As Canada continues to rebuild the economy from the crippling effects of the pandemic, the nation is turning to the real estate industry for support.

New data from Statistics Canada (Stat Can) shows that real estate commissions and fees as part of real gross domestic product (GDP) reached a new high in March, as housing activity across the country continues to soar while prices are projected to escalate further.

This comes as the Canadian Mortgage Housing Corporation (CMHC) predicts that national home prices will continue their upward trajectory. The average selling price of a home is expected to increase 14% to $649,400 in 2021, from $567,699 last year. The national housing agency also forecasts property resales could climb as much as 9% to 602,300 units over the same period.

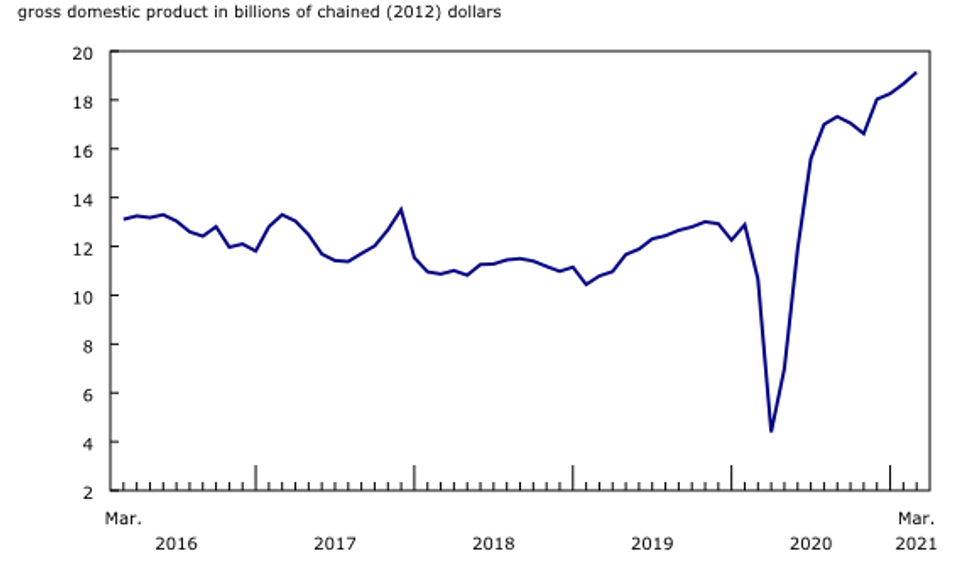

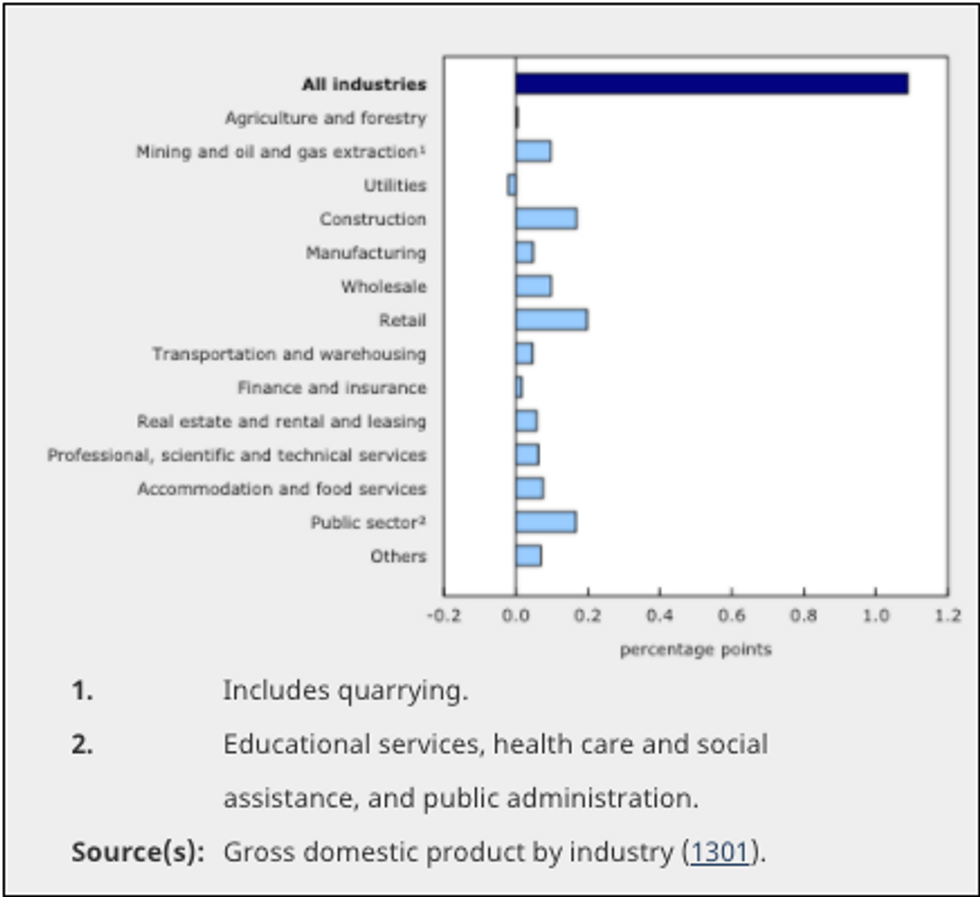

Stat Can says GDP grew 1.1% in March, following 0.4% growth in February, marking the 11th consecutive monthly increase that continued to offset the steepest drops in Canadian economic activity on record observed a year prior. However, total economic activity was about 1% below the level observed in February 2020, before the COVID-19 pandemic.

READ: National Home Sales Fell ‘Broadly’ in May, Following Low Seller Turnout

In March, professional service industries experienced notable growth, including legal services, which Stat Can says derives much of their activity from real estate transactions, growing 1.2%.

Continued increases in home resale activity in Ontario and Western Canada pushed the level of activity at offices of real estate agents and brokers up 2.6% to yet another all-time high in March.

According to Stat Can, Canadian real estate commissions and fees hit a record high in the latest GDP data, with seasonally adjusted commissions and fees reaching $19.14 billion in March, up 2.56% from a month before. This is 79.7% higher year-over-year and up 77.47% from March 2019.

When looking at GDP for Q1-2021, Stat Can says the real estate and rental and leasing sector rose 1.3% as increases in the majority of subsectors contributed to the growth. Continued strong home resale activity in many markets across the country pushed activity at the offices of real estate agents and brokers up 8.4% to record-high levels during this quarter.

While March showed continued growth, Stat Can says preliminary information indicates an approximate 0.8% decline in real GDP in April, the first decline since April 2020.

The declines were felt mostly in retail trade and accommodation and food services and in part of additional public health measures coming to effect in some parts of the country. Stat Can says there are also notable declines in manufacturing, real estate and rental and leasing, and educational services.

However, Stat Can says this estimate will be revised on June 30 with the release of the official GDP data for April.