court granted PwC a bankruptcy order on MMAC, and PwC is expected to bring its contempt application to the Court on Monday, September 11.