Community Land Trust (CLT)

A community land trust is a non-profit that owns land to keep housing affordable permanently through resale restrictions.

September 29, 2025

What is a Community Land Trust?

A community land trust (CLT) is a non-profit organization that owns land to preserve long-term housing affordability. Homes are sold or rented at below-market rates while the trust retains ownership of the underlying land.

Why a Community Land Trusts Matter in Real Estate

CLTs matter in real estate because they protect against displacement, stabilize neighborhoods, and ensure permanent affordability. They give communities control over land use and housing outcomes.

Example of a Community Land Trust in Action

A non-profit community land trust in Vancouver acquires land and sells homes at affordable prices, ensuring resale restrictions keep them affordable for future buyers.

Key Takeaways

- Non-profit ownership of land to ensure affordability.

- Homes sold or rented below market rates.

- Prevents displacement and supports community stability.

- Ensures permanent affordability with resale restrictions.

- Empowers communities to guide housing outcomes.

Related Terms

- Affordable Housing Agreement

- Inclusionary Housing Policy

- Non-Profit Housing

- Housing Affordability

- Land Lease Community

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps)

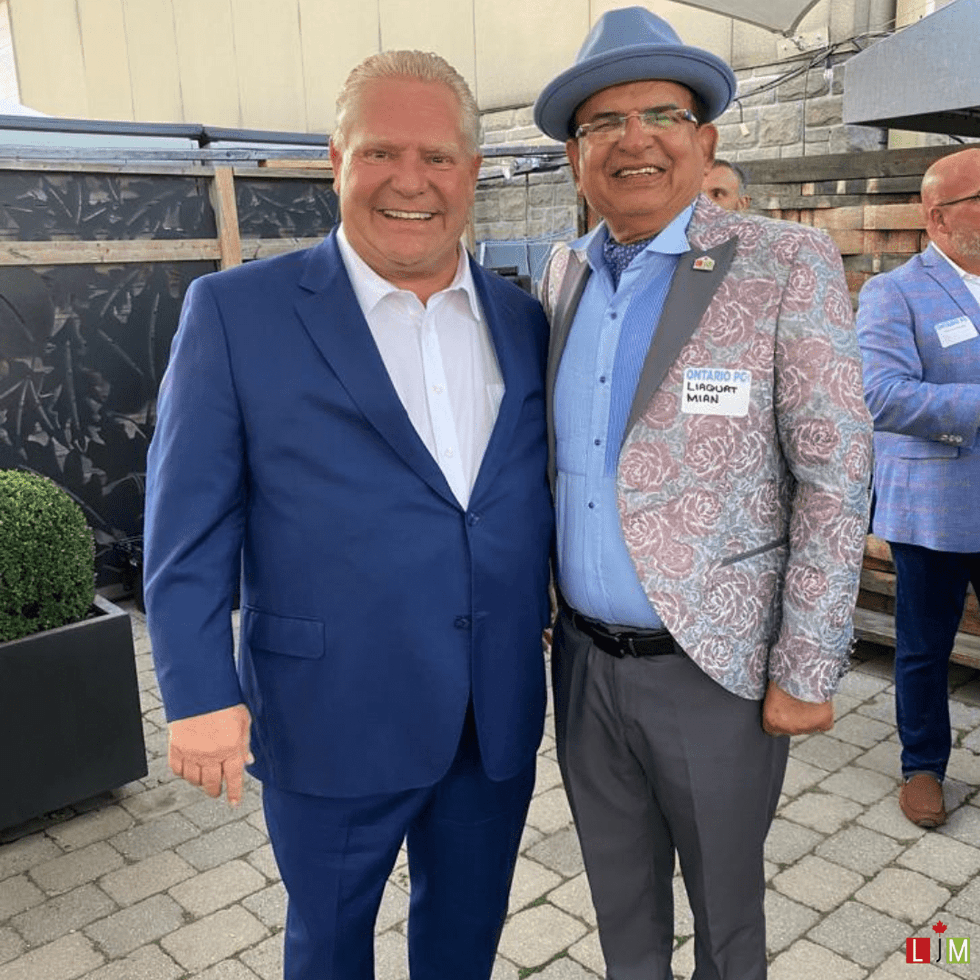

The LJM Tower at 2782 Barton Street East in Hamilton in June 2025. (Google Maps) Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

Ontario Premier Doug Ford and LJM Developments President Liaquat Mian. (LJM Developments)

CREA

CREA

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Liam Gill is a lawyer and tech entrepreneur who consults with Torontonians looking to convert under-densified properties. (More Neighbours Toronto)

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

Eric Lombardi at an event for Build Toronto, which is the first municipal project of Build Canada. Lombardi became chair of Build Toronto in September 2025.

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)

A rendering of the “BC Fourplex 01” concept from the Housing Design Catalogue. (CMHC)