After a rocky year of interest rate hikes pushing prices down and sending buyers to the sidelines, home sales across Canada hit a 14-year low in January.

According to newly released statistics from the Canadian Real Estate Association (CREA), fewer than 35K homes were sold across the country in January, marking a 37.1% decline from a year prior, and the lowest level for the month since 2009.

Sales were down 3% on a monthly basis, reversing the slight gain of 1.3% seen in December. Although some markets, including Hamilton-Burlington and Quebec City, saw an uptick in sales, the gains were "more than offset" by declines in Greater Vancouver, Victoria, Calgary, Edmonton, and Montreal.

New listings were up 3.3% on a monthly basis, spurred by a slew of activity in British Columbia, but remained historically low across Canada. Nationally, new supply saw its worst level January since 2000.

With new listings on the rise and sales declining, the sales-to-new listings ratio dropped to 50.7% compared to 54.4% in December. Nationally, there were 4.3 months of inventory at the end of January, which is close to where the measure was in the months leading up to the start of the pandemic.

"The big question on everyone’s minds after last year was what will housing markets do in 2023?" said Jill Oudil, CREA Chair. "We may have to wait another month or two to see what buyers are planning this year since new listings are currently trickling out at near-record low levels, but that should change as the weather warms."

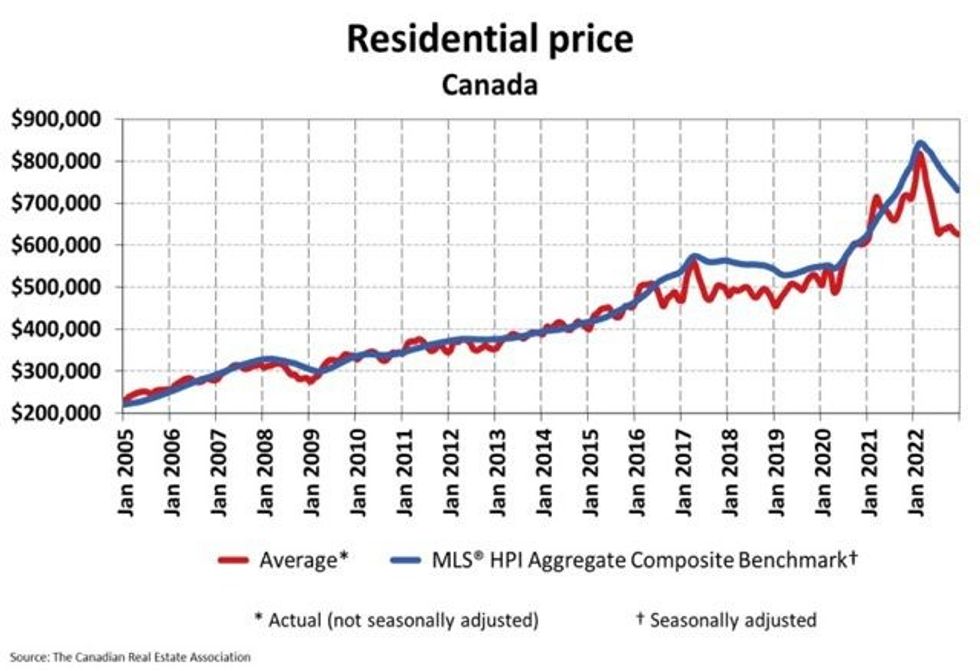

Continuing the downward trend that began last spring, the Aggregate Composite MLS Home Price Index (HPI) declined 1.9% on a monthly basis in January.

Nationally, the measure is now 15% below its February 2022 peak. CREA cautioned that the next two months will likely post the highest annual declines as we move past the record prices of last spring.

While prices have softened in nearly every market across Canada, more significant declines have been seen in parts of Ontario and BC, while they've barely budged in Calgary, Regina, Saskatoon, and St. John's. CREA noted that prices on the east coast appear to have bottomed and are now trending upwards once more.

The average (not seasonally adjusted) national home price hit $612,204 in January, an 18.3% decline from a year prior. Removing the heavily influential and expensive markets of Greater Vancouver and the Greater Toronto Area cuts nearly $113K from the national average price.

Despite significant blows to Canada's real estate market in January, CREA anticipates sunnier conditions come spring.

"Early 2023 feels a lot like 2019, where after a year in which it became much harder to qualify for a mortgage, everyone was wondering if the market would pick up in the spring," Shaun Cathcart, CREA’s Senior Economist, reminisced.

"In 2019 the market started off slow, as there wasn’t much to buy. It took off once spring listings started to come out. With the Bank of Canada increasingly signaling that rates are now at the top, it’s possible the spring market this year could also surprise, particularly in areas where prices have been stable or are now stabilizing. Buyers are likely feeling increasingly confident in taking on variable rate mortgages, and 2023 will probably be a good window of opportunity to be able to engage in a calmer home search and buying experience following the intense market conditions of the last few years.”