Following months of a frenzied housing market, in which prices climbed to unstable heights as inventory levels depleted further, the risk of uncontrollable price growth and overheating has eased as the housing market continues to moderate.

While purchasing activity throughout the country may show signs of cooling, resale activity is still historically strong -- restrained by a lack of new inventory. However, it's these tight demand-supply conditions that could keep the chance of a housing price collapse low, according to a new Canadian housing check from RBC -- an analysis of national and provincial trends in housing affordability and developments in major metropolitan housing markets.

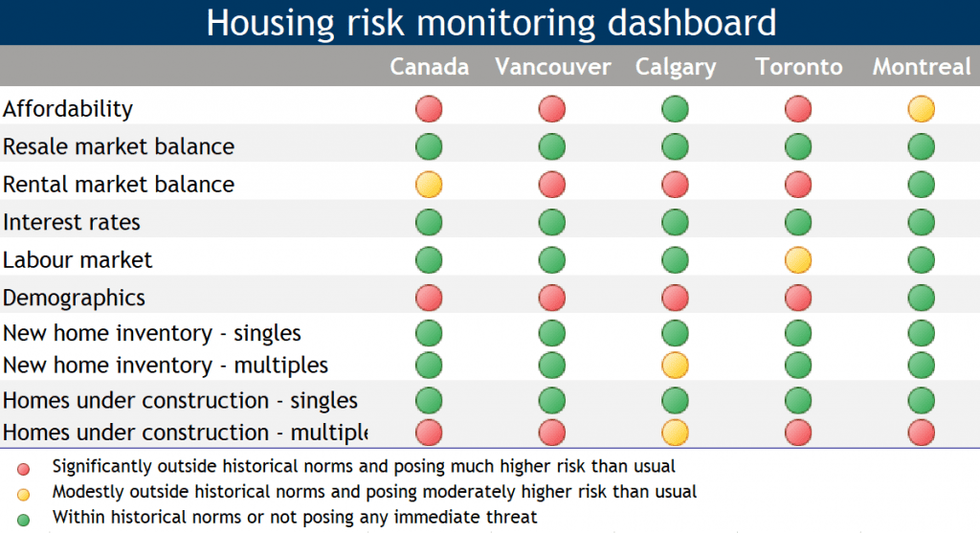

According to the health check, while Canadian homeowners might still favour the current rock-bottom interest rates, homeownership costs are still spiking across the country, with Canada's largest markets -- Vancouver and Toronto -- fairing the worst, while affordability issues become more worrisome in Montreal.

RBC says several factors could cause further risks of market overheating, including the threatening Delta variant; the chance of rising interest rates; further possible policy intervention that could create uncertainty; and a dip in immigration.

READ: Vast Majority of Canadians Think Low Interest Rates Are Impacting Housing Affordability

Though, RBC said there are a few factors that no longer pose a risk to the housing market, including continued improvements in the labour market as pandemic restrictions ease and increasing construction of multi-residential dwellings in response to low inventories in most major markets.

While overheating has subsided on a national level, Canada's major housing markets still face varying risks that could cause further complications. For example, in Vancouver, housing affordability is "exceedingly poor" and poses a major source of vulnerability.

This comes as buyers continue to compete fiercely for the remaining homes as inventory levels soften, further maintaining high prices. Though there is still a chance of dwindling immigration, RBC says it'll be temporary -- tempering any potential risk it poses, including the rental market.

In Calgary, on the other hand, the market has recovered solidly in the past year as inventories of existing and newly built homes are no longer excessive and prices rise moderately. RBC says demand-supply conditions are the tightest they’ve been in years, further pointing to price gains in the near term. However, a high rental vacancy rate and drop in immigration pose risks, though these are expected to improve once travel restrictions ease.

After reaching sky-high levels at the start of the year, both resale activity and new listings in Toronto have slowed since spring. The lack of listings has kept the market extremely tight and prices under intense upward pressure. Subsequently, the pressure has extended to the condo market, where prices are now "firming."

RBC says "overstretched" affordability remains a significant issue and top vulnerability in Canada's largest city, while, similar to Vancouver, a dip in population growth poses a risk. Though, it will be short-lived.

Over in Montreal, RBC says the existing home market moderated to more sustainable levels during the summer. While the pace of property value appreciation is easing, the bank says there’s little risk of a sharp decline, and sellers still have the upper hand. However, affordability is a moderate yet growing concern, while elevated rental apartment construction warrants close monitoring.

RBC’s report comes as national home sales continued to cool in July, falling for the fourth consecutive month --down 3.5% from June and a further 28% from March’s peak -- as new inventory reached a record low. With inventory down, prices continued to rise, with the actual national average sale price hitting $662,000 in July, up 15.6% year-over-year.

With the federal election under a month away and all parties proposing changes to housing policies to improve affordability, the elected federal government will likely introduce additional measures to help ease the market. However, RBC says the impact on the housing market remains unknown.