Rental markets across Canadian cities may have soared over the past year, but when it comes down to it, renting is still, for the most part, cheaper than owning a home. But there are a few exceptions.

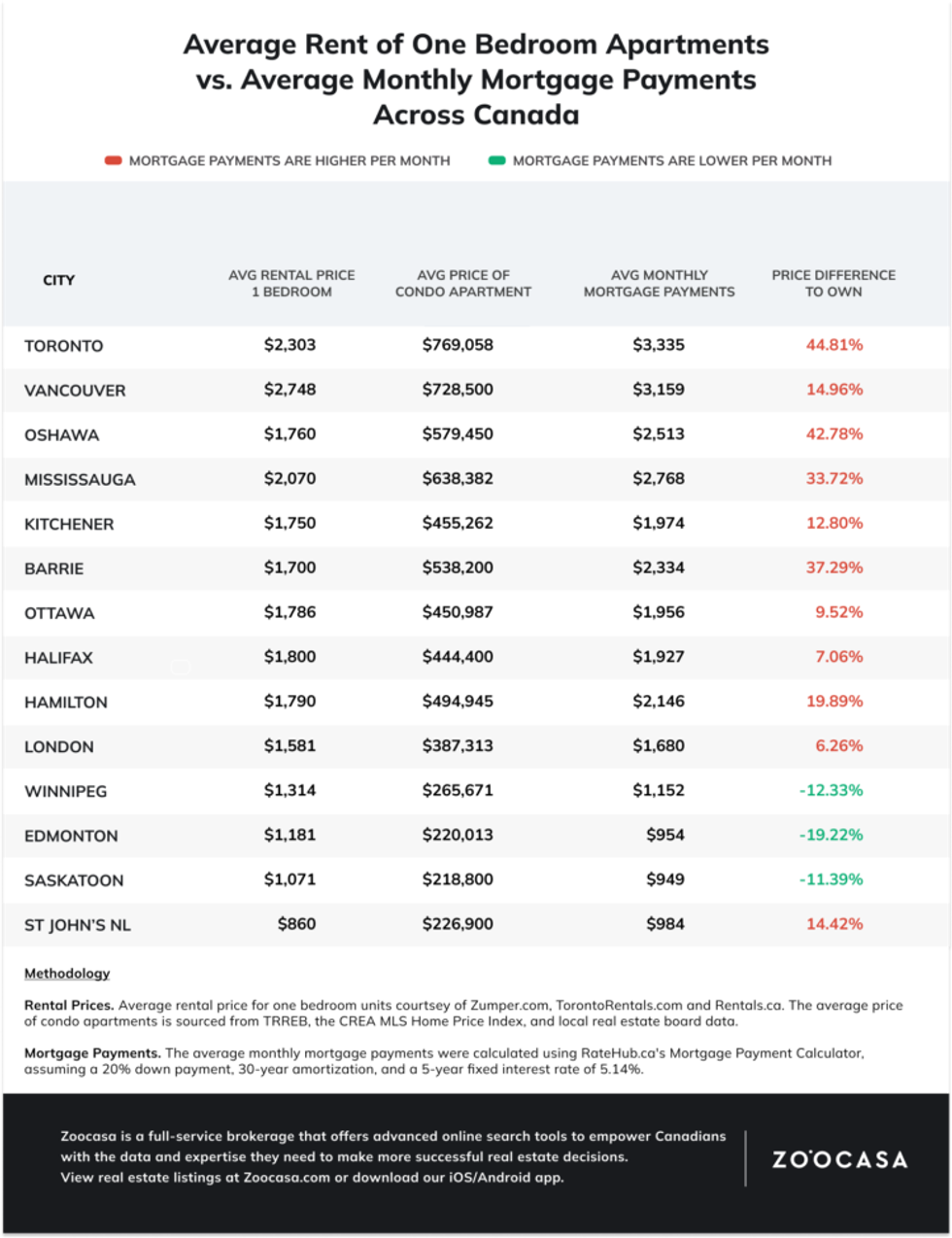

A new report from Zoocasa analyzed the cost of owning a condo apartment compared to renting a one-bedroom across 14 major Canadian cities and found that in three of them, it's actually cheaper to own rather than rent. Those three cities -- Winnipeg, Edmonton, and Saskatoon -- are already known for having relatively affordable real estate prices, making the opportunities to own there even more accessible.

In Winnipeg, the average rental price of a one-bedroom is $1,314. Compare this to the average monthly mortgage payment for a condo apartment of $1,152 and you'll save 12.33% by owning.

Edmonton rental prices average $1,181 per month, which is 19.22% higher than the average monthly mortgage payment of $954 for a condo apartment. And in Saskatoon, rental prices for a one-bedroom average out to $1,071 -- 11.39% higher than the average monthly mortgage payment of $949.

Every other city analyzed for the report was found to have more expensive mortgage payments than monthly rent prices. Even in Toronto where rent prices have ballooned 21% year over year, the average condo apartment, priced at $769,058, will cost you 44.81% more than the average one-bedroom rental. Neighbouring Oshawa had a similar 42.78% discrepancy, with renters paying $1,760 per month compared to an average of $2,513 in mortgage payments.

Over in Vancouver, the country's second most expensive market for condo apartments, the difference between rent prices and mortgage payments is a much smaller 14.96%. According to the report, the average one-bedroom there will run you $2,748 while average monthly mortgage payments come out to $3,159.

Rapidly rising interest rates have had profound effects on both rental and mortgage prices. Continual rate hikes have pushed more and more would-be homeowners into the rental market, leading to greater demand, even tighter supply, and, thus, higher prices.

"The rise in demand for rentals is reflected in the housing market; in September of last year when interest rates were low, there were 9,046 sales across the GTA," the report reads. "This September, we were down to 5,038, a decline of 44%. With that higher cost of borrowing, some are considering rentals as a more financially sound option."

Some will note that rising interest rates have caused home prices to drop in markets across the country, and indeed they have. In the Greater Toronto Area, for example, the average benchmark price was $1,334,544 in February of this year at the peak of the housing market. As of September, it had fallen to $1,086,782 -- a drop of 18.6%. But at the same time, higher interest rates are causing mortgage payments to jump up substantially. A recent report from Ratehub.ca found that homeowners renewing their fixed-rate mortgages in November will likely see their payments jump by 21%.

Although inflation slowed to 7% in August, it is still well above the Bank of Canada's target rate of 2%. With this in mind, experts are anticipating another increase in the overnight lending rate later this month.