With more interest rate cuts "all but guaranteed" for the coming months, sales ticked up — though nominally — in August as would-be-homebuyers continued to hold out for lower rates, shows findings from the Canadian Real Estate Association's (CREA) August statistics report.

“Despite some fledgling signs of life to kick off the long-awaited monetary policy easing cycle, Canadian housing market activity still looks to be stuck in the same holding pattern it’s been in all year,” said Shaun Cathcart, CREA’s Senior Economist. “That said, with ever more friendly interest rates now all but guaranteed later this year and into 2025, it makes sense that prospective buyers might continue to hold off for improved affordability, especially since prices are still well behaved in most of the country.”

So let's assess the damage of Canadian consumers' steadfast self-control.

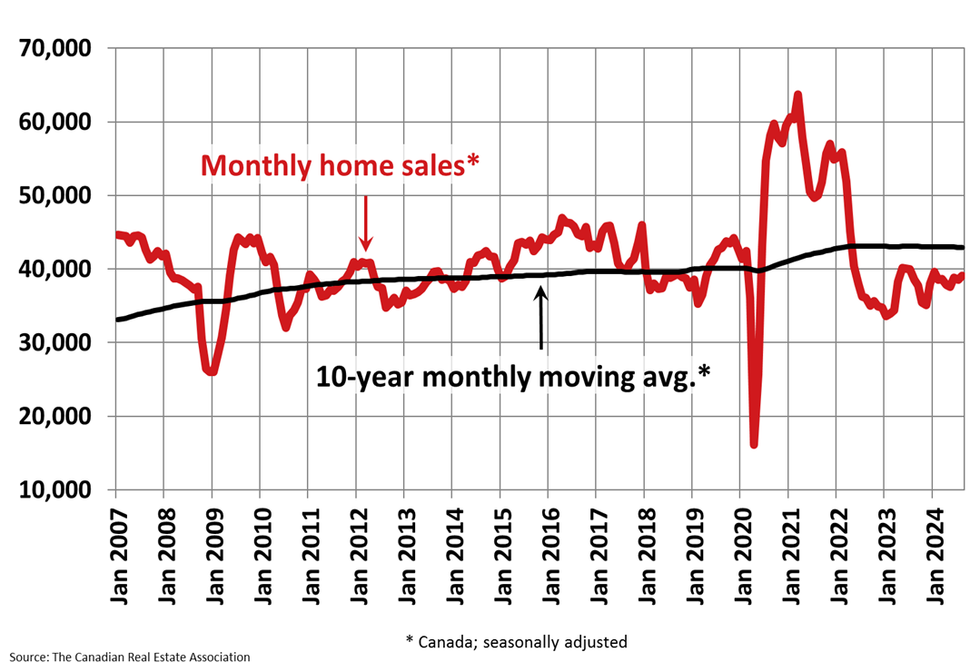

Year over year, home sales were down 1.9% in August, though they did inch up 1.3% on a month-over-month basis — their highest level since January and their second highest in over a year, according to the report. On the supply side, new listings increased by 1.1% from July, driven by a "much-needed boost" in Calgary. This increase brought the total number of properties listed for sale to 177,450 by the end of August, up 18.8% from the prior year but still 10% below the 200,000 listings typically recorded this time of year.

With listings outstripping sales again this month, the new national sales-to-new listings ratio now sits at 53%, continuing a holding pattern of ratios in the low 50s that has persisted since April of this year. “With more interest rate cuts now expected between now and next summer, the stage is set for a faster return of demand, but we’re clearly not there just yet,” said James Mabey, Chair of CREA.

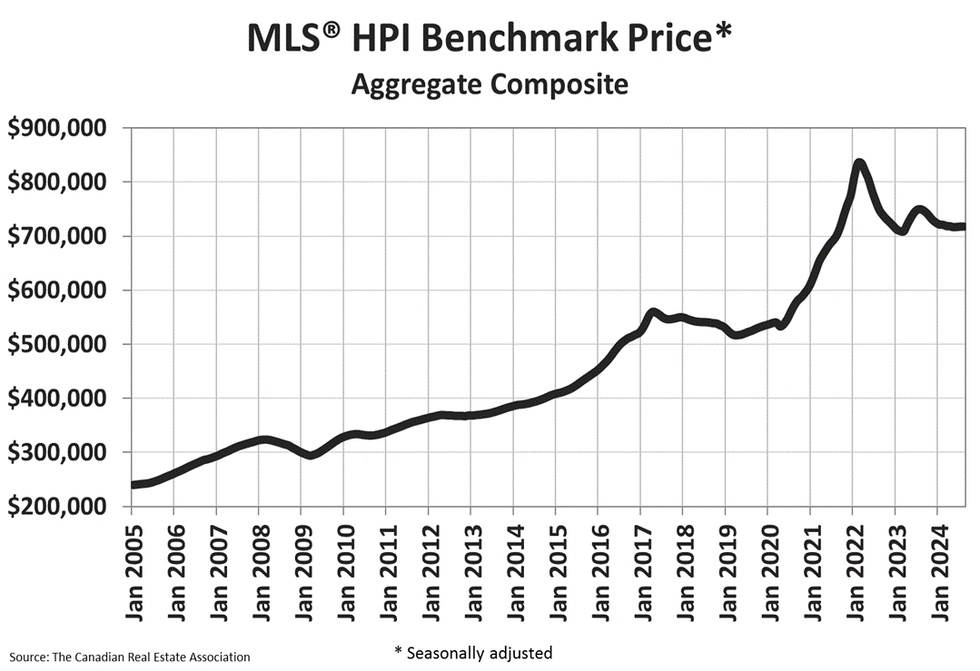

On the inventory front, we're sitting at 4.9 months, down from 4.2 in July but continuing the nearly year-long holding pattern of inventory hovering between 3.8 and 4.2 months. And reflecting this relative stagnation, the National Composite MLS® Home Price Index (HPI) went essentially unchanged from July to August, with the actual (not seasonally adjusted) national average home price now at $649,100, compared to $667,317 in July.

While prudent Canadians await the lower interest rates essentially guaranteed by the Bank of Canada, for the moment, the housing market continues to operate at a relative standstill. According to the report, "National home sales increased in June following the Bank of Canada’s first interest rate cut since 2020, and activity posted another small gain in August on the heels of the second rate cut in late July, but the bigger picture appears to be a market mostly stuck in a holding pattern."

- Bank Of Canada Cuts Interest Rate For Third Consecutive Time ›

- 70% of GTA Homes, 80% Of Condos Selling For Below Listing Price ›

- Fall To See Softer Home Prices, More Multiplexes Hitting The Market ›

- Canadian Housing Starts Dropped 22% In August ›

- August New Home Sales See Another "Historically Low" Month In The GTA ›

- Home Sales Inch Up In September, 2025 Rebound Still Expected ›