[Editor’s Note: This article was updated on November 22 to reflect the fact that the bid by 1000612843 Ontario Inc. failed to close.]

Three years into the receivership proceedings of the troubled Central Park Ajax project, the case has once again hit a snag, with a bid to buy the project that was approved by the Ontario Superior Court having failed to close.

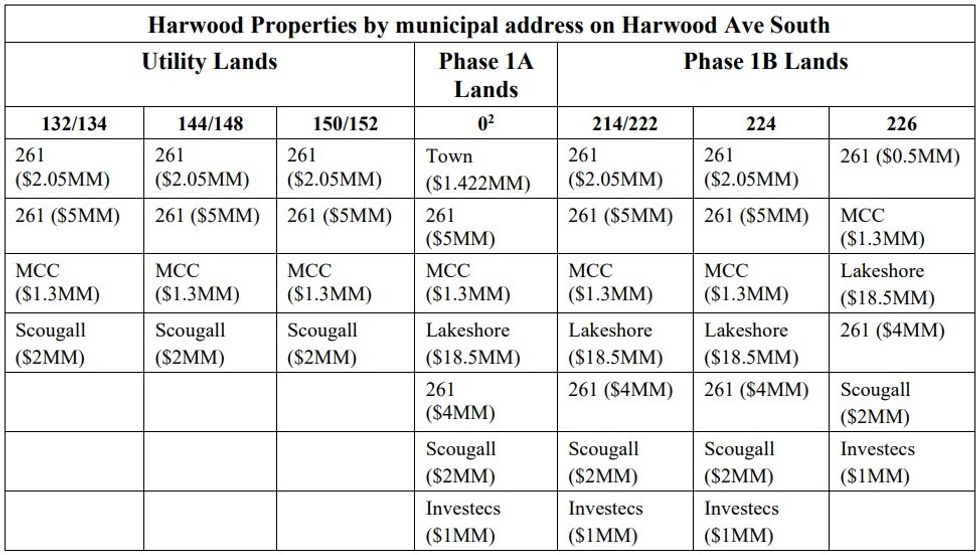

The Central Park Ajax project was set for an aging commercial plaza along Harwood Avenue South, located directly across the street from Town Hall, that consists of 184–188 Harwood Avenue South (referred to as the "Phase 1A Lands"); 214, 224, and 226 Harwood Avenue South (aka "Utility Lands"); and 134, 148, and 152 Harwood Avenue South (aka "Phase 1B Lands").

The lands were being developed by LeMine Investment Group, who owned the properties under Central Park Ajax Developments Phase 1 Inc., 9654488 Canada Inc., 9654461 Canada Inc., 9654372 Canada Inc., 9617680 Canada Inc. and 9654445 Canada Inc., all of which were the subject of the receivership proceedings.

LeMine Investment Group is owned by Tong (Thomas) Liu, who also headed a 26-storey condo tower at 3070 Ellesmere Road in Scarborough called The Academy that was placed under receivership in September 2019. Those proceedings ended with the project being sold to Podium Developments.

For the Ajax site, LeMine had envisioned a multi-phase, 410-unit residential condo complex of two buildings rising 10 storeys each. The development, which would have sat just minutes from the Ajax GO and Highway 401, was extremely successful during pre-sales, but would face financial troubles later on that eventually resulted in legal action being taken by both the developer's lenders and the Town of Ajax.

LeMine v. Town of Ajax

The conflict between the developer and the Town of Ajax first came to light in early-2018, when the developer sought $300 million in damages "arising from alleged breach of contract, defamation, libel, slander, slander of title, and unlawful interference with contractual relations," according to a court decision by Justice A.M. Mullins.

As Mullins describes, the Town had developed a Community Improvement Plan to revitalize its core, which involved certain municipally-owned property being conveyed to developers. The Town entered into a sale-and-development agreement with Windcorp Grand Harwood Place Ltd. for Phase 1A, with Windcorp retaining the right of first offer for future development phases.

The site plan was then approved for two 10-storey residential buildings atop two levels of underground parking. Windcorp then assigned the development rights and obligations to LeMine Investment Group in June 2015, with approval from the Town. LeMine successfully sold a majority of the residential units within two weekends, but later returned to the Town with a project budget increase from $95,845,407 to $107,171,990.

LeMine also asked to modify the building design to add two storeys and the Town agreed to consider the revised site plan, when the partnership then began to sour.

