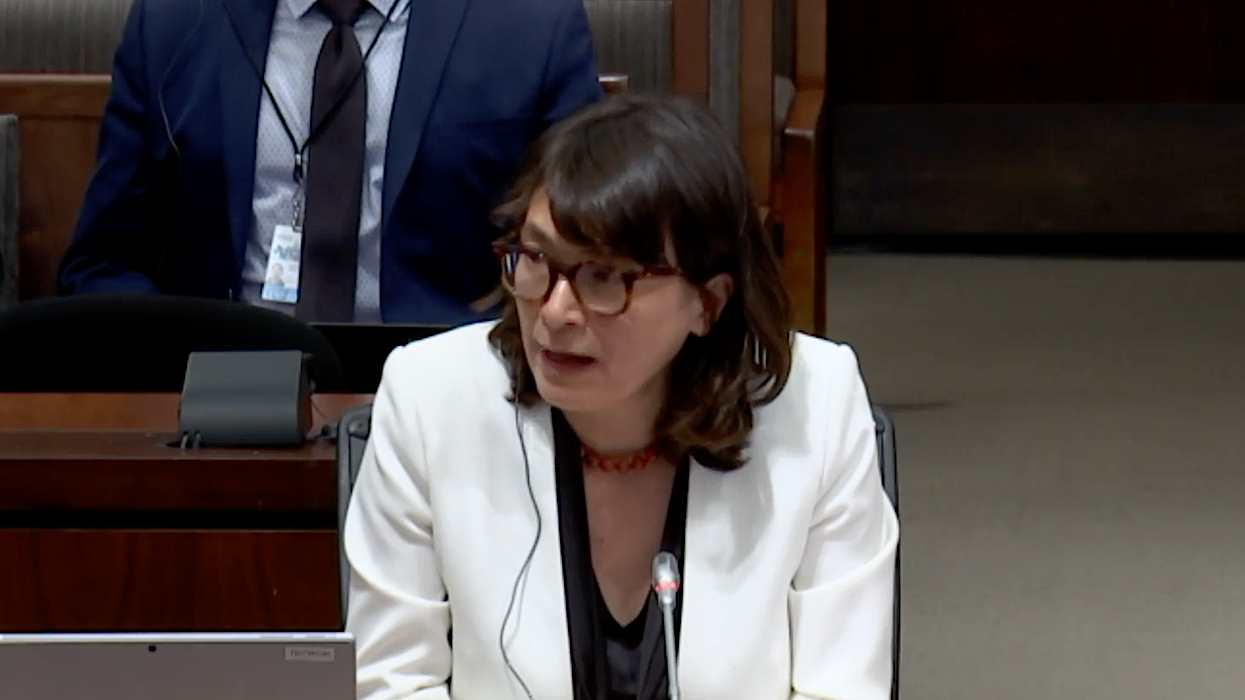

President and Chief Executive Officer of the Canada Mortgage and Housing Corporation (CMHC), Romy Bowers, spoke at the House of Commons’ Standing Committee on Monday and offered some insights into where Canadians stand on their mortgages.

“We are a mortgage insurer, so we have a pretty good sense of the state of the mortgage market by monitoring our balance sheet. And we're very conscious of the impact that high interest rates are having on Canadians,” said Bowers, who confirmed over the weekend that she will be stepping down from her role with CMHC at the end of this year.

On the crown corporation’s books, there are presently around 6,000 households with “highest risk mortgages” given today’s interest rate realities, translating to about 2% of all mortgages insured by CMHC.

While Bowers said that those 6,000-some households are at the “greatest exposure of loss,” she also said that she doesn’t believe the country is in for a wave of mortgage defaults. However, a “large spike in unemployment” could change that, she added.

“Our arrears are at historic lows. And as long as the employment picture is strong, we do not anticipate defaults.”

Bowers additionally stated that the number of Canadian mortgages in arrears is now at 0.25%. (That figure is down from 0.5% in December 2022.)

“It's very low, partly because house prices continue to increase in some markets, people have more equity, and the employment picture for homeowners at least is very strong,” Bowers explained.

Despite the fact that mortgage arrears are reportedly down, it’s certainly worth noting that many borrowers are tapping into longer mortgage amortization periods — an option that is now being offered quite commonly by lenders, so long as the initial downpayment has been made — which is helping to keep heads above water.

RBC said in its third-quarter report to shareholders that 43% of its residential mortgages now have amortization periods exceeding 25 years. Meanwhile, Toronto-Dominion (TD) Bank’s third-quarter report showed that 48% of its mortgages now have amortization periods greater than 25 years.

Both RBC and TD have reported a spike in amortizations being extended to more than 35 years. The typical amortization period in Canada is 25 years.

- Majority Of Borrowers 'Concerned' About Future Mortgage Renewals ›

- CMHC Head Romy Bowers To Step Down After 9 Years With The National Agency ›

- 60% Of Canadian Mortgages Set To Renew In The Next 3 Years ›