Construction Permit

Understand construction permits in Canadian real estate — what they are, when they’re needed, and their role in safe, legal building.

July 27, 2025

What is a Construction Permit?

A construction permit is official authorization from a local government allowing the start of construction or major renovations in compliance with building codes and zoning laws.

Why Construction Permits Matter in Real Estate

In Canadian real estate, construction permits ensure that new builds and alterations meet safety, structural, and planning requirements.

Key points:

- Required before starting most construction work

- Ensures compliance with building codes and zoning

- Helps protect property owners from legal and safety issues

Understanding construction permits helps owners, builders, and developers manage compliance and avoid costly penalties.

Example of a Construction Permit in Action

The builder obtained a construction permit before starting the foundation work on the new duplex.

Key Takeaways

- Required for most construction or major renovations

- Ensures code and zoning compliance

- Protects safety and legal standing

- Must be obtained before work starts

- Helps prevent penalties or work stoppages

Related Terms

- Building Permit

- Building Code

- Permit Compliance

- Final Inspection

- Zoning

Christine Boyle and Gregor Robertson. (Government of British Columbia)

Christine Boyle and Gregor Robertson. (Government of British Columbia)

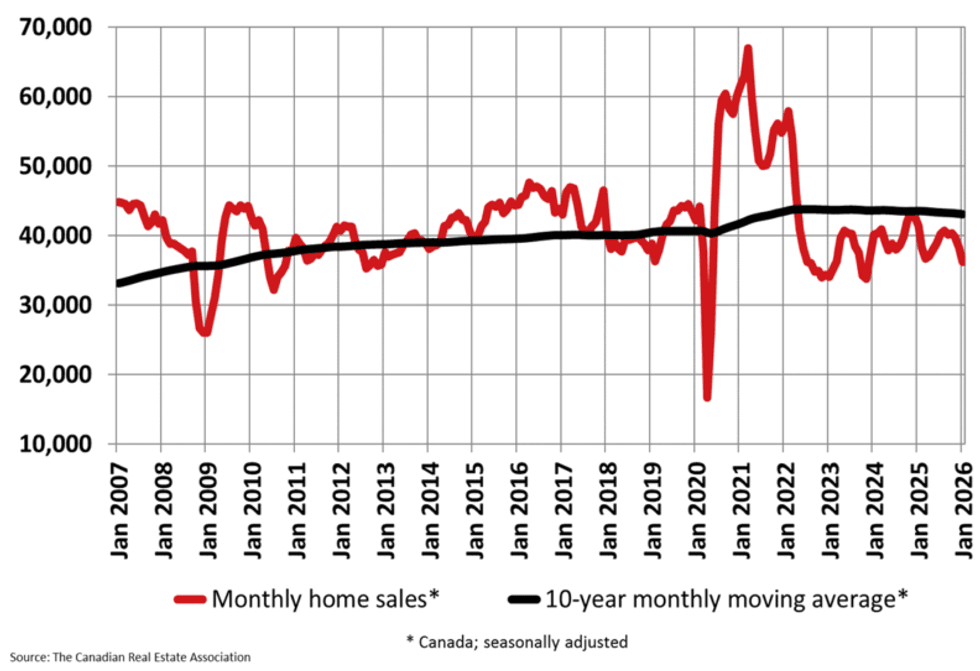

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

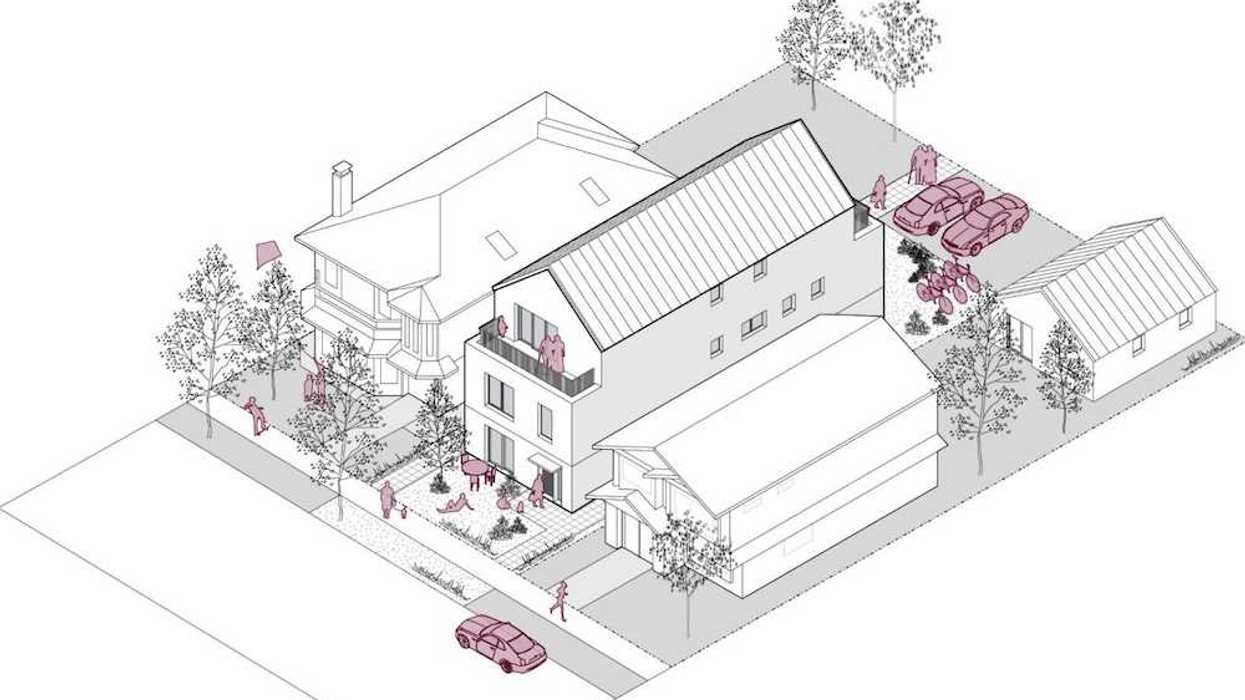

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam

Rendering of 9 Shortt Street/CreateTO, Montgomery Sisam Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect

Rendering of 1631 Queen Street/CreateTO, SVN Architects & Planners, Two Row Architect Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance

Rendering of 405 Sherbourne Street/Toronto Community Housing, Alison Brooks Architects, architectsAlliance