New data shows that Canadian home prices ended the year on a “downward trend,” and aren’t expected to bottom out until at least late spring.

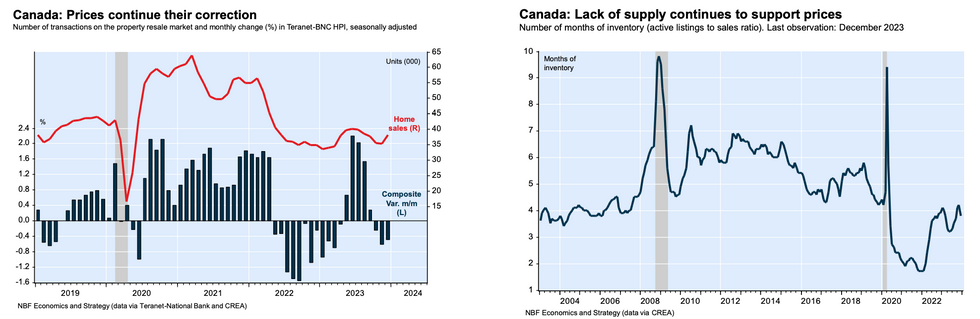

The latest Teranet-National Bank Composite House Price Index — it's representative of observed or registered home prices across 11 CMAs, so long as they have been sold at least twice — fell 0.5% on a seasonally adjusted basis between November and December, marking the third straight month of decline.

Before adjusting for seasonal effects, the index slipped 1.3%, which was the largest drop since November 2022.

Although a number of local real estate boards reported stronger-than-anticipated sales activity last month — for instance, the Toronto Regional Real Estate Board reported an 11.5% uptick in sales between December 2022 and 2023 — National Bank of Canada Economist, Daren King, writes that transaction levels were still too “weak” to meaningfully prop up prices.

“Persistent affordability issues (despite the recent drop in fixed mortgage rates), combined with a less buoyant job market, have contributed to the decline in property prices,” King adds.

“Despite a less vigorous economy, we are not yet witnessing a wave of additional supply on the real estate market. In fact, active listings declined in December, and the number of months of inventory fell from 4.2 in November to 3.8 during the month, helping to limit the fall in prices.”

Although the composite index represents a “weighted average” of observed or registered home prices in Victoria, Vancouver, Calgary, Edmonton, Winnipeg, Hamilton, Toronto, Ottawa-Gatineau, Montreal, Quebec City, and Halifax, Teranet and National Bank track prices across 31 Canadian cities in total. Of those, close to 60% saw home prices soften to some degree.

Cities that saw home prices slip last month included Victoria (-3.9%), Vancouver (-1.5%), Toronto (-0.8%), Ottawa-Gatineau (-0.3%), Guelph (-7.0%), Peterborough (-4.9%), and Kitchener (-4.3%). Conversely, price gains were recorded in Calgary (+2.3%), Halifax (+2.2%), Quebec City (+0.9%), Hamilton (+0.9%), Winnipeg (+0.6%), and Montreal (+0.5%), Sherbrooke (+5.9%), and Barrie (+5.6%). Prices remained flat in Edmonton.

“For the months ahead, prices should continue to decline despite the support of historical population growth and the shortage of housing supply, as the deterioration in the labour market is set to continue. We expect the composite index to return close to its early 2023 low by late spring, with a cumulative decline of around 8% from its April 2022 peak,” says King.

“For their part, the interest rate cuts expected to begin in Q2 should set the stage for market stabilization in the second half of the year.”