The Canadian rental market, more or less, picked up in 2024 where it left off in 2023, says Urbanation President Shaun Hildebrand.

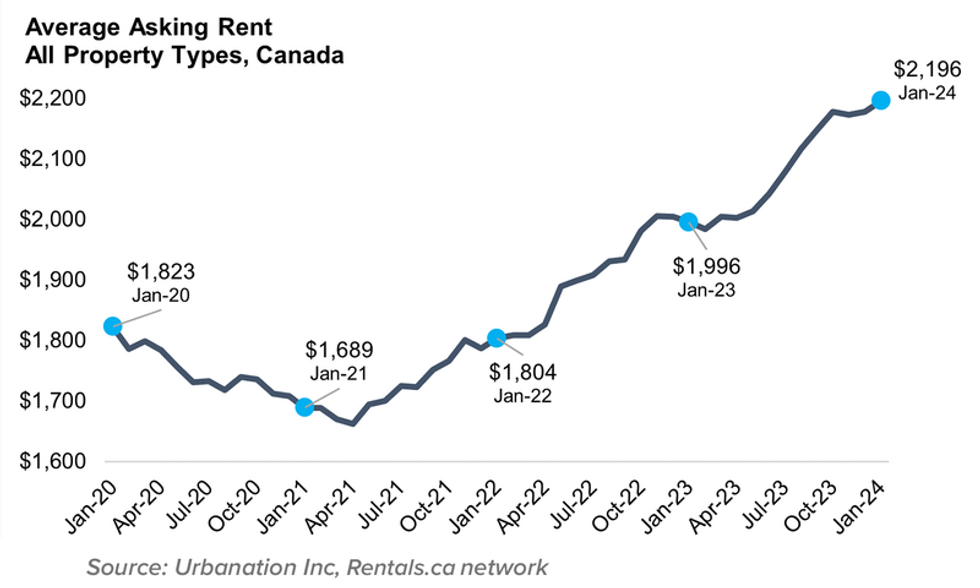

Hildebrand points out that the national asking average rent across all property types struck yet another ‘new high’ in January — as has been the trend for months now — clocking in at $2,196 according to new national data from Rentals.ca and Urbanation.

To put that price in perspective: it’s up 0.8% from the month prior and 10% from January of last year.

Meanwhile, the data shows that average asking rents have been edging up by around 20% on average (or $373 per month) since January 2020 (before the onset of the pandemic lockdowns).

“However, an underlying narrative has emerged between softening rents in expensive markets and strengthening rents in more affordable markets,” Hildebrand also warns. “These shifts in demand are symptomatic of a worsening supply situation for rentals in Canada.”

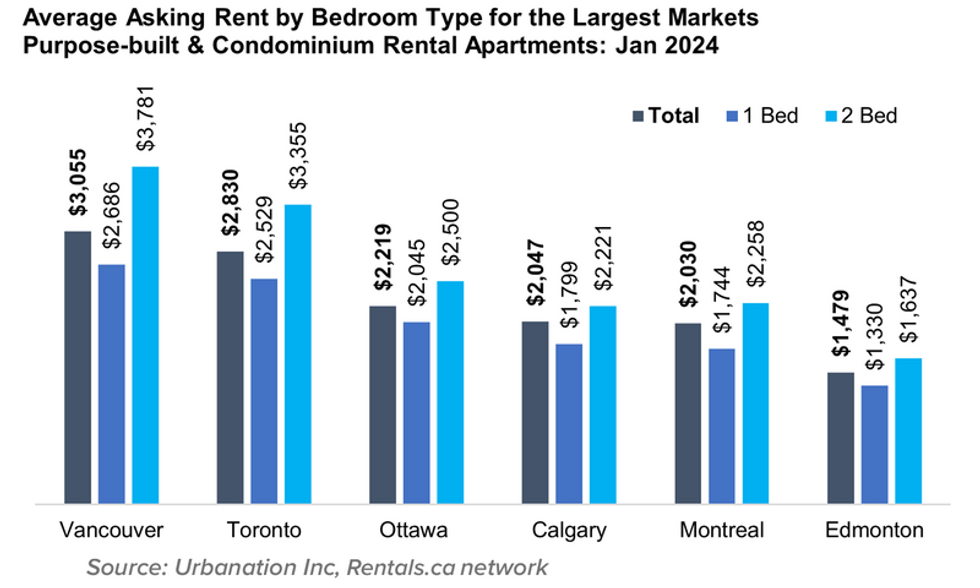

Hildebrand's sentiments on the latest rental market data underscore a narrative that has been building since at least the fall: Toronto and Vancouver remain two of the priciest rental markets in the country, yet rent growth in both markets is either slowing to a crawl or reversing course completely as affordability challenges have mounted.

