Things are looking bleak on Canada's housing supply front.

According to a new report from RE/MAX Canada, housing inventory may reach a crisis point in major Canadian centres without intervention.

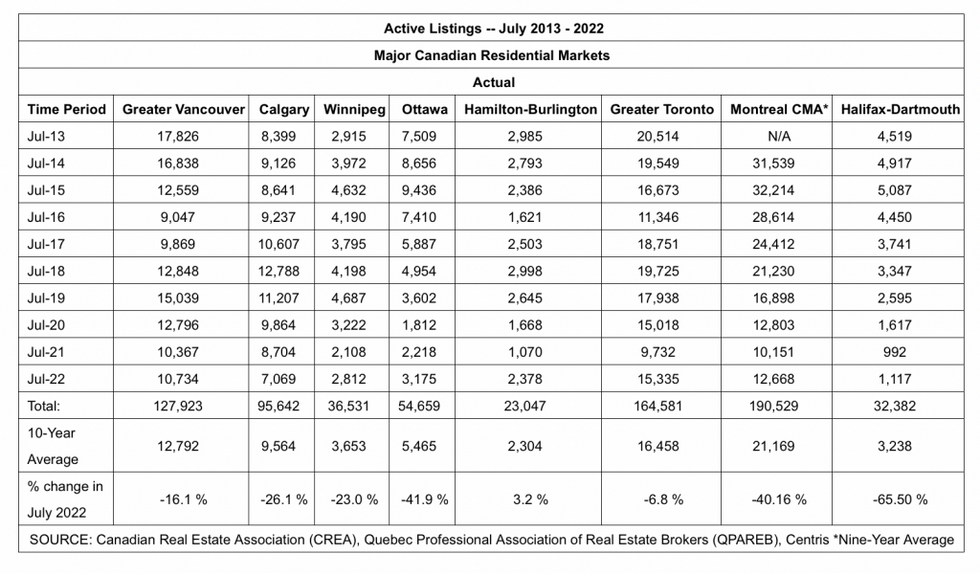

Released this morning, the 2022 Housing Inventory Report highlights how inventory levels in major Canadian housing markets have been dwindling over the past decade. In July, active listings ran below the 10-year average in almost all markets surveyed, based on Canadian Real Estate Association data and insights from the RE/MAX network. This is occurring despite softer overall real estate activity.

READ: Cooling Housing Market to Trigger "Mild Recession" in 2023

The RE/MAX Canada Housing Inventory Report examined active listings in July from 2013 to 2022 in eight Canadian centres -- Greater Vancouver, Calgary, Winnipeg, Hamilton-Burlington, the Greater Toronto Area (GTA), Ottawa, Montreal (CMA), and Halifax-Dartmouth -- and found inventory levels have fallen short of the 10-year average in seven of those markets in 2022.

Double-digit declines are noted in Halifax-Dartmouth (65.5% below the 10-year average); Ottawa (down by almost 42%); Montreal (down 40% from the nine-year average); Calgary (running 26% below average inventory levels); Winnipeg (down 23%), and Greater Vancouver (down 16%). The housing inventory shortage was less pronounced in the GTA, where it was down almost 7% from the 10-year average. Hamilton-Burlington was the only market to buck the trend, reporting a nominal 3.2% increase over the 10-year average, says RE/MAX Canada.

In analyzing the 10-year July average in the decade spanning 2003 and 2012, several markets experienced more active listings than in the most recent decade (2013-2022). These included the GTA (21,243 active listings versus 16,458), Hamilton-Burlington (3,473 active listings versus 2,304) and Greater Vancouver (14,352 active listings versus 12,792).

"Supply was far more robust in the early 2000s in centres such as Greater Vancouver, the Greater Toronto Area and Hamilton-Burlington," according to Christopher Alexander, President, RE/MAX Canada. "That stability lent itself to healthy sales and price appreciation year-over-year and provided an anchor for the Canadian housing market during the Great Recession. Population growth and household formation have played a significant role in depleting inventory levels from coast to coast over the most recent decade, triggering chronic housing shortages in large urban centres that resulted in mini 'boom' and 'bust' cycles. If we don't move now to build more housing in the current lull, it's expected that this same scenario will continue to resurface over and over again."

According to Statistics Canada, Canada has seen significant double-digit population growth between 2006 and 2021, and that is poised to increase further with Canada's commitment to welcome 1.2M immigrants into the country between 2021 and 2023, combined with growth in new international students.

As the report highlights, while the strategy is aimed at propelling economic growth and reducing labour shortages -- something that’s become glaringly apparent as of late -- it’s expected to intensify the inventory shortage, especially in places like Vancouver and Toronto.

"Inventory remains key to the overall health of Canadian housing markets -- affordable, accessible housing depends on supply," reads the report. It points to a recent report from Canada Mortgage and Housing Corp. (CMHC) that concluded that the country needs to build 3.5M new homes by 2030 to tackle the affordability issue, yet Canada is averaging only 200,000 to 300,000 new units per year. And it's creating a ripple effect that leaves no element of the housing market untouched.

"The truth of the matter is that we probably need more than the CMHC estimate to create the desired level of affordability," says Alexander. "During this window of softer demand, building efforts should be ramped up, not down. The offshoot effect is straining rental markets and contributing to ever-rising levels of homelessness throughout the country."

Population growth is not the only variable exacerbating the housing supply challenge, says RE/MAX. New housing starts and purpose-built rentals continue to fall short. "Meanwhile, a number of factors have emerged to create a perfect storm impacting available housing now and in the future, including inflation and rising interest rates, increased global supply chain interruptions, swelling construction costs and a serious shortage of trades labour, to high land acquisition costs and slow municipal approval processes," reads the report.

It highlights higher rates of developer pullback in light of softening demand in the short term, combined with current economic and market realities

"Current market realities have upended the economic viability of many developments, causing new residential projects to be cancelled or put on hold indefinitely," says Elton Ash, Executive Vice President, RE/MAX Canada. "The feasibility of many new or planned housing starts is now in question, but the ones that already had smaller margins -- affordable housing and starter homes -- are at the top of the chopping block. If we're already experiencing an inventory crisis, what will the consequences be when demand rebounds?"

Good question.

"The trouble is that housing development is a slow process, and experience tells us the only thing slower might be government processes," says Alexander. "Removing barriers and cutting red tape is necessary. A crisis is looming, but the outcome is not cast in stone. There is a short runway to reverse course before the impacts become very real for Canadian homebuyers and renters."