Credit Score

Understand how credit scores affect Canadian mortgage approval, what factors influence your score, and how to improve it before buying a home.

May 22, 2025

What is a Credit Score?

A credit score is a numerical rating that reflects a borrower’s creditworthiness and financial reliability based on past credit behavior.

Why Credit Scores Matter in Real Estate

In Canadian real estate, credit scores are a major factor in mortgage approval. Lenders use scores to assess the likelihood that a borrower will repay their loan responsibly.

Scores typically range from 300 to 900:

- 680+ is considered good for mortgage qualification

- Higher scores may result in better interest rates and terms

Scores are based on factors including payment history, credit utilization, length of credit history, recent inquiries, and types of credit.

Poor credit may limit options to higher-interest or alternative lenders. Borrowers should review and improve their scores before applying for a mortgage.

Understanding credit scores helps buyers prepare for mortgage success and secure more favorable financing.

Example of a Credit Score in Action

A buyer with a credit score of 735 qualifies for a competitive fixed-rate mortgage from a major bank.

Key Takeaways

- Measures financial trustworthiness.

- Used in mortgage and loan decisions.

- Affects interest rates and terms.

- Based on credit history and usage.

- Can be improved before home buying.

Related Terms

- Mortgage Qualification

- Debt Service Ratios

- Pre-Approval

- Lender Guidelines

- Alternative Financing

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

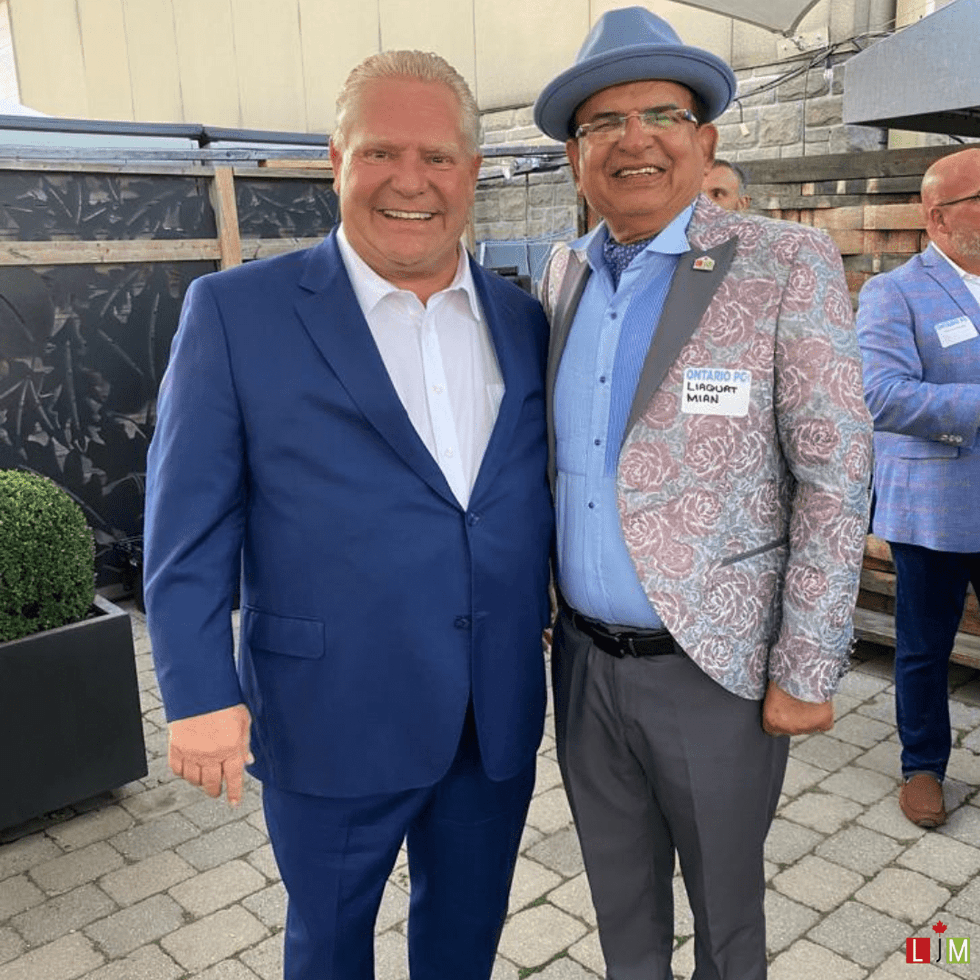

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

401-415 King Street West. (JLL)

401-415 King Street West. (JLL)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)