Property technology platforms have exploded across Canada over the past decade, with a steady stream of new additions coming onto the scene every year.

From technology to 3D print homes to AI-driven realtor recommendation platforms, these proptech ventures are drumming up quite the interest, and with that comes quite the financial investment. A new analysis from Proptech Collective of the roughly 500 active proptech startups in Canada found that over the last year and a half (since June 2022), these companies have raised over $1.5B.

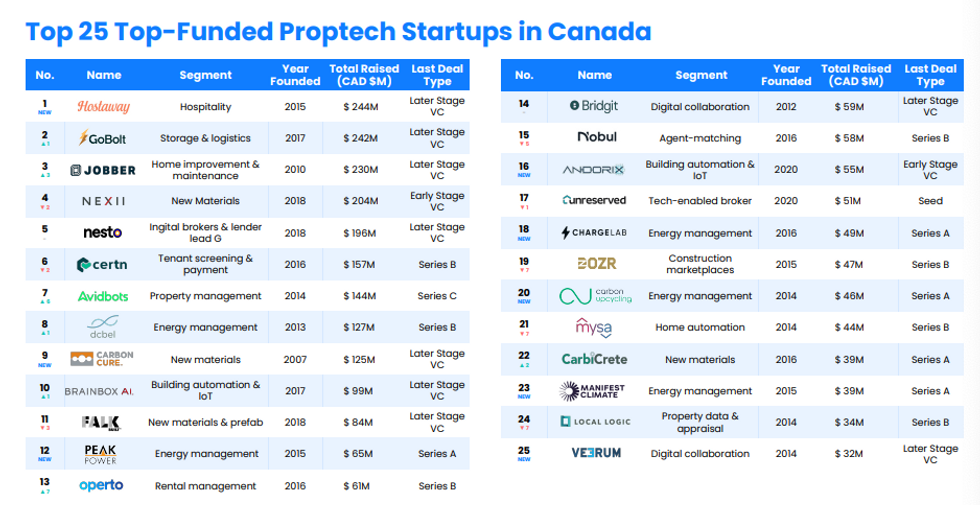

The top six companies alone are responsible for the vast majority of that capital, raking in over $1.1B collectively. Leading the pack is vacation rental software Hostaway, with $244M raised. It's followed by logistics platform GoBolt with $242M, home services booking platform Jobber with $230M, sustainable builder NEXII with $204M, and online mortgage lender Nesto with $196M. Rounding out the top six is tenant screening and payment platform Certn with $157M.

Even amidst these lofty financial achievements, the report notes that in today's more challenging macro-environment, proptech founders are having to adjust to longer fundraising and sales cycles. Founders are less focused on valuations, and rather are zoning in on finding "true partners," the report says. Some are even having to adjust their sales strategies, opting to sell into stronger performing sectors within real estate instead.

"It’s definitely been a harder market for startups, so many are focused on bringing their business back to basics," said Raj Sing, CEO and Founder of deal management software Altrio. "At the same time, we still have to be ambitious - we’re here to create the future, not wait for it."

On the investor side, the report notes that greater success has been seen from investing in proptech founders who "have intimate knowledge of the market they're serving." As well, venture capital investors, knowing that playing a long-term game is important, are also looking for "companies and teams that can weather these cycles."

Proptech in general is tricky business, as real estate is "fragmented by location, asset type, property characteristics, and more," Proptech Collective notes. Many real estate companies have tried to develop in-house technology but with mixed results, pushing many to evaluate what tech they'd like to own and where they'd rather partner with third-party solutions.

"There is rarely a silver bullet, so thoughtful road mapping is necessary before rushing into a solution," the report reads, also noting that "the macroeconomic climate is a motivator and a deterrent to invest in new technology. It can make processes better, faster, and more accurate, but it’s challenging to give mindshare or budget to these initiatives. It’s a delicate balance that organizations are grappling with."

Through conversations with proptech founders, real estate leaders, and VC investors, the report lays out four key future trends that stood out: decarbonization, affordability, AI, and integration and consolidation.

Leaders shared concerns about the effects of climate change, and are placing a stronger emphasis on carbon reduction initiatives and climate-forward technology. To address affordability, proptech advancements have been made in co-ownership platforms, alternative financing, and modular or prefabricated construction.

As the world marches forward with AI, the proptech sector is embracing it with the automation of repetitive processes, scenario analysis for development planning, generative AI for architectural design, and machine learning for predictive modelling on building operations.

As for integration and consolidation, the real estate industry is continuously looking for ways to create a more holistic experience for customers with broader data sharing across their systems.