As of last month, the asking average rent in Toronto is $2,830, and that figure has edged up just 2.4% over the past year to $2,830. Meanwhile, in Vancouver, the average asking rent, at $3,055, is actually down 3% compared to its year-ago measure.

In stark contrast, the major Canadian markets known for their enduring affordability continue to observe dramatic rent appreciation. In Calgary, the average asking rent has jumped up 12.8% year over year to $2,047. Meanwhile, rent growth recorded in Edmonton has sailed past Calgary’s level with an annual rise of 17.1% to $1,479.

In addition, rents have appreciated 9.1% year over year in Ottawa and 9.5% year over year in Montreal.

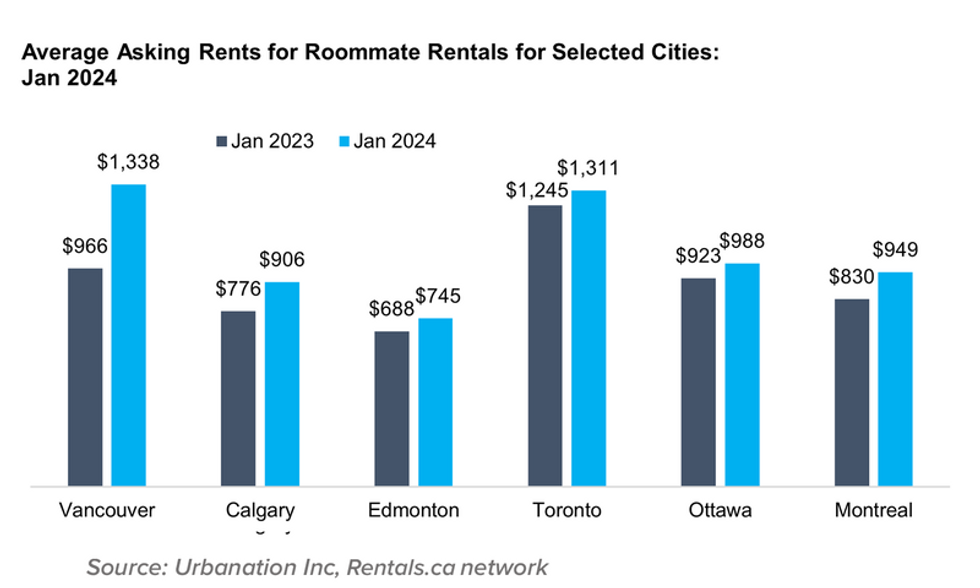

In spite of the reality that rent growth is slowing in both Toronto and Vancouver, “roommate rents” continued to swing unequivocally high last month, clocking in at $1,311 and $1,338 in those respective markets. Again, in those respective markets, rents for shared accommodations have shot up more than 5% and 34% year over year.

Roommate rents have also picked up some steam in Calgary, Edmonton, Ottawa, and Montreal. In those markets, rents for shared accommodations are up around 17%, 8%, 7%, and 14%, respectively.

On a national basis — and more specifically, across four major Canadian provinces: Ontario, British Columbia, Alberta, and Quebec — rents for shared accommodations struck a new high last month, sailing past the $1,000 mark for the first time on record.

Last month’s rendition of this report forecasted that, more broadly, Canadian rental markets will become “somewhat more balanced” with interest rate cuts and as home-buying activity picks back up, and more recently, TD Economist Rishi Sondhi has made predictions in a similar vein. He writes in a recent note that national rent growth is “likely to cool” in the coming years — to some degree, at least.

“We’d be hesitant to pencil in too much softness given the prospect of a resilient economy, the fact that rent growth doesn’t typically swing much year-to-year, and the likelihood that population growth remains firm, despite economic and regulatory headwinds,” says Sondhi.

“Rent growth in the purpose-built space could cool to 5% to 6% this year from 8% in 2023. Meanwhile, growth in the more expensive condo space could be slower, given indications that gains are already easing in markets like Toronto amid rising supply and stretched affordability.”