A new report shows just how much the Canadian housing market is softening. CIBC economists Benjamin Tal and Katherine Judge said on Wednesday that the market is in “recessionary territory” and facing “the most significant test since the 1991 recession.”

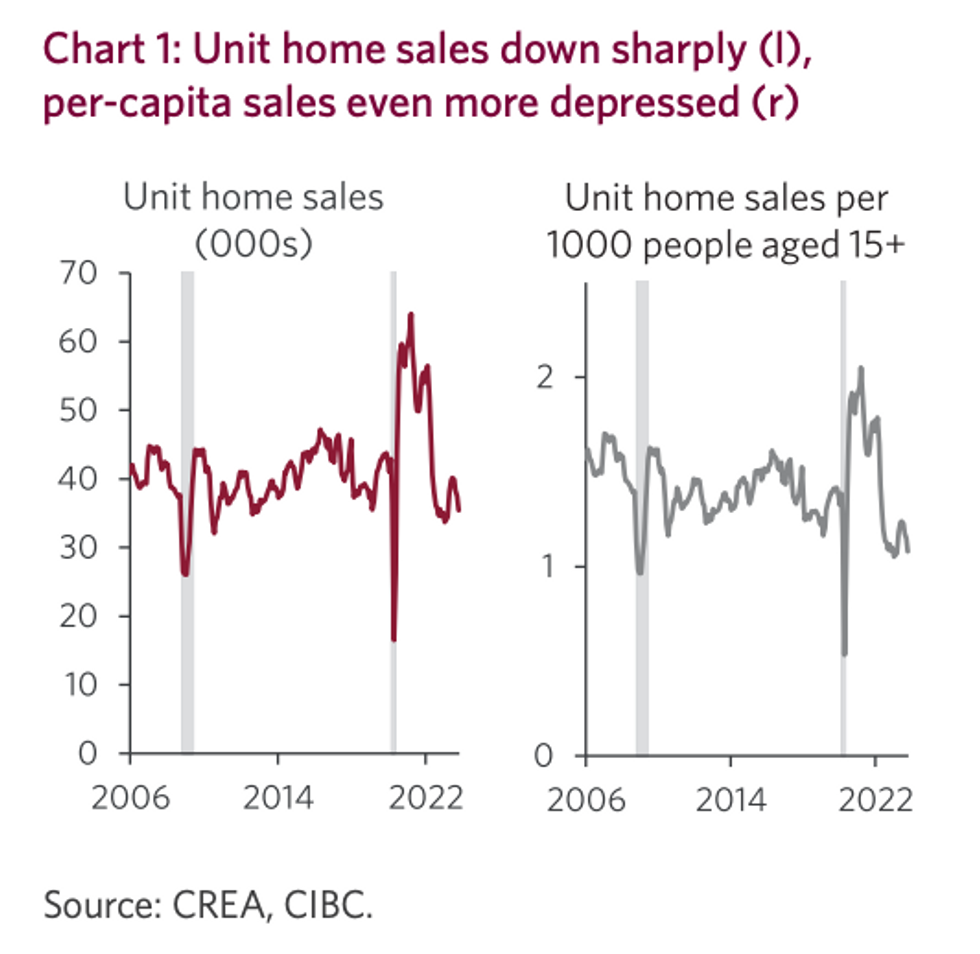

“Unit sales reached a peak of 64,000 in early 2021, and are now down by 45%, leaving them 12% below their pre-pandemic decade-average level,” says the report. “In per capita terms, activity looks even more depressed, with sales at lows not seen since the 2008 recession, outside of the early Covid lockdowns.”

They add that activity is expected to “deteriorate further” in the first half of 2024 amid elevated interest rates and as supply “floods the market.”

“The weakness is pronounced in overvalued centres where debt service burdens are high, namely Toronto and Vancouver, causing a free fall in unit sales in those cities,” says the report. It additionally notes that, on the contrary, unit sales are running above pre-pandemic levels in the Atlantic and Prairie regions, with the exception of Halifax and St. John.

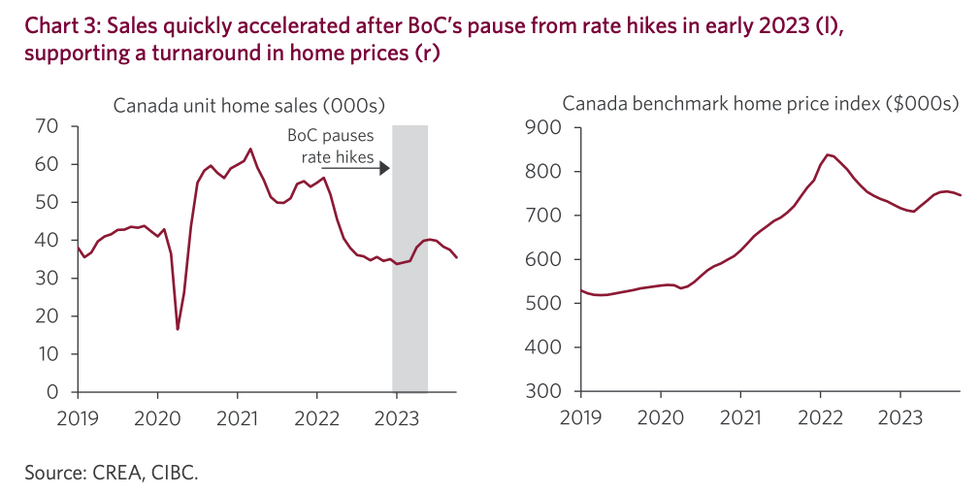

“Still, we expect the downward pressure to get worse before it gets better. While the Bank of Canada has likely reached its terminal rate of interest, we do not expect a repeat of the speedy recovery seen immediately following the pause in rate hikes announced in January.”

