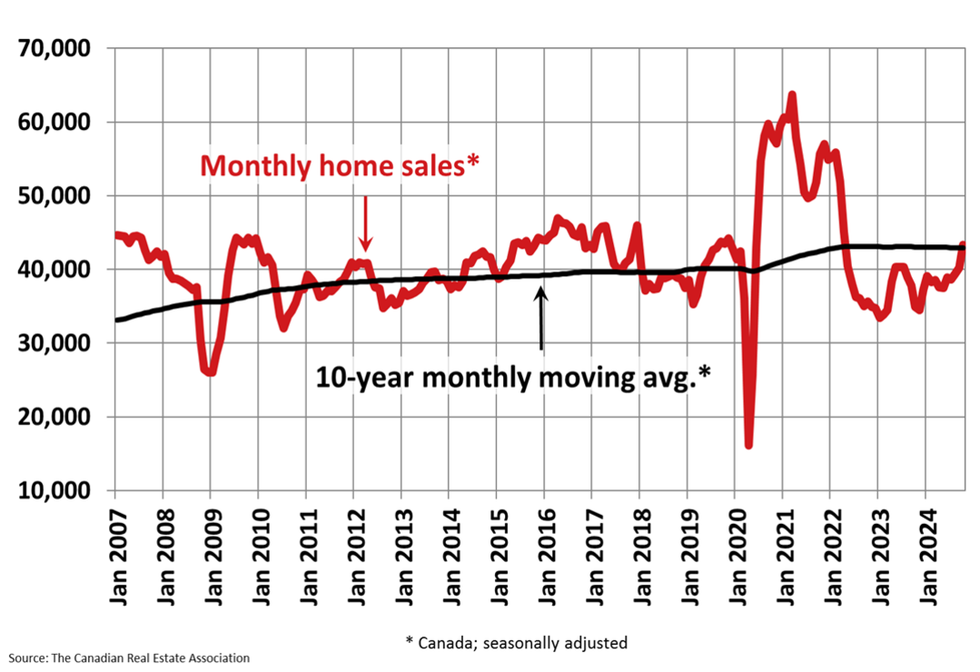

After Toronto and Vancouver real estate boards posted striking year-over-year increases in home sales for October — 44% and over 30%, respectively — it appears they're not alone, as the Canadian Real Estate Organization (CREA) reported Friday that nationwide sales in October were the highest they've been since April 2022.

All in all, sales rose 7.7% on a month-over-month basis and a grew a substantial 30% from October 2023, on a not-seasonally-adjusted basis. In comparison, sales only rose 1.9% month-over-month in September and 1.3% in August, representing a potential breaking of the 'holding pattern' that has characterized the last several months, despite consecutive rate cuts.

Though the Bank of Canada (BoC) has delivered four interest rate cuts since June, including a healthy 50-bps cut in October, CREA is attributing the growth to a jump in listings.

“The jump in home sales last month was definitely an October surprise, although with the big interest rate cut of 50 basis points announced during the last week of the month, the increase was more likely related to the surge in new listings we saw in September,” says Shaun Cathcart, CREA’s Senior Economist. “There probably won’t be another rush of new supply like that until next spring, and at that point, mortgage rates should be close to their expected lows, as well. With that in mind, you can think of the October numbers as a sort of preview for what we might expect to see next year.”

After 'surging' by 4.8% in September to 185,427, new listings fell 3.5% month over month in October to 174,458 active listings, representing an 11.4% increase from last year. The dip was led by a drop in supply in the GTA, but thanks to the September growth, new supply remains at some of the highest levels since mid-2022, according to CREA.

As a result, we saw a tightening of the sales-to-new listings ratio in October to 58%, up from 52% in September, with sales rising and listings falling. For reference, balanced housing market conditions typically experience a ratio between 45% and 65%. Currently, the long-term average is 55%.

Now, we can expect 3.7 months of inventory on a national basis, down from 4.1 months at the end of September and the lowest level in more than a year, skewing us slightly closer to a sellers' market, which begins when inventory gets below about 3.6 months.

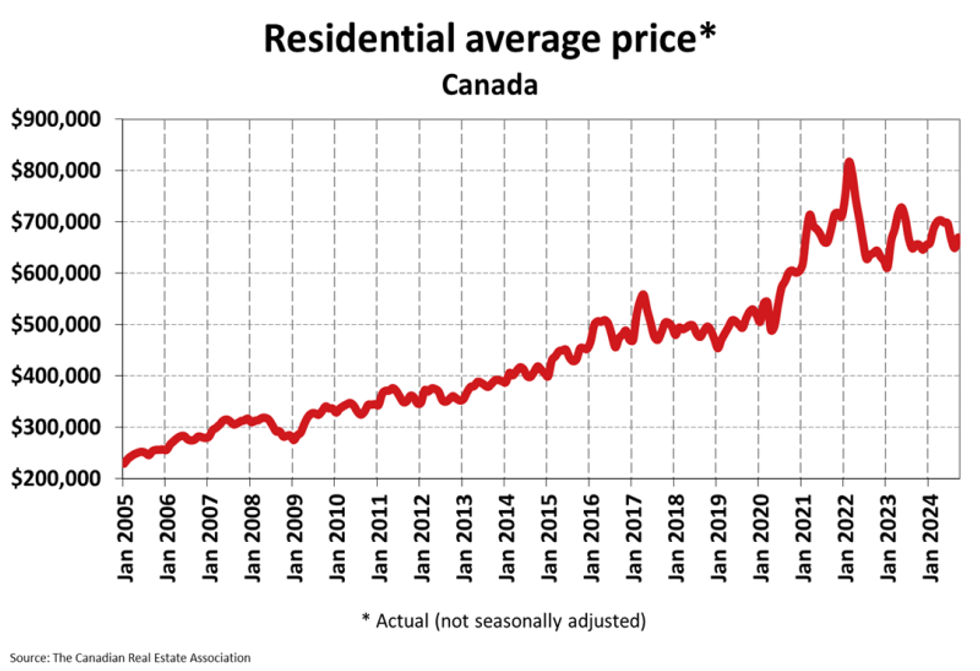

As for home prices, the National Composite MLS® Home Price Index (HPI) ticked down 0.1% from September, keeping in line with the relatively stagnant home prices we've seen since the beginning of the year. On a non-seasonally adjusted basis, the HPI was down 2.7% from October 2023, but on an actual basis, it's up 6%, landing us with an average national home price of $696,166 in October, up from $669,630 in September.

Moving into the the end of 2024 and beyond, CREA's Chair James Mabey says the continuation of October's positive sales trends will come down to listings.

“October’s strong sales numbers across Canada suggest buyers have been in the market since rates began to fall in early summer, but they were waiting for the right property to come up for sale, which didn’t happen in a big way until September,” says Mabey. “The extent to which that will be able to continue between now and next spring will depend on the number of listings coming onto the market."

- Metro Vancouver Real Estate Markets On The Upswing After Rate Cuts ›

- Rate Cuts Taking Hold In GTA, Home Sales Jump 44% From 2023 ›

- Canadian Home Sales Inch Up In September, Rebound Still Expected For 2025 ›

- New Home Sales "Notably Low," Down 60% From Last October ›

- Canadian Home Sales Up 26%, Pointing To “Active” Winter Market ›

- Canadian Home Sales Dip In December, To Surge In Spring ›

- Canadian Home Sales Dip In January Amid Tariff Uncertainty ›