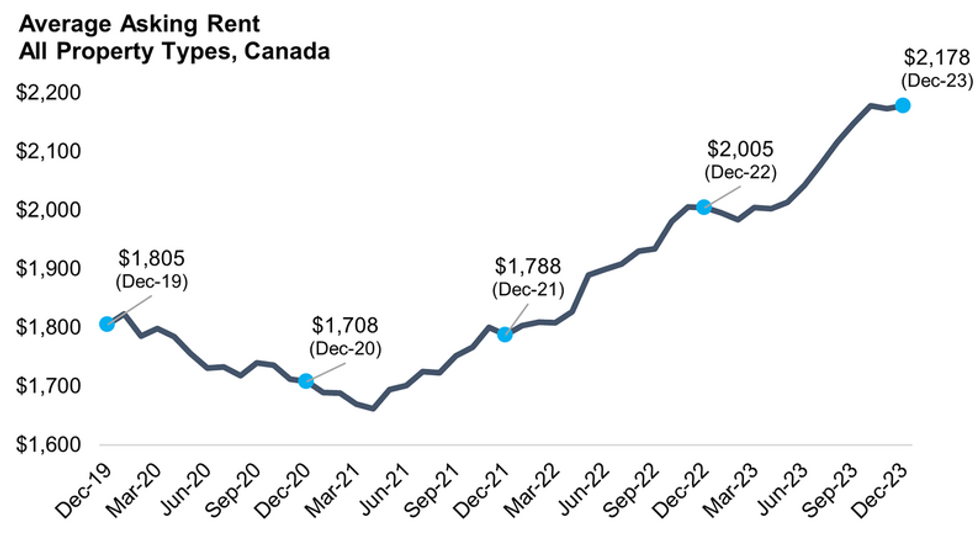

Canadian rents ended 2023 on a pricy note, with the asking average price hitting yet another record high of $2,178 in December. That figure is up 8.6% from its year-ago level and marks a 22% increase over the past two years, according to new data from Rentals.ca and Urbanation.

As anyone with a stake in the country’s rental market will likely already know, Rentals.ca and Urbanation release a report on the rental market each month, delving into what’s going on not only on a national basis, but at provincial and municipal levels as well. This latest rendition of the report deviates from the norm in that it looks back on the trends that characterized Canadian rental markets in 2023 (and how those trends stack up to 2022) and also forecasts what’s to come in 2024.

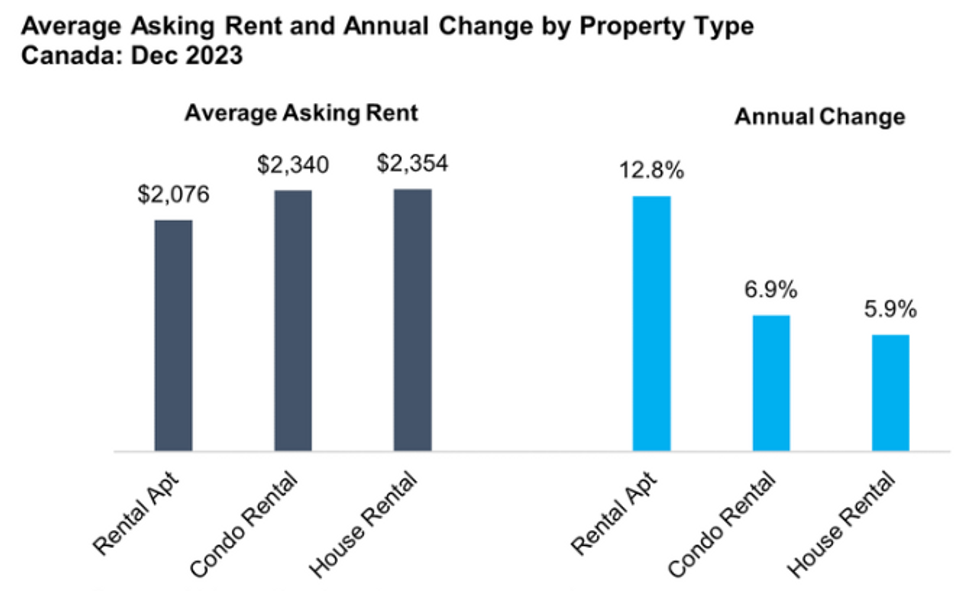

Looking at national rent growth through a more granular lens reveals that traditional purpose-built rental apartments were the most reasonably priced rental accommodations through 2023 (relative to condo and house rentals). At the same time, purpose-built rentals saw a 12.8% rate of annual increase, and managed to well outpace other property types in terms of rent growth over the past year.

Also on a national basis, the data shows that rents across both purpose-built and condominium apartments shot up 10.7% in 2023, matching the growth observed over the year prior. Where there was some noticeable variation was across different unit types. Rent growth was the steepest for smaller, more affordable unit types, including one-bedroom apartments (up 12.7% over the past year) and studio apartments (up 11.9% over the past year).