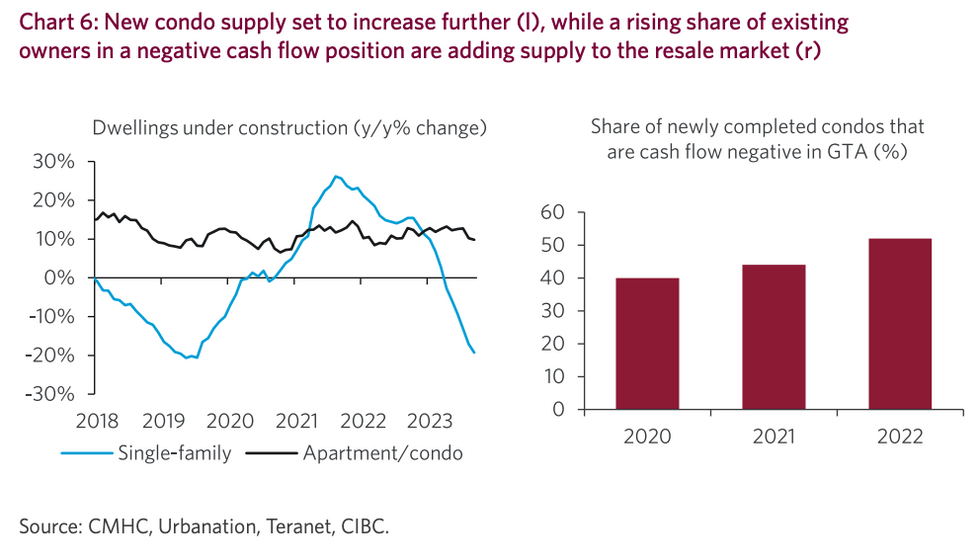

The report also says that the Canadian condo market is anticipated to “soften the most” in the coming quarters.

“While the recent slowing has led to a notable decline in the number of low rise units under construction, that’s not the case in the condo space, where the number of units under construction is up by no less than 10% year over year,” it says.

"Adding to that new supply is increased selling in the resale market, as investors (mostly of multiple unit holders) are listing aggressively due to growing negative cash flow positions. Indeed, rent is increasing strongly at 7% year over year, but mortgage interest costs are escalating by 31% year over year, making owning financially unfeasible as an investor."

