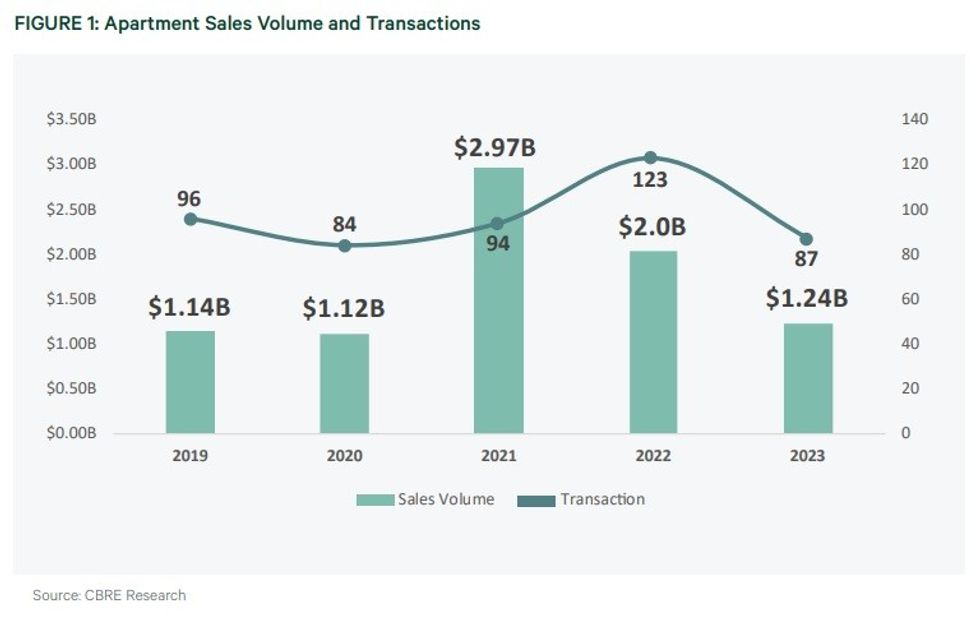

After low amounts of activity in the multi-family market to start off 2023, primarily due to elevated borrowing costs, transaction volume and dollars saw an improvement in the second half of the year, but the year-end totals nonetheless finished significantly lower than in 2022.

According to a report published by CBRE's National Apartment Group this week, a total of 87 multi-family transactions occurred in the Greater Vancouver and Greater Victoria regions in 2023, compared to 123 in 2022 — a 30.3% decline. Transaction dollars also decreased by 38%, from about $2B in 2022 to $1.24B in 2023.

The 2023 totals were also low compared to 2021 with its 94 transactions for $2.97B, but were better than 2020, which recorded just 84 transactions for $1.12B.

According to CBRE, the number of transactions remained relatively the same across both halves of 2023, but the second half of the year saw a notable increase in transactions of over $15M, recording 15, compared to seven in the first half of the year.

Of the $1.24B in sales, a bit over half (53%) came from the private sector, while public REITs accounted for 23%, private institutions accounted for 20%, and governments accounted for 4%.

Of the 87 transactions, 68 were in the Greater Vancouver region (including the Fraser Valley), with the west side of Vancouver seeing the highest number, 22, like it did in 2020 (15), 2021 (52), and 2022 (32). One of the biggest transactions that occured in the west side was for 1450 W 12th Avenue, also known as Chalmers Lodge, which was acquired by BC Housing for $40.5M in April, in a deal brokered by Colliers. All in all, the west side of Vancouver accounted for $162,268,500 in sales.

Downtown Vancouver and the West End accounted for just seven of the 87 transactions, but nonetheless saw the highest dollar amount of all Greater Vancouver submarkets, at $206,565,000. The sale of the Granville Suites Hotel by local student housing developer GEC Living accounted for $70M of that total, in a deal brokered by Avison Young. Another notable transaction was Bosa Properties selling their rental building at 1142 Granville Street, named The Standard, to Concert Properties. The sale price has not been disclosed, but the deal was again brokered by Avison Young.

The eastside of Vancouver accounted for the second-highest number of transactions, 16, and the second-highest dollar amount, $164,449,000. Notable transactions include the sale of the 114-unit building at 1649 E Broadway for $68M, in a deal brokered by CBRE.

The Fraser Valley submarket recorded the highest dollar amount outside of the City of Vancouver, at $120,777,648, with one of the most notable deals being CAPREIT's acquisition of the Parque On Park building in Langley for $53.7M, in a deal brokered by CBRE.

In the Greater Victoria region, a total of 19 transactions occurred and were split relatively evenly across the different submarkets. Notable transactions include the sale of 1233 Fairfield Road in Victoria for $19.6M, the sale of 687 Admirals Road in Esquimalt for $22.5M, and the sale of 1010 McKenzie Avenue in Saanich for $18.5M, the last of which was also brokered by CBRE.

Very notable, however, was the submarket of Langford/Colwood, which despite seeing just four transactions, hit a dollar volume total of $208M — more than any submarket in both the Greater Victoria and Greater Vancouver regions in 2023. Those four transactions were the $34M sale of 3554 Ryder Hesjedal Way, the $43.5M sale of 728 Meaford Avenue, the $60M sale of 2830 Peatt Road, and the $70.5M sale of 2840 and 2850 Carlow Road.

Greg Ambrose, Vice President of CBRE's National Apartment Group in BC, says that in 2024, we can expect to see institutional capital continue to flow from older multi-family buildings to new purpose-built rental buildings, creating acquisition opportunities for private capital to acquire large institutional-quality rental buildings that wouldn't hit the market historically.

"The Canadian multi-family market is one of the tightest property sectors in North America and Vancouver has the lowest multi-family vacancy rate in the country," he adds. "This combined with the growing undersupply of housing and affordability challenges around ownership bode well for multi-family rental fundamentals."