Taxing the gains in homeowners’ equity has long been a prickly point of discussion in Canada, one that the federal government has repeatedly denied they’d consider. However, a new report backed by Crown Corporation funds is suggesting just that -- and it’s ruffling quite a few feathers.

The report, which was released by housing affordability think tank Generation Squeeze and funded by CMHC’s National Housing Strategy’s Solutions Labs Program, takes a hard look at Canada’s housing affordability challenges, and proposes several measures to help reign in rampant price growth, which has become particularly acute over the course of the pandemic. A number of major Canadian housing markets experienced record-breaking years in 2021, with both sales and price gains smashing previous benchmarks set in 2016.

Read: Toronto Real Estate Had Its Biggest Year on Record in 2021

This has put pressure on all levels of government to produce policies that will improve housing market affordability and stem speculative investor activity.

Would Tax Homeowners With Values Between $1 -2 Million

The report draws three main conclusions, including tweaks to the CPI measure used by the central bank when setting monetary policy, and establishing a new affordable housing bond to finance the creation of affordable rentals.

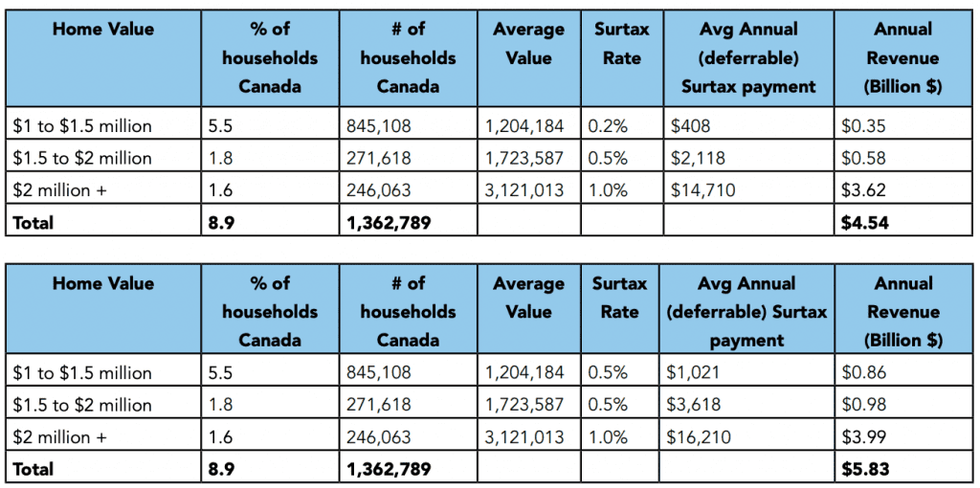

The recommendation causing the hullabaloo, though, is an implementation of an annual surtax on homes valued over $1 million. The tax then increases on a progressive scale based on a home’s value:

- Homes valued between $1 million - $1.5 million: 0.2%

- Homes valued between $1.5 million - $2 million: 0.5%

- Homes valued above $2 million: 1%

Homeowners would have the choice to pay annually, or defer the tax, with interest, until they sell the home. The goal would be to reduce the amount of tax-sheltered funds currently held up in principal residences, which would de-incentivize using real estate as a source of wealth accumulation, rather than as a place to live. Generation Squeeze posits such a measure would bring in $5.83 billion annually, which could then be siphoned into spending for affordable housing initiatives, green co-ops, or into social services such as childcare or long-term care.

According to the report’s calculations, a homeowner with a home valued between $1 million to $1.5 million could expect to pay $408 annually, while those living in abodes worth over $2 million could expect to shell out $14,710. The report suggests this will impact 9% of Canadians, with the remaining 91% of homeowners unaffected.

Possible Surtax Rates and Revenue

Would Taxing Homeowners Help Ease Affordability Concerns?

But could taxing home values -- whether or not they rise during the tax year -- really be a cure for Canada’s market inequalities?

John Pasalis, President of Realosophy Real Estate, tells STOREYS the focus is on the wrong type of taxation.

“I don’t think this really solves anything, and one challenge I think a lot of people have with this issue is the idea of more tax. In this report they estimate that this tax will raise $5 billion a year. But of course, part of this tax can be deferred so most of these gains may not be realized for some time down the road,” he says.

Instead, he recommends government focus should instead shift to raising overall property taxes rather than income taxes, which would take some of the pressure off those without equity, while simultaneously reducing the appeal for speculative investment in the market.

READ: Toronto Continues to Have the Lowest Property Tax Rates in Ontario

“If you lower income taxes, renters effectively get tax relief, because their income taxes are going down, and homeowners get income tax relief, but they end up paying that in their property taxes,” he says. “This is great for renters, and it reduces the desire to use real estate as this asset and speculative investment because you instantly increase the carrying cost to own real estate. So, it basically slows down the rate of growth in home prices, and becomes more attractive for end users, more-so than investors, and I think that’s one of the big differences.”

However, there’s little need for existing homeowners to panic - as Pasalis points out, this is simply a research-based proposal and impending tax shock is unlikely to come, especially given how unpopular any hint of taxing homeowner capital gains has been in the past.

“It is amusing that everyone -- at even the thought of doing research into capital gains on principal residences -- just creates such a media uproar,” he says. “It’s hilarious.”