The demand for office space and the return to office are still having a significant effect on the commercial real estate market, as increased vacancies across Canada are now resulting in fewer and fewer new projects being started, according to a CBRE report published on Tuesday.

Overall, the national office vacancy rate is now at 17.7% after Q1, "with slight market softening noted in both the downtown and suburban segments," CBRE says, and has been trending steadily up from about 10% in Q1 2020, around the time of the COVID-19 pandemic.

Six of the 10 marketes included in CBRE's report saw net absorption of less than 100,000 sq. ft, with some seeing negative absorption. As a result, this is now the second straight quarter Canada has seen negative net absorption.

The ABCs of Office Space

While overall office vacancy is up, there is a clear line of demarcation, or what CBRE refers to as a "bifurcation" with office vacancies in Canada. Both vacancy rates and rental rates for Class A office space are still performing better than Class B spaces, and particularly so when also factoring in whether the space is in a downtown market or a suburban market.

"Older downtown product with outdated amenities has struggled to attract and retain tenants," said CBRE. "As a result, vacancy in the downtown Class B segment has fully decoupled from not only Class A, but also all classes of suburban office space, where employees benefit from shorter commute times."

Downtown Class B office space has the highest vacancy rate, at 22.7%, compared to downtown Class A space, which has the lowest vacancy rate, at 15.9%. Rental rates have a similar gap as well, with downtown Class A space commanding nearly $30 per sq. ft while downtown Class B space is at about $20 per sq. ft.

In the suburban market, Class A space has a vacancy rate of 18.1% compared to the 16.5% of Class B space, and CBRE points out that "the rapidly rising downtown Class B vacancy is making it increasingly apparent that demand for cheap commodity space has evaporated and been replaced with the want for spaces that act as conductors for business productivity and development."

While suburban Class A space vacancy is currently higher than that of suburban Class B, CBRE believes that "rising vacancy in this segment may prove temporary" as it offers both accessibility and quality. In other words, there is still a so-called "flight to quality."

READ: Gensler's Steven Paynter on His Office Building Conversion Algorithm

The Office Supply Pipeline

The return to office en masse has not really occurred yet, and with demand for office space questionable at best, the supply pipeline of such space is showing a noticeable slowdown.

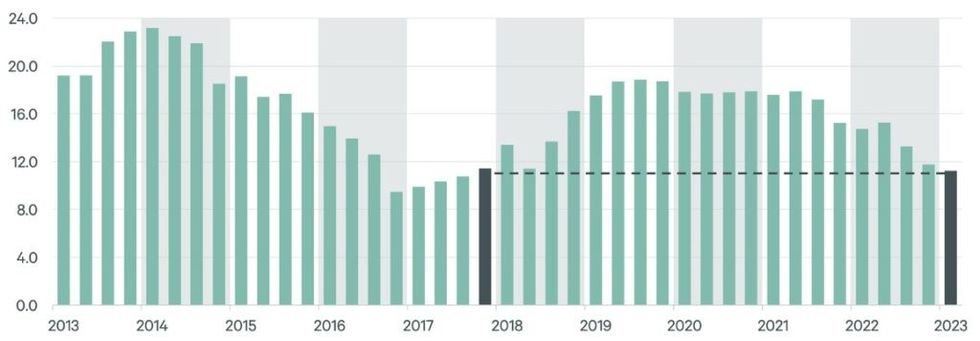

CBRE estimates that there is currently 11.2M sq. ft of office inventory under construction, which has steadily declined beginning in 2021 and is now at its lowest point since late-2017.

The active development pipeline slowdown is even more prominent when zooming in on individual markets, as CBRE data shows that the bulk of projects underway are heavily concentrated in Toronto, Montreal, and Vancouver, which account for over 10M sq. ft alone. Additionally, four markets have no active office construction projects at all.

Much like demand, supply is also looking better out in the suburbs, as CBRE notes that suburban office projects have accounted for 80% of new starts in the last four quarters, based on square footage, whereas they accounted for just 17.4% back in 2018.

Nearly 700,000 sq. ft of inventory was delivered in Q1 in Toronto, Montreal, and Vancouver, and CBRE notes that a majority of it was in downtown.

"The remainder of the year is expected to see an additional 6M sq. ft. of new supply, which would put 2023 above recent yearly deliveries," CBRE says. "The delivery of these spaces is a long time coming, with the majority having commenced construction prior to the pandemic, in 2018 and 2019."

In an interview with STOREYS regarding their own report, which was published last week and showed similar trends, Colliers Senior National Director of Research Adam Jacobs also pointed out that the construction cycle that began just before the pandemic is now coming to an end.

"Things are going to balance out some," Jacobs said. "There was a ton of construction, and work from home, and as the cycle now finishes up, we should see more equilibrium."