"LeMine wanted the land to be transferred to it, in order to obtain the financing it needed for the project," said Justice Mullins. "Ajax was concerned, understood Mr. Liu, that LeMine would not build the approved 10 storey project if the revised submissions for 12 storeys was rejected and, accordingly was chary of transferring the lands."

Thomas Liu then agreed in writing that it would build the 10-storey project even if the additional storeys were not approved. However, planning staff believed that what LeMine submitted did not constitute a fully-realized site plan application, the back and forth dragged on, and the Town eventually exercised its right under the original sale-and-development agreement to repurchase the lands, citing the developer's failure to commence construction by the deadline outlined in the agreement.

LeMine subsequently sued the Town, claiming that the Town was not entitled to exercise the repurchase right because the deadline was missed as a result of the Town being slow to make a decision on the revision. The legal fight boiled down to the terms of the contract, and Justice Mullins ultimately ruled in favour of the Town, after a five-day trial that began in June 2018. LeMine appealed the ruling, but the appeal was ultimately dismissed.

The Receivership

After the dismissal, the two sides could not agree on a repurchase price, which the Town ultimately sought to determine via legal action, but that litigation was unable to reach a conclusion by the time the properties became the subject of a receivership application in November 2020 submitted by 2615333 Ontario Inc., which held multiple mortgages over the Harwood properties.

According to the Receiver, the Town sought to repurchase the property and delete all of the charges registered on the property, but there was "a significant disparity between the proposed repurchase price on the one hand, and the value of the lands and mortgages to be forfeited on the other." Stakeholders thus objected "on the basis that the proposed repurchase price is unconscionably low and that it will result in unjust enrichment to the Town of Ajax, to the detriment of the other stakeholders."

2615333 Ontario Inc. said demands for payment and Notices of Intention to Enforce Security were delivered to LeMine on November 22, 2018, followed by the issuance of a Statement of Claim to enforce the mortgage security, and that they were owed $10,294,623, which LeMine denied.

According to court documents, on top of the amount owed to 2615333 Ontario Inc., other encumbrances on the property included a $1,422,000 vendor take back mortgage held by the Town and several other charges, at least one of which was also cross-collateralized with LeMine's aforementioned 3070 Ellesmere Road property in Scarborough.

After the receivership application was filed, the Town of Ajax commenced its own receivership application against the property. It later withdrew its application, however, and instead consented to 2615333 Ontario Inc's application, so long as the Town was consulted on the eventual sale, the new purchaser was required to enter into a development agreement with the Town, and the Town retained a repurchase option like it originally had.

The Ontario Superior Court granted the receivership order on April 15, 2021, with TDB Advisory — then known as RSM Canada Limited — appointed as the Receiver, but LeMine immediately appealed the decision, resulting in a stay of the receivership that began on April 26, pending the outcome of the appeal. Prior to the hearing, however, LeMine withdrew its appeal, and the receivership was resumed in February 2022.

The Sales Process

After a long period of time when the Receiver and Town worked out the details and requirements for the new purchaser, the sales process was approved by the Ontario Superior Court in June 2023, with Avison Young chosen as the listing team.

According to the Receiver, "after extensive efforts," 19 parties showed interest and progressed to the point of signing confidentiality agreements. Two parties ultimately submitted bids, but one was disqualified after failing to pay a deposit, and the second was then also not chosen after they asked for a $3 million reduction on the sale price, citing the costs they believed to be needed to prepare building permit plans.

The development agreement with the Town was "not well received by the market," the Receiver said, so the Receiver and Town returned to the drawing board to make revisions, with the Receiver pointing to "inaccurate" representations by the Town regarding how close the project was to obtaining a building permit.

"The Receiver now understands that the Town’s representations were not accurate," the Receiver said in a report in February 2024. "Following the outcome of the Sale Procedure, the Receiver’s Information is now that it would likely take between 6-10 months to obtain a building permit."

The project then went through a new sales procedure, which again ultimately came down to two bids: a bid by 1000612843 Ontario Inc. — an entity related to Lakeshore Luxe Design and Build Group Inc., which holds an $18.5 million charge against the property — and a lower back-up bid by the Town in case the first bid fails to close.

The purchaser agreed to satisfy the purchase price, which was not disclosed, by paying a certain amount in cash and assuming the $18.5 million mortgage on title held by Lakeshore. Further, they agreed to enter into the new development agreement with the Town.

The 1000612843 Ontario Inc. purchase agreement was signed by Anthony De Francesco on behalf of the company and the Ontario Superior Court approved the transaction on October 3, but subsequently failed to close, the Town of Ajax told STOREYS. The Town did not say whether they are proceeding with their back-up bid.