“Two-bedroom rents increased at a slower rate in 2023 compared with 2022, while all other unit types experienced faster rent growth in 2023,” the report adds.

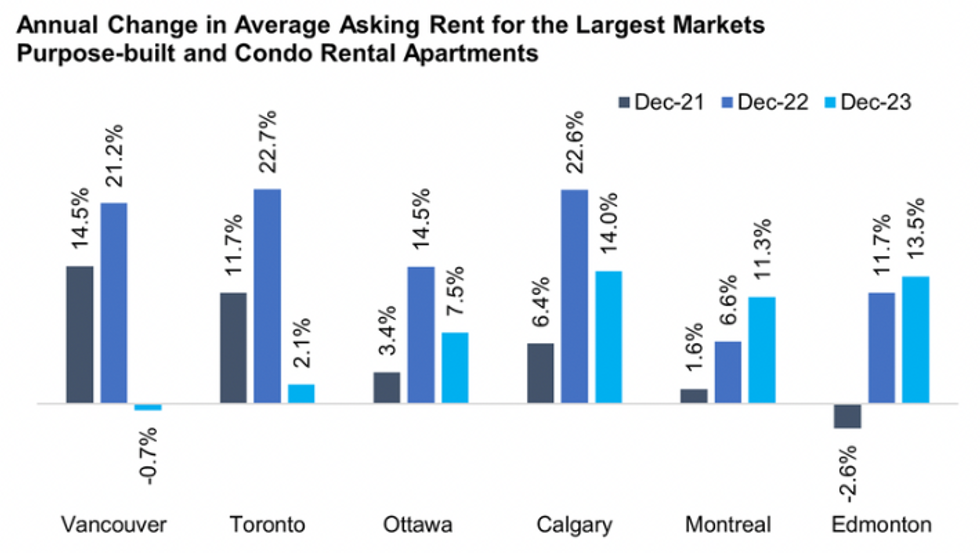

The data also shows just how much Toronto and Vancouver's rental markets have slowed down over the past year. Average asking rents rose just 2.1% in Toronto and slipped 0.7% in Vancouver in 2023. In stark contrast, average rent in Calgary grew 14% over last year, making the western city the fastest-growing of Canada’s six largest markets. Still, as of December, average rent remains relatively high in both Toronto and Vancouver, at $2,832 and $3,059, respectively, and comparatively affordable in Calgary, at $2,071.

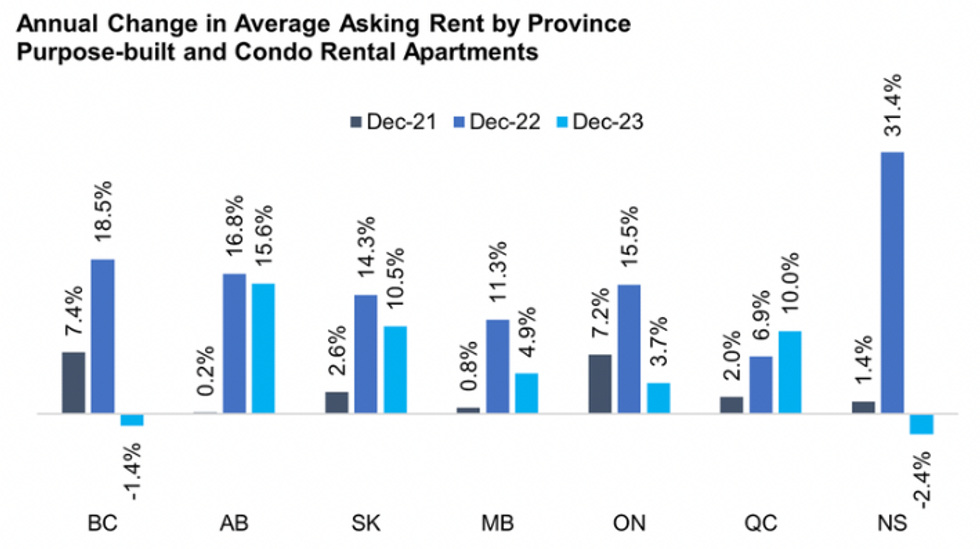

Provincially, Alberta saw a 15.6% uptick in rent growth over 2023 (following a 16.8% increase in December 2022), while rents in Ontario edged up just 3.7% (following a 15.5% increase in December 2022). In BC, rents slipped 1.4% in 2023, a far cry from the 18.5% increase in the metric observed at the tail-end of 2022.

Looking forward to 2024, Rentals.ca and Urbanation forecast that Alberta will continue to see above-average rent increases — a testament to its relative affordability — while more expensive markets like Ontario and BC will continue to see slower, below-average rent growth.

More broadly, the expectation is that Canadian rental markets will become “somewhat more balanced” as 2024 progresses and as the economy slows and homebuying ability improves as a result of interest rate cuts. Rent growth is expected to “converge” towards its five-year average of around 5%.

A “continued rise in apartment completions and an increase in tenant turnover” should help to placate demand and “help temper rent growth” in the near term as well.