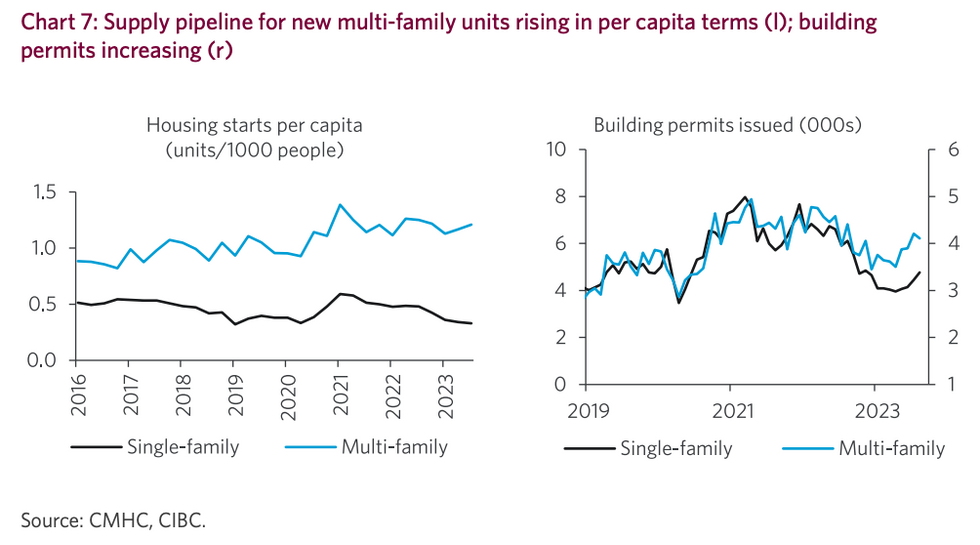

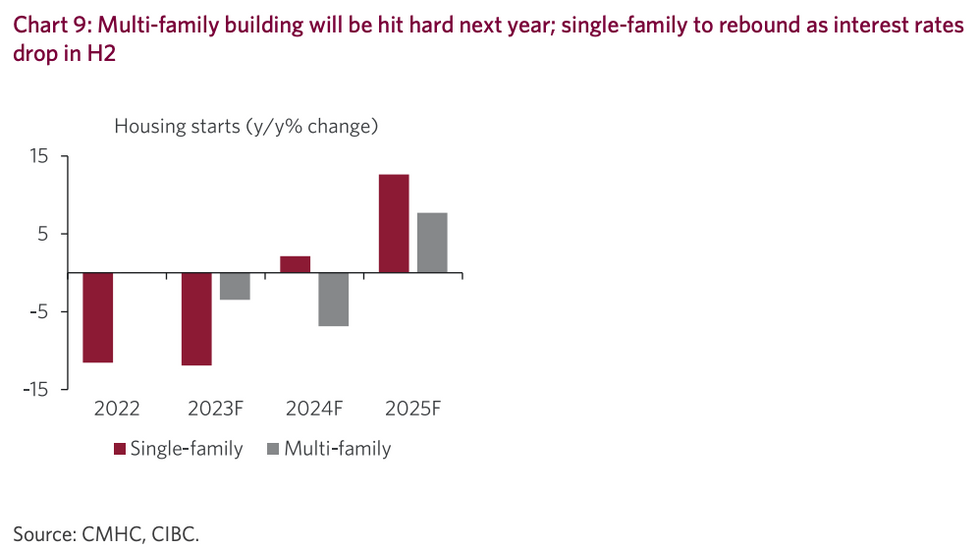

Similarly, Tal and Judge note, new construction data has revealed a rising trend in multi-family construction per capita "despite a deterioration in demand from investors." This comes in contrast to the pull back seen in the single-family market, which further hints at the condo space feeling the bulk of the weakness ahead.

"However, the recent drop in condo presales in Toronto implies a slowdown in building ahead despite permit issuance trends," the report notes.

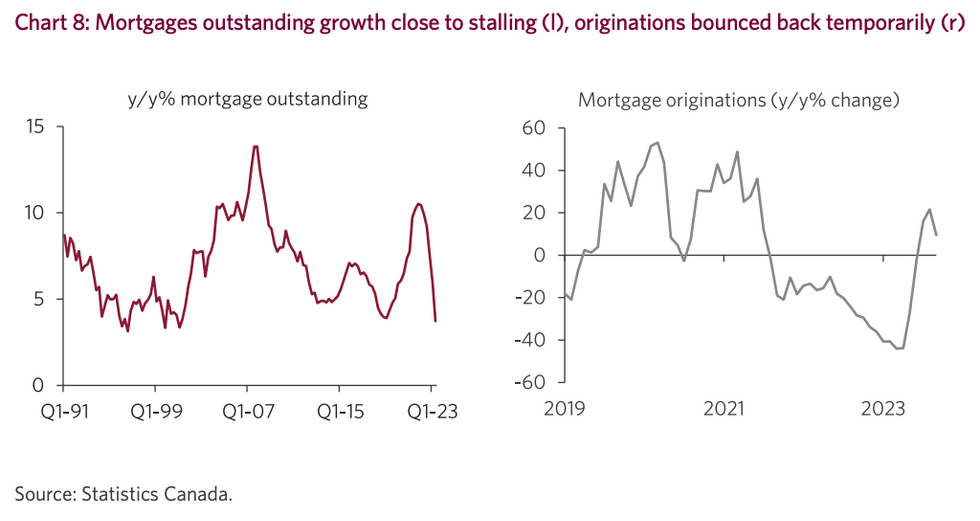

The report also draws attention to the fact that, more broadly, the mortgage market is currently “a shadow of its former self.”

“With the number of mortgages now slightly below its year-ago level, and mortgages outstanding growth plummeting in year-over-year terms, reflecting the drop in originations in 2022-23, and smaller mortgages on average,” it says.

“In fact, the current pace of slowing in mortgages outstanding is the fastest on record. While mortgage originations turned higher temporarily in the summer months, as signs of the overnight rate peaking presumably attracted some buyers back into the market, that move hasn’t been sustained based on the more timely unit sales data.”

The report then notes that although mortgage delinquency rates are currently low and “well below” pre-pandemic levels, the coming months will bring “a further rise in the unemployment rate along with widespread mortgage renewals at higher interest rates,” which presumably could result in a further increase in delinquencies.

“With listings on an upward trajectory, and demand from strong population growth and a relatively tight labour market eroded by high interest rates, housing market activity will continue to deteriorate. Caution amongst investors will account for a significant portion of the slowing, as investors account for almost one third of home sales and are highly leveraged.”

Condo sales and prices “will see the most significant damage” going forward, according to CIBC, with sales expected to fall between 10% and 15% by the first quarter of 2024.

“Homebuilding will retreat further, particularly in the condo space where presales have dropped off, which will make a tight rental market even tighter. As the Bank of Canada begins cutting interest rates in 2024, demand will start to recover, particularly in the second half of the year and into 2025, resulting in a rebound in home